Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The most noteworthy thing about Tesla’s car sales is that they are shrinking. Elon Musk’s electric vehicle giant on Wednesday reported an 11 per cent decline in revenue from automobiles in the fourth quarter of 2025. Yet drill down, and there is at least one place the company is turning itself around. That is Japan.

Set against 1.6mn car deliveries globally, the 10,600 units Tesla shifted in Japan last year, according to the Japan Automobile Importers Association, are no big deal. Even so, that was double the number it sold the previous year, a reminder of how far the company has historically underperformed in that market relative to the rest of the world.

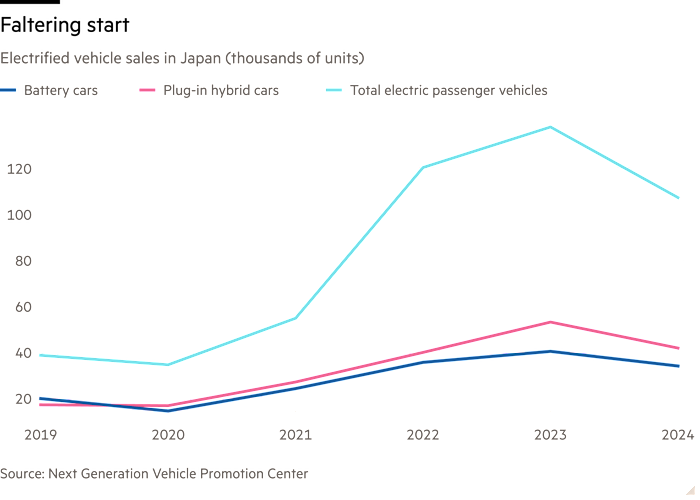

Japan’s electric car market remains small. Battery electric vehicles account for less than 2 per cent of new car registrations, according to Jato Dynamics, and growth has slowed in recent years. Local carmakers remain heavily invested in hybrids because they support margins and dealer economics. As a result, Tesla’s presence in the country was regarded as marginal, with sales unlikely to make a significant impact on the local market or the company’s finances.

Last year’s jump in sales did not coincide with a new model or higher subsidies, factors that typically drive increases of that scale. But there was a shift in how Tesla sells. The company has been expanding its physical presence through showrooms in malls and making it easier to secure a test drive, an implicit acknowledgment that its online-first strategy was limiting demand in a market it entered in 2010.

The increase in sales is notable given the slowdown in Japan’s broader electric vehicle market. Tesla’s stores are also outperforming those of peers. Musk’s company sold about 366 cars per dealership last year, more than other import brands such as Mercedes-Benz and BMW and in line with larger local carmakers, on a per-site basis.

This will not transform Tesla’s global earnings: China and the US make up almost three-quarters of the company’s revenue. It may also fire up local rivals such as Toyota, which are backed with ample cash flows from petrol and hybrid sales allowing them to price defensively. Valuations reflect this constraint, with Toyota trading at about 13 times forward earnings, reflecting low profit expectations for electric vehicles in Japan.

Nonetheless, Tesla’s shift towards physical retail in Japan — and the results it has produced — are encouraging. Musk likes to talk grandly about humanoid robots, self-driving taxis and AI, which can shift attention away from the more prosaic business of selling cars. Beneath all that hype, the company can get results from a return to traditional retail basics.