Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

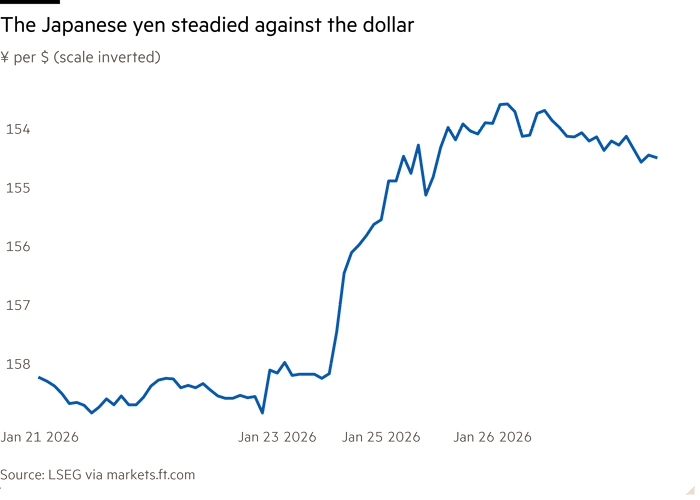

Japan’s currency steadied on Tuesday as traders in Tokyo watched for signs of government intervention following days of big swings in the widely-traded currency.

The yen traded around ¥154.60 against the dollar on Tuesday, down about 0.3 per cent. Since Friday, it has surged more than 2 per cent on speculation that the US and Japan are lining up co-ordinated intervention to support the currency.

Uncertainty in Japan’s bond and currency markets has intensified since Prime Minister Sanae Takaichi called a snap election. Campaigning for the February 8 poll formally started on Tuesday.

Yields on 40-year Japanese government bonds, which surged to record highs last week following Takaichi’s announcement of the elections, climbed 0.02 percentage points to 3.92 per cent. Bond yields move inversely to prices.

Gold prices also rose 1 per cent to $5,061 a troy ounce, off from a record reached during trading on Monday.

“It is calmer in the market,” said Shoki Omori, chief global desk strategist at Mizuho. But he said there was still pressure on longer-dated JGBs.

“The market is starting to test” how much capacity and capability the government has to intervene, he said. “They don’t want to do that abruptly . . . instead it’s a gradual pressure.”

Kohei Iwahara, an economist for Japan at Natixis, said: “The signal from government authorities to intervene in foreign exchange markets is starting to wane. The market has digested it and forgotten it.”

The yen hit an 18-month low this month as investors digested Takaichi’s stimulus plans and grew concerned about whether she could fulfil them without provoking turbulence in the bond market.

Takaichi also promised a two-year suspension of consumption tax on food. The idea, which it is estimated would cost the government an estimated ¥5tn ($32bn), helped send 40-year yields over 4 per cent.

The government has intensified verbal warnings that it is ready to intervene in the foreign exchange market. On Sunday, Takaichi said that her government would take “all necessary measures to address speculative and highly abnormal movements”.

That followed US authorities conducting a “rate check” of market participants last week, a move that is often a precursor to foreign-exchange intervention.

“While it cannot be ruled out that a yen-buying intervention on the order of several hundred billion yen took place, the deviation [in Bank of Japan current account balance data] is too slight to conclude definitively that intervention occurred,” said Yujiro Goto, chief foreign exchange strategist at Nomura. “The possibility . . . cannot be completely dismissed.”

Other analysts played down the probability that direct government market intervention had happened and warned that the rebound in the yen could prove shortlived since the fundamental dynamics in the forex markets had not shifted.

“Currently it is hard to envision that the US would go so far as to conduct an actual [dollar] selling intervention,” said Osamu Takashima, a strategist at Citi, adding that the yen would probably have to weaken beyond ¥160 against the dollar for the Japanese to act.