The head of India’s largest IT services company has dismissed fears that AI will upend the $300bn outsourcing industry and lead to mass lay-offs, as companies in the sector signal signs of stabilisation after the disruptive launch of ChatGPT.

Tata Consultancy Services chief executive K Krithivasan said he did not expect further large-scale cuts after India’s largest private employer lost nearly 30,000 people, or 5 per cent of its workforce, through lay-offs and voluntary exits over the past two quarters.

“There will always be some segment within some small pockets within the company who will not fit in the scheme of things,” Krithivasan told the FT in an interview. “AI is not going to create lay-offs by itself.”

He said that TCS’s AI services, which help clients integrate and adopt the technology, were gaining traction and leading to productivity gains, giving companies more “headroom” to sign additional deals with the IT group.

The future of India’s IT industry was called into question after the release of AI models that automate tasks previously performed by outsourcing businesses, such as customer support, data management and software development. But the companies are seeing evidence of growth in offering an expanding suite of AI tools, helping offset slowing sales in the US and Europe, their largest markets.

Abhishek Pathak, a sector analyst at Motilal Oswal Financial Services, said the IT services companies were managing the threat by partnering with OpenAI and Anthropic to build tailored models and chatbots for clients.

They were “willing to cannibalise a bit of their revenues in order to thrive in the next phase of services”, said Pathak, referring to the IT services companies. “Not everything is rosy in the direction of travel from here,” he warned. “[But] we could see something on the positive side.”

While TCS’s quarter-on-quarter revenue grew by 0.6 per cent to $7.5bn in the quarter ending in December, annual revenue from AI services expanded by 17.3 per cent to $1.8bn over the same period.

This month, Infosys raised its full-year sales growth forecast from 2-3 per cent to 3-3.5 per cent after signing large deals, including a $1.6bn contract with the UK’s National Health Service to “leverage AI to streamline operations and improve patient care”.

The Bengaluru-based company, which increased its headcount by more than 5,000 to 337,000 employees as of December, said 90 per cent of its 200 largest clients were integrating the technology.

“We had strong momentum in AI adoption across our client base,” said Infosys chief Salil Parekh during an earnings call this month, where he also highlighted a partnership with San Francisco’s Cognition AI to better serve the financial services sector.

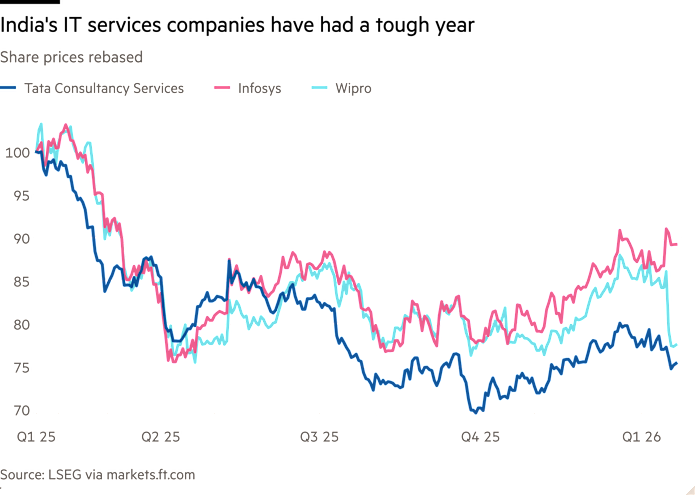

Despite the signs of growth, the outlook for Indian outsourcers remains uncertain, according to analysts. Shares of TCS are down more than 20 per cent in the past 12 months, while Infosys and Wipro have fallen 8 per cent and 20 per cent, respectively.

Indian IT services were “generally out of favour” with investors, driven by debates over the impact of AI on the industry and whether the slowdown was structural or “cyclical pain” due to US economic uncertainties, said Kumar Rakesh, a Mumbai-based analyst at BNP Paribas.

“We are in the camp that it’s more of a cyclical slowdown, not necessarily a structural slowdown,” he said, noting that new deals for the outsourcers remained concentrated in Europe, underscoring the challenges in the US.

The latest results of IT services companies suggested demand was “stable-to-improving, though with limited visibility on the extent of recovery” in 2026, Goldman Sachs said.

Aside from three large deals worth $2.6bn won by Infosys, Tech Mahindra and HCLTech, industry-wide new bookings were flat year on year in the quarter ending in December at $16.5bn, Jefferies analysts said in a recent note. The analysts added that companies needed to “win mega deals consistently to accelerate growth”.

Outsourcers are also grappling with rising geopolitical tensions. The companies have been hit by US President Donald Trump’s changes to H-1B visas, spurring them to localise their workforce faster. Higher interest rates and inflation in the US, as well as in other markets, are expected to weigh on growth.

Still, analysts expect AI investments to generate more momentum over the next year. “We think clients are gradually moving from proof-of-concept projects to standalone implementations of AI,” said analysts at Nomura.

“Bigger revenue pools for India IT service providers should emerge when enterprise adoption of AI happens, which we think is likely to gather pace in the next 12-18 months.”

Krithivasan suggested that revenue from AI services would grow faster after a period of experimentation with the technology, which had slowed down orders.

“This technology delivers value in terms of productivity, in terms of helping you do things that you have not been able to do before,” he said. “We believe it is going to deliver value.”