Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Indonesia’s rupiah fell after President Prabowo Subianto’s nomination of his nephew as deputy governor of the central bank fuelled concerns over its independence.

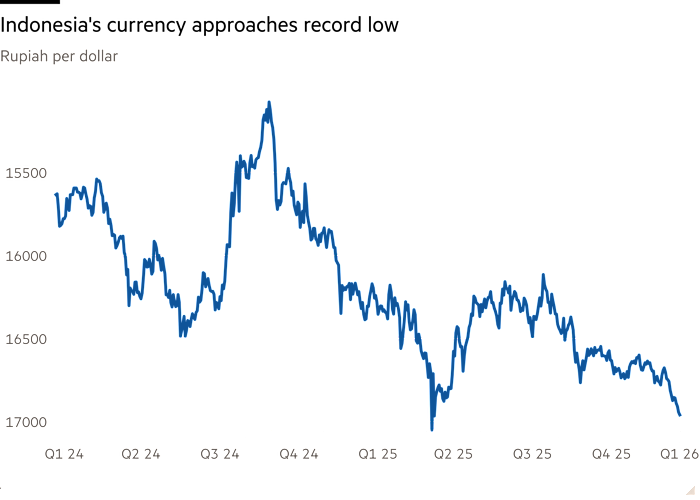

The currency, which had already been trading near its lowest levels since the 1998 Asian financial crisis due to persistent concerns over Indonesia’s fiscal position, weakened to 16,945 to the US dollar on Tuesday, close to a record low hit last April.

The rupiah’s fall came a day after Thomas Djiwandono, currently deputy finance minister, was nominated to fill the Bank Indonesia position.

Investors perceived Thomas’s nomination as an attempt to influence the central bank to help Prabowo’s government hit its target of 8 per cent growth for this year, analysts said.

“If Thomas is elected one of the governors, I think there will be more concern over the independence of the central bank,” said Rully Arya Wisnubroto, chief economist and head of research at Mirae Asset Sekuritas Indonesia.

“It’s similar to the US. The government of Prabowo wants [Bank Indonesia] to be more aggressive in [its] monetary policy,” he said, adding that Prabowo wants “to have both monetary and fiscal policies” to be pro-growth.

8%

President Prabowo Subianto’s GDP growth target

Finance minister Purbaya Yudhi Sadewa said Thomas’s appointment would not compromise the central bank’s independence.

“It has no connection to independence,” Purbaya said late on Monday. “Unless, when making decisions, there is direct government intervention. So far, there hasn’t been any. So BI is independent.”

When asked if Thomas would remain a government official if his nomination was confirmed, Purbaya said: “As soon as he joins BI, he should be independent, not a government element.”

Following the rupiah’s decline on Tuesday, the finance minister said the government would “maintain the independence of the central bank to the maximum extent possible”.

State secretary Prasetyo Hadi said this week that Thomas was one of several nominees to fill the vacant central bank role. His nomination will be put forward to parliament’s lower house, which will eventually select a candidate for the job. Prabowo’s ruling coalition has a comfortable legislative majority.

In a statement late on Monday, the central bank said it would remain focused on its primary task of “achieving and maintaining rupiah stability, maintaining a smooth payment system and safeguarding financial system stability that supports sustainable economic growth”.

The central bank has been intervening in the market frequently over the past year to defend the rupiah. However, a tilt towards a pro-growth approach might make it tolerate a weaker currency.

The president, a former military general, has vowed to boost growth to 8 per cent from the current 5 per cent — a level that Indonesia has maintained for more than a decade except during the Covid-19 pandemic.

However, the economy is currently experiencing a slowdown due to long-standing dependence on commodities, a decline in the manufacturing sector and failure to create higher-income jobs.

Thomas’s nomination is the latest in a series of moves that investors and economists see as Prabowo’s efforts to bring the central bank under his control and to loosen Indonesia’s strict fiscal stance that has been in place since the 1998 crisis.

Indonesia’s parliament is considering expanding the central bank’s mandate to include supporting economic growth, the FT reported last year. The draft bill also proposes giving parliament the power to remove the central bank governor and other board members.

Last year Prabowo also removed fiscally conservative finance minister Sri Mulyani Indrawati and replaced her with Purbaya, who is more focused on growth and aligned with Prabowo’s policies.

The rupiah could come under more pressure as investors fret over fiscal discipline under Prabowo, who has announced expansive spending plans such as the $28bn free lunch programme for schoolchildren even as government revenue collection has failed to grow.

Indonesia’s fiscal deficit climbed to 2.92 per cent last year — close to a domestic legal cap of 3 per cent.

MUFG’s senior currency analyst Michael Wan said Thomas’s appointment was being perceived by the markets “rightly or wrongly to be a potential impact on BI’s central bank independence”.

Additional reporting by William Sandlund in Hong Kong