Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

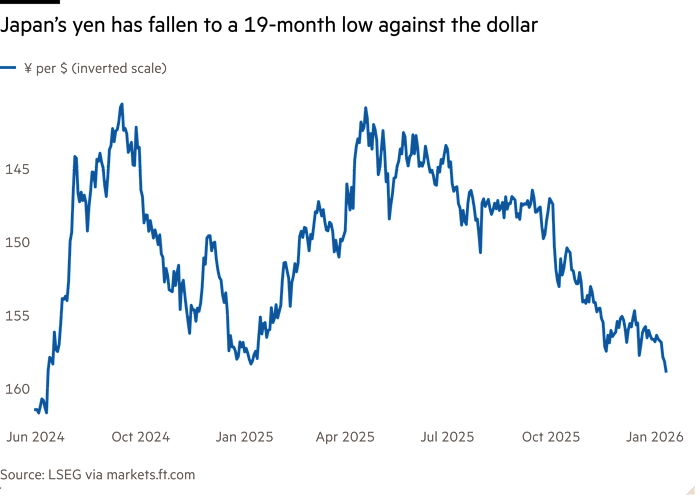

Japanese stocks surged to an all-time high and the yen tumbled to a 19-month low as markets bet that a possible snap election next month would reignite the “Takaichi trade”.

The Nikkei 225 stock index rose as much as 3.6 per cent on Tuesday while the yen weakened to ¥158.88 against the dollar, its lowest rate since July 2024 and close to levels at which Japan’s finance ministry has previously stepped in to support the currency. Brokers in Tokyo said domestic and foreign investors were driving the stock rally.

The market moves were underpinned by speculation that Prime Minister Sanae Takaichi would call an early election, betting on using her support among younger Japanese to try to restore her Liberal Democratic Party’s majority in parliament.

A Japanese media report on Tuesday, citing senior ruling party sources, said Takaichi had signalled to the LDP her intention to call a snap election after dissolving parliament on January 23. She took over the party leadership in October and has since enjoyed high approval ratings.

“With the China row still bubbling and with popularity at these very high levels, the market and the electorate are waiting for Takaichi to do something bold. Calling an election now would be that move,” said Neil Newman, Japan strategist at Astris Advisory.

Markets have tested a variety of “Takaichi trades” since October, based on the idea that she favours more government stimulus and would oppose too rapid a rise in interest rates. Her $135bn stimulus proposal has spooked bond markets and weighed on the yen while boosting equities.

Stock buying on Tuesday was focused on technology, defence and basic materials, all areas expected to benefit from Takaichi’s spending focus.

Yields on 20-year Japanese government bonds rose to a record high of 3.135 per cent, while the 10-year yield climbed to 2.135 per cent — its highest since February 1999. Yields move inversely to prices.

The market remained tilted towards a weaker yen, said Barclays Japan economist Naohiko Baba in a note to clients on Tuesday, adding: “If the exchange rate approaches 160, FX intervention may be anticipated.”

Some market participants remain sceptical that Takaichi will risk a snap election, given the overall popularity of the LDP remains relatively low.

The yen’s persistent weakness has become an intensely political issue in Japan, where it has contributed to rising food and energy prices — a sharp contrast to years of deflation and little change in the cost of living.

The yen has weakened despite the Bank of Japan raising interest rates in December to a 30-year high of 0.75 per cent and expectations among economists that the central bank will increase borrowing costs again this year.

Japan’s finance minister Satsuki Katayama, who met US Treasury secretary Scott Bessent on Monday, said after the meeting that Bessent shared Tokyo’s concerns about the yen’s recent weakness, fuelling speculation that Japanese authorities might intervene to support the currency.

“I expressed my concerns about the one-way weakening of the yen,” Katayama told reporters. “Secretary Bessent shares those concerns.”

Katayama has previously said she had a “free hand” to intervene if needed. Japan intervened on four occasions in 2024, when the yen weakened to about ¥160 a dollar.

Shoki Omori, chief global desk strategist at Mizuho, said the Bessent-Katayama meeting was notable for its focus not on the exchange rate itself but on whether the moves had become excessively one-sided and rapid.

“I do see a chance of intervention,” said Omori, adding that traders would be looking at how consistently authorities conduct currency policy and the extent to which their messaging can gain credibility in the market.

Some investors said the rise in the country’s long-term borrowing costs, compounded by Takaichi’s fiscal plans, was fuelling concerns over its debt burden of more than 200 per cent of GDP, the largest among rich nations.

“The market is worried about debt sustainability,” said Kit Juckes, chief FX strategist at Société Générale.