Good morning. Donald Trump has announced a 25 per cent tariff on countries that do business with Iran, a move that could hit India hard as a key trading partner to the Islamic republic. The White House declined to provide more details about the US president’s plan. We’ll be keeping an eye on developments.

Meanwhile, corporate results season has started, with IT services companies TCS and HCL Technologies kicking things off yesterday. Both reported higher revenue but lower profits compared with the year before. TCS’s annual revenue rose 5 per cent while profit after tax was down 14 per cent. On the bright side, the company’s North American business demonstrated signs of growth for the first time in two years. HCL Tech’s operating revenues rose 13 per cent year on year, but its net profit fell 11 per cent.

In today’s newsletter, Vodafone Idea gets a breather from the government. But first, are India’s free trade agreements worth their while?

Deficit widens

India has been on an FTA signing spree since the second half of 2025, concluding deals with the UK, New Zealand and Oman in the past few months.

The next major one is with the EU, with commerce minister Piyush Goyal wrapping up another round of discussions in Brussels over the weekend for what is now being billed as the “biggest” deal yet. This week, several high-profile delegations from the bloc are visiting India: German Chancellor Friedrich Merz arrived in Ahmedabad yesterday, France’s diplomatic adviser is in Delhi ahead of President Emmanuel Macron’s visit next month, and Poland’s foreign minister is also expected in the capital soon. In fact, Indian officials are hoping to announce a deal later this month, on Republic Day (January 26), and European Commission president Ursula von der Leyen and European Council chief António Costa will be the guests of honour.

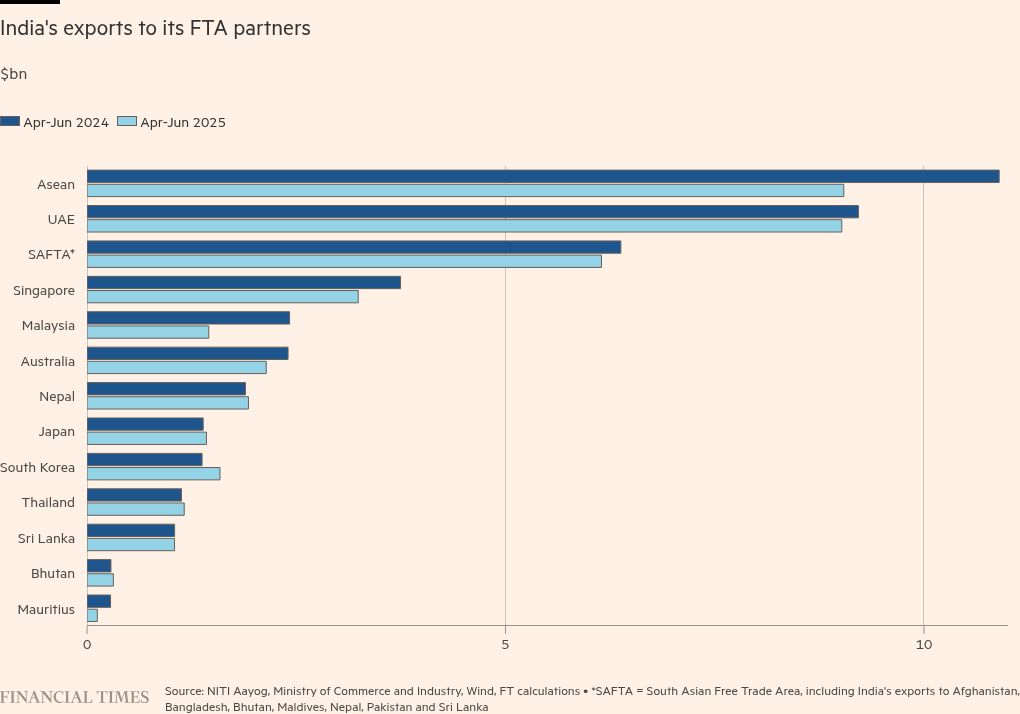

This is all very well, but has the succession of trade deals been effective in promoting Indian exports? A report published last week by government think-tank NITI Aayog suggested that, contrary to expectations, India’s trade deficit with its FTA partners was actually widening. During the first quarter of this fiscal year, the deficit with these countries increased by 59.2 per cent compared with the year before.

Exports to Asean countries saw the biggest slowdown at almost 17 per cent, with figures for Malaysia and Singapore falling 39.7 per cent and 13.2 per cent respectively, and outbound shipments to the country’s second-largest FTA destination, the UAE, were down 2.1 per cent. The report attributed this skew to India’s rising imports of inputs and energy products and declining participation in export-oriented manufacturing.

NITI Aayog also highlighted the need for deeper value-chain integration and competitiveness within India’s existing trade deals. This is a valid point and one that the government needs to consider. Signing an agreement is not a magic wand that immediately jump-starts exports. It merely signals access to a market. The sector bucking the trend of shrinking export growth is electronics, which rose 47 per cent, after companies such as Apple increased production in India. It now accounts for 11 per cent of India’s total exports.

Most of the other sectors are weighed down by both decreasing cost advantage and bureaucratic and other difficulties in doing business. This was also reflected in the response to the government’s production-linked incentive scheme. While electronics and now semiconductor manufacturing have taken off, in 2025 the government was forced to sunset the scheme for several other industries because of poor participation. For real impact, India should double down on its focus on a sectoral approach to boosting exports. In the current scenario, the more significant influence of trade agreements will be in opening up the domestic market to foreign goods.

Do you think India’s FTAs will help boost India’s exports? Hit reply or email us at indiabrief@ft.com

Recommended stories

India needs to import more capital and export fewer workers, writes Ruchir Sharma.

US prosecutors have launched a criminal investigation into Federal Reserve chief Jay Powell.

Wall Street is heading for its best investment banking year since the pandemic.

Donald Trump has threatened to block ExxonMobil from Venezuela.

How Leica plans to survive the iPhone age.

Vodafone Idea given a breather

The government has cut the fees it earlier demanded from Vodafone Idea, giving the beleaguered mobile services operator some room to breathe and an opportunity to shore up its balance sheet.

Dues from Vodafone Idea will be reduced to Rs1.24bn ($13.8mn) a year for the next six years, and then further capped at Rs1bn annually from March 2032 to 2035. All told, the company’s dues to the government currently stand at more than $9bn. The move, made official after the company informed bourses last week, comes after the supreme court had urged authorities to reconsider its demands following a plea from the telecoms company.

The fee in question, known as adjusted gross revenue or AGR, is the part of the income that telecoms operators have to share with the government for licensing and spectrum usage charges. There has been a long dispute between companies and the central government over how AGR should be defined. The industry thinks this should be paid only on core phone services, while the government argues it should also cover all other incomes.

The move is seen as a step towards furthering India-UK relations after the two countries concluded a free trade agreement in July last year. But in a way the administration is also giving itself this relief because a 49 per cent stake in the company is now owned by the government, following a debt-to-equity swap last year.

The more important point, however, is whether this relief will set Vodafone Idea on the path to recovery so that it can once again become a worthy third player in India’s telecoms industry. Currently, the sector is a duopoly comprising Jio and Bharti Airtel, which have nearly 50 and 40 per cent market share respectively. As was evident from the debacle in the aviation sector last month when IndiGo Airlines went into an operational tailspin, duopolies are good only for the two companies involved and certainly not for their customers. Now that there is greater clarity on its dues, Vodafone Idea is better placed to raise credit and improve its business prospects. But there is a long way to go and this is just a first step.

Go figure

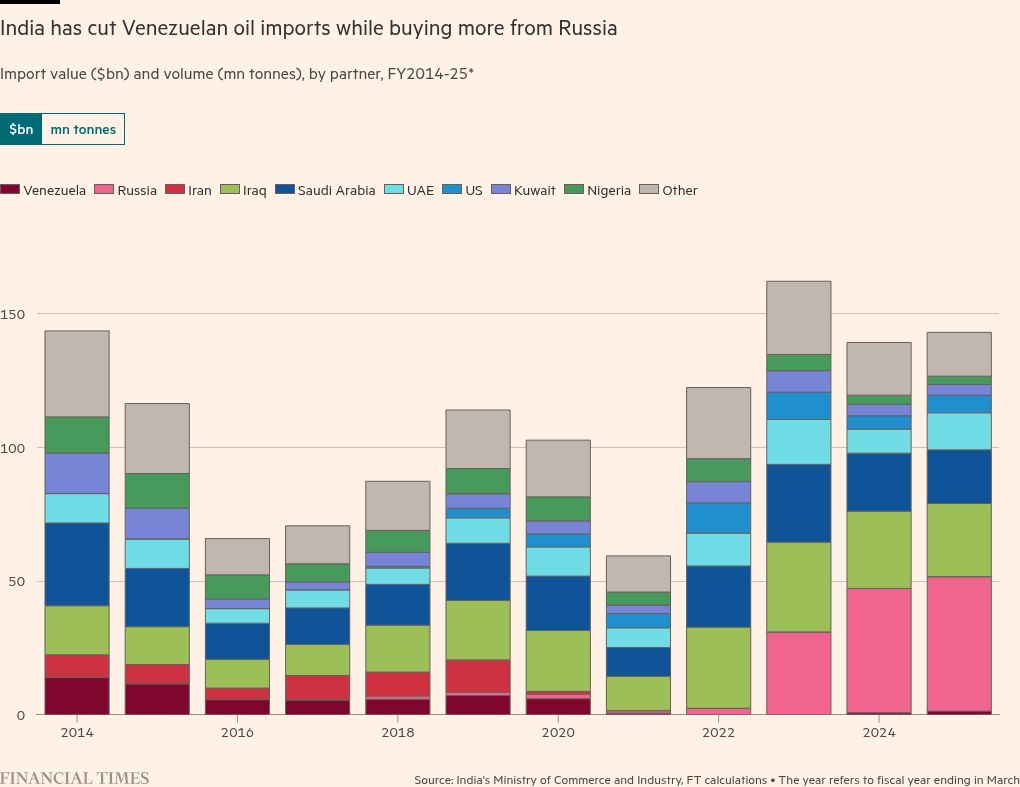

Indian refiners, including Mukesh Ambani’s Reliance Industries, were major buyers of Venezuelan crude before Trump tightened sanctions on Maduro’s regime in 2019, after which they expanded imports from Russia. But Washington’s intervention this month to depose Maduro and take control of the country’s energy resources has opened the door for Indian refiners to regain access to the world’s largest crude reserves.

My mantra

“When you are in the business of making real assets in remote parts of India, the most important consideration is how do you ensure you get the social licence to operate in the area. The full support of the community is key to the project.”

Akshay Hiranandani, chief executive, Serentica Renewables

Each week we invite a successful business leader to tell us their mantra for work and life. Want to know what your boss is thinking? Nominate them by replying to indiabrief@ft.com

Quick question

What do you want to hear about the least in 2026? Tell us here.

(Is your favourite bugbear missing from this list? If you want to vent, hit reply or email me at indianbrief@ft.com)

Buzzer round

On Friday, we asked: Which popular Danish product has a patented interlocking system that allows users to connect components from 2025 with original pieces made in the 1950s?

The answer is of course, Lego!

Aniruddha Dutta was first with the right answer, followed by Nitin Lall, Mahithi Pillay and Samir Gaonkar. Congratulations! Lots of correct answers this week. Everyone loves Lego!

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.