At India’s flagship energy conference last year, Venezuela’s sanctions-hit vice-president Delcy Rodríguez appealed to New Delhi to resume purchases of her country’s oil, warning that “those who tried to exclude Venezuela from the international energy formula were wrong”.

A year on, Rodríguez is now Venezuela’s interim president and India is well positioned to become a beneficiary of US President Donald Trump’s recent actions against her predecessor Nicolás Maduro, analysts said.

Washington’s intervention to depose Maduro and take control of Venezuela’s energy resources has opened the door for Indian refiners to regain access to the world’s largest crude reserves, which they had largely stopped buying because of US sanctions.

A resumption of oil flows would come at an opportune moment for the Indian oil industry, which is working to find alternatives to sanctioned Russian crude under pressure from US tariffs.

Trump has accused India, which imports about 90 per cent of its crude oil, of helping fund Moscow’s war machine in Ukraine, and imposed a punitive 25 per cent tariff on the country over the oil purchases. Negotiations over a US-India trade deal are also dragging.

Indian refiners, including Reliance Industries, controlled by Asia’s richest man Mukesh Ambani, were major buyers of Venezuelan crude in the past, before Trump tightened sanctions on Maduro’s regime in 2019.

“In principle, India has much to gain,” said Michael Kugelman, senior fellow for south Asia at the Atlantic Council.

“Ramped-up Venezuelan production would help meet massive Indian fuel demand. Private Indian energy giants could make a killing from refining more Venezuelan heavy crude, and India could achieve its goal of better diversifying its sources of foreign oil — and especially if it continues to scale back Russian oil imports.”

Caracas has long looked to India as a destination for its energy exports. Venezuela’s heavy crude sells at a cheaper rate than the international Brent benchmark due to its lower quality, making it especially appealing to some Indian refiners as they seek to diversify supply and replace discounted Russian oil.

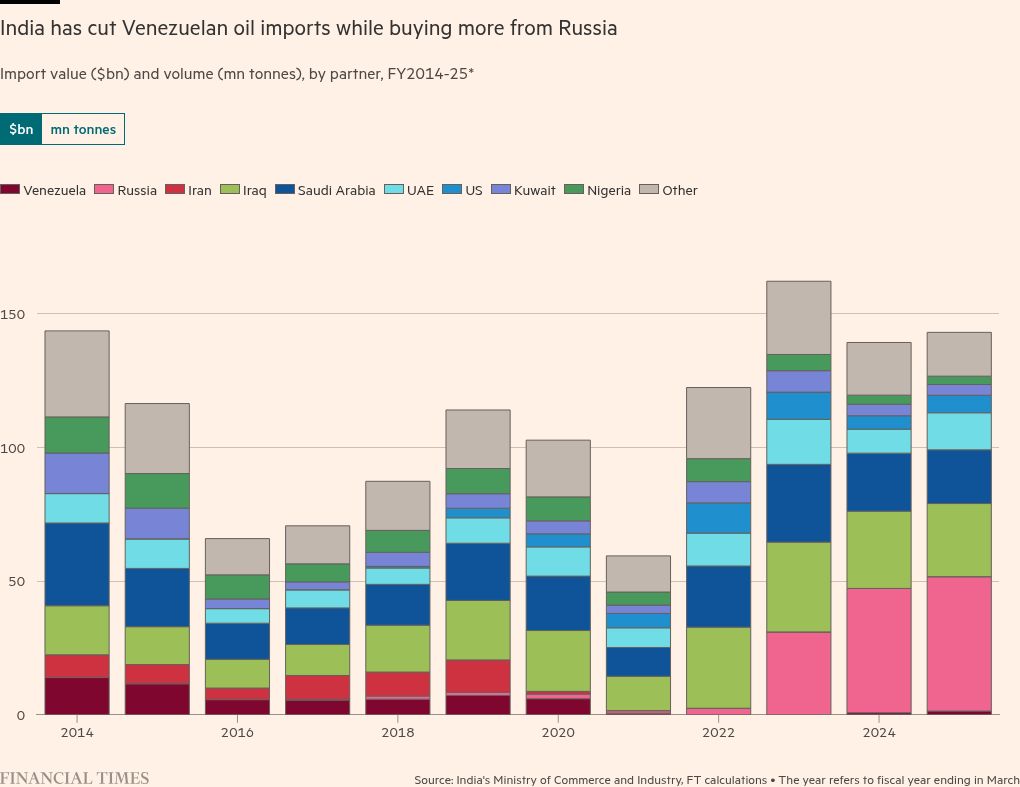

India imported $1.4bn worth of crude oil from Venezuela in the fiscal year ending March 2025, after the US eased some sanctions. But that figure was down from $6bn in the year to March 2020, according to Indian government data.

While there could be some short-term uncertainties about Venezuelan oil supply, “Indian refiners are very familiar with Venezuelan crude and would be open to buying again once conditions are favourable,” said Premasish Das, head of S&P Global’s crude oil and fuel research for Eurasia, Africa and the Middle East.

Maduro — who, along with Rodríguez, was also a follower of Indian guru Sathya Sai Baba — had made overtures to India to purchase more of his country’s sanctioned crude oil before he was captured and brought to the US to stand trial.

“India’s investment in energy in Venezuela will only grow, and our energy future will increasingly be linked to India,” Maduro said in a statement last year to coincide with the India Energy Week conference.

After Maduro’s extradition to New York, India’s government said “recent developments in Venezuela are a matter of deep concern”, but has otherwise remained muted. India’s foreign ministry did not respond to a request for comment. Kugelman said New Delhi would not want to “poke the bear” as it seeks relief from US tariffs that are as high as 50 per cent.

Indian officials have, meanwhile, expressed optimism about strengthening economic engagement with Caracas.

The resumption of oil flows could, in particular, provide an opportunity for Reliance, which said in November that it would stop buying Russian crude after the US imposed sanctions on Rosneft and Lukoil, two of the largest Russian oil producers.

The conglomerate had struck a deal to buy about 20 per cent of its supply from Venezuelan state oil company PDVSA in 2012, an agreement that was obstructed by US sanctions.

But analysts cautioned that rebuilding Venezuela’s oil infrastructure would require huge investment. The South American country’s oil sector would need capital investment of about $180bn to return to an output of about 3mn barrels a day by 2040, according to an estimate by Rystad Energy, a Norway-based consultancy.

The Trump administration said on Wednesday that it would seek to manage Venezuelan oil sales “indefinitely”.

“Venezuelan crude could potentially help at the margin, but it’s not a silver bullet,” said Sumit Ritolia, a lead Kpler analyst. Venezuelan oil “is very heavy and only a few Indian refineries can process it efficiently, so volumes would be selective rather than system-wide,” he said.

Among those is Reliance’s Jamnagar facility, the world’s largest refining complex, which is set up to process the heavy, sour and acidic Venezuelan crude that previously traded at a $5 to $8 a barrel discount to Brent, according to Jefferies.

Reliance received a green light from the US Treasury to import Venezuelan crude in 2024 despite the sanctions. The group has received several shipments and executed oil-for-naphtha swaps with PDVSA, most recently in May 2025, according to data provider Kpler.

India Business Briefing

The Indian professional’s must-read on business and policy in the world’s fastest-growing big economy. Sign up for the newsletter here

A person close to Reliance said the company would “buy from wherever they can get the best quality at the best price, like any other business”.

“We await clarity on access for Venezuelan oil by non-US buyers and will consider buying the oil in a compliant manner,” a Reliance Industry spokesperson said.

Jefferies analysts estimated that India’s state-owned Oil and Natural Gas Corp, which has stakes in Venezuelan fields, may also be entitled to about $500mn in unpaid dividends. Hardeep Singh Puri, the Indian oil minister, told the FT in February that he had “some money stuck” in the country.

A person familiar with the thinking of Indian oil companies said the flow of Venezuelan crude was “a big deal back in the day” for India’s refiners.

“This is a great opportunity for Reliance — their refining division loves these dirtier oils and have always loved it.”

Data visualisation by Haohsiang Ko in Hong Kong