This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

Thailand-Cambodia dispute flares

US cuts rates to three-year low

Singapore’s latest antisocial scourge: pickleball

US President Donald Trump has said he would call the leaders of Thailand and Cambodia after armed clashes between the south-east Asian countries broke out this week.

What’s happening: Thai and Cambodian forces resumed fighting on Monday in multiple locations along their shared 800km border, the worst outbreak between the neighbours since a five-day conflict in July that killed at least 48 people. Each side has accused the other of initiating hostilities and of targeting civilians, as a Trump-brokered truce that had paused the July conflict broke down. More than 500,000 people have been evacuated from the border region.

This week’s clashes reignited a dispute that has dragged on for more than a century. Thailand and Cambodia have competing territorial claims over several temples and surrounding areas.

Trump’s role: In July, the US president had threatened to raise tariffs on the export-dependent countries if they did not stop fighting, forcing them to reach a ceasefire. In his first comments since the resumption of the conflict, Trump said late on Tuesday that he would call both countries. “Tomorrow I have to make a phone call,” Trump said at an event in Pennsylvania. “Who else could say ‘I’m going to make a phone call and stop a war of two very powerful countries’.” Read more about the escalating conflict.

US-Indonesia trade pact in danger: Indonesia’s trade deal with Washington is at risk of collapsing as US officials become increasingly frustrated at what they view as Jakarta reneging on the terms of the agreement

Here’s what else we’re keeping tabs on today:

Five more top stories

1. The Federal Reserve has cut interest rates to a three-year low after a divisive meeting that exposed deep fractures in the central bank over whether to prioritise weakening employment or elevated inflation. The central bank lowered its benchmark rate by a quarter point for the third time in a row to a range of 3.5 per cent to 3.75 per cent, matching Wall Street forecasts.

2. China has put domestic artificial intelligence chips on an official procurement list for the first time, bolstering the nation’s tech sector ahead of Trump’s move to allow Nvidia exports to the country. The step was designed to enhance the use of domestic semiconductors in China’s public sector and could be worth billions of dollars in new sales to local chipmakers.

Chinese economy: IMF managing director Kristalina Georgieva has said that China needs to fix “significant” imbalances in its economy, including deflation that has driven a depreciation of the renminbi and boosted exports.

3. Investment bankers in Hong Kong have been warned over the quality of their paperwork in filings for initial public offerings after a boom in listings in the Chinese territory. Hong Kong financial regulators sent letters to banks in the territory highlighting several concerns — including text that was copied and pasted from previous prospectuses.

4. The European Commission has carried out raids at Temu to investigate whether the Chinese ecommerce group received unfair subsidies. The probe into Temu, part of Chinese group PDD, comes amid a broader crackdown by the bloc on the flood of cheap imports from China from online retailers that also include Shein.

5. Trump said US forces have seized an oil tanker off the coast of Venezuela, escalating tensions with the regime of Nicolás Maduro. The seizure comes as the US president raises pressure on the Venezuelan leader to step down.

More Venezuela news: Venezuelan opposition leader María Corina Machado has slipped out of hiding for the first time in more than a year to travel to Oslo where her Nobel Peace Prize was awarded, though she did not arrive in time for the ceremony.

News in-depth

Saudi Arabia, Abu Dhabi and Qatar are providing $24bn of financial muscle for Paramount CEO David Ellison’s $108bn hostile bid for Warner Bros Discovery, underlining the Gulf’s position as a financier of choice for mammoth US deals. The arrangement is an unusual case of collaboration between the jockeying Gulf powers, who are set to contribute almost 60 per cent of the $41bn equity in Paramount’s bid. For the Gulf investors, the deal offers a rare opportunity to acquire a sizeable stake in a top US media brand.

We’re also reading . . .

Singapore pickleball: The sport has become a lightning rod issue, pitching enthusiastic picklers against neighbours driven mad by the game’s relentless noise, writes Owen Walker.

Data breach: The chief executive of South Korea’s biggest online retailer has stepped down, after taking responsibility for a massive data leak.

Immigration data dragnet: The Trump administration is gathering vast amounts of personal information in its drive to deport 1mn people this year.

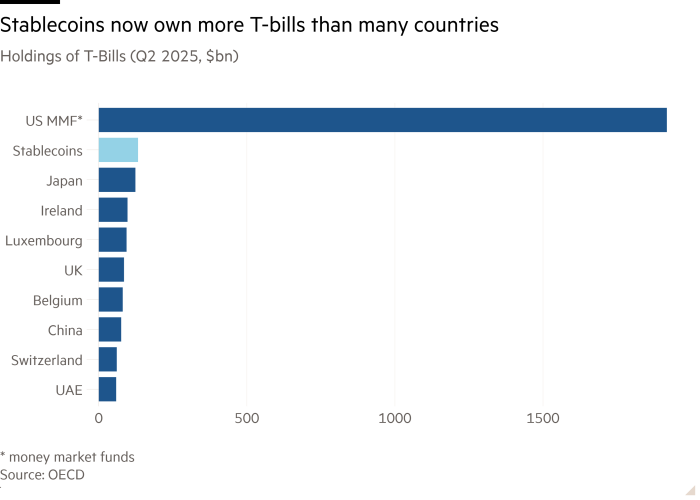

Chart of the day

Dollar-based stablecoins offer benefits for the US, which might promote their use, partly in order to enhance the dominant role of the dollar and so help finance its huge fiscal deficits. Britain and the EU, however, are better off resisting them, according to Martin Wolf.

Take a break from the news . . .

Columnist Jemima Kelly gets up close — sometimes a little too close — with the wildlife on safari in western Uganda.