Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

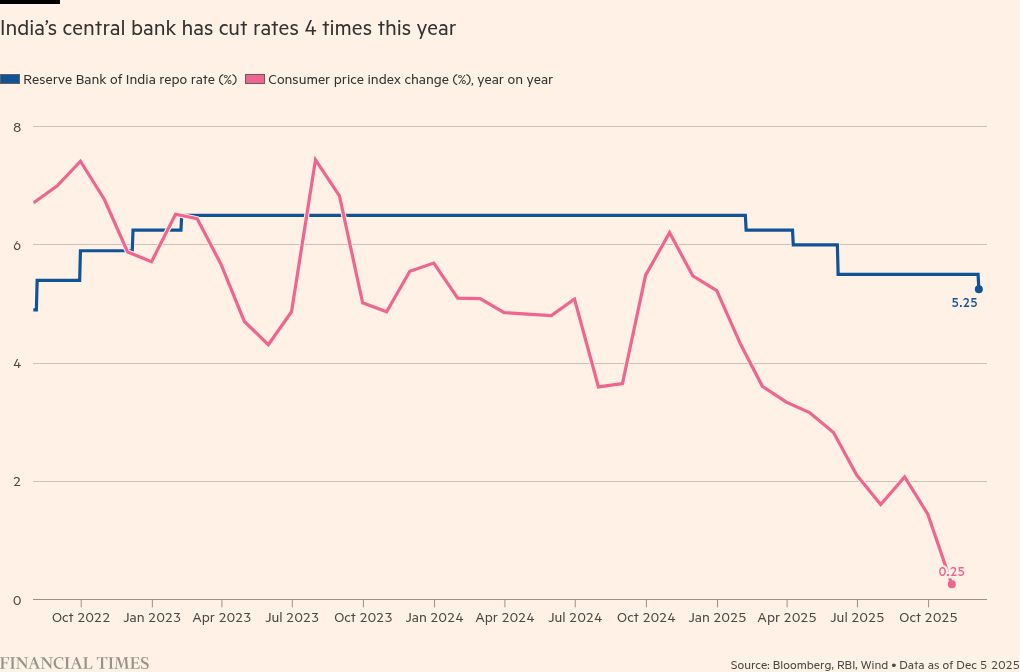

India’s central bank has announced a quarter of a percentage point cut to its benchmark interest rate, as it sought to take advantage of a “Goldilocks period” of soaring growth and record-low inflation.

The latest cut, at the conclusion of the Reserve Bank of India’s three-day meeting on Friday, brought interest-rate reductions under governor Sanjay Malhotra, who took over the reins of the Indian central bank late last year, to 1.25 percentage points.

The benchmark rate now stands at 5.25 per cent.

The move came after official data last week showed the economy expanded at a rate of 8.2 per cent in the quarter to September, shrugging off concerns about the impact of 50 per cent tariffs on its exports to the US.

Inflation has also eased from above 6 per cent last year to near-zero levels, which analysts said gave the central bank room to cut rates further.

“Despite an unfavourable and challenging external environment, the Indian economy has shown remarkable resilience,” Malhotra said, though he warned growth was “expected to soften somewhat”.

The stronger than expected growth and “benign” inflation in the first half of the financial year presented “a rare Goldilocks period”, he added.

The RBI also revised up its growth forecast by half a percentage point for the fiscal year ending in March, to 7.3 per cent.

Indian stocks rose following the announcement, with Mumbai’s Sensex climbing 0.2 per cent and the Nifty 50 index adding 0.3 per cent. The rupee weakened 0.4 per cent past Rs90 against the dollar, approaching record lows reached on Wednesday. The Indian currency has been the worst-performing in Asia this year.

Malhotra on Friday announced plans to inject liquidity into the market, saying the central bank would conduct open market operations of Rs1tn ($11.1bn) and dollar-rupee swaps worth $5bn.

India’s economy is domestically focused, making it less exposed to Donald Trump’s tariffs than some of its more trade-dependent regional peers. The US president doubled levies on Indian goods to 50 per cent in August over the country’s purchases of discounted Russian oil.

A weaker currency has provided some protection for Indian exporters by reducing the costs of their goods and making them more competitive.

But the impact of the trade war with the US is expected to become more apparent in the current quarter, according to analysts who have also raised questions about the bullish recent GDP reading.

Prime Minister Narendra Modi has set a target of achieving developed country status by 2047, India’s centenary of independence from Britain, which economists say would require average annual GDP growth of about 8 per cent.

Modi’s government has unveiled a series of recent structural economic reforms, including a simplification of the country’s goods and services tax regime and an overhaul of the labour code, in an effort to provide relief for businesses and protection against external shocks.

Malhotra took over the RBI’s governorship a year ago amid decelerating economic growth and with inflation exceeding the central bank’s target ceiling of 6 per cent.

He quickly embarked on a series of rate cuts, slashing 1 percentage point from the benchmark rate over three consecutive meetings in the first half of the year.

Retail inflation for October stood at 0.25 per cent, compared with the same month a year earlier.

Data visualisation by Haohsiang Ko in Hong Kong