The metal lift clangs and rattles during its 10-minute journey down to “68 Level”, over 2km beneath the scrubland near the Arizona town of Superior.

Its passengers step out into what feels like warm rain, thanks to water in the area between 68 level and the surface. They wear hard hats, steel-capped boots and a one-piece suit with emergency breathing apparatus attached to it. “Stench”, a pungent gas, will be released into the complex as an evacuation signal in an emergency.

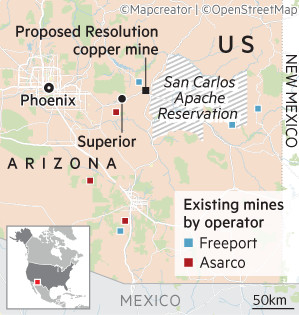

This is the deepest part of a huge complex in Arizona’s famous “copper triangle”, which has been mined since the 19th century. Resolution Copper, its owner, has spent more than $2bn to date on developing and permitting the site.

It is likely to be another decade before it starts hauling copper out of the ground, and even that is partly dependent on a key court ruling expected in 2026. The deposit is located underneath what some Native American people say is sacred land, and legal wrangling has delayed its progress.

The project would “forever change the landscape”, says Terry Rambler, chair of the local San Carlos Tribal Council, who opposes it. “This fight is not just for today, it’s for 100 years from now, for my kids and my grandkids.”

But Resolution expects the vast deposit to produce enough metal to meet up to a quarter of annual US copper demand over four decades and, economically, the stars are aligned for such a heavy investment.

Demand for copper is being boosted by the construction of grid infrastructure for the green transition and to power data centres for artificial intelligence. These need between 27 and 33 tonnes of copper per megawatt of power, according to miner Grupo México, over twice the requirement of conventional data centres.

BHP, the world’s biggest mining group by market value and a shareholder in Resolution, estimated in January that the amount of copper used in data centres worldwide will grow “sixfold by 2050”.

Then there is the move towards global rearmament. “A lot of copper demand is hidden,” says mining entrepreneur Robert Friedland. “Military requirements for copper are never publicly disclosed.” Analysts at Société Générale estimate that global defence spending grew by 9.4 per cent to $2.7tn in 2024.

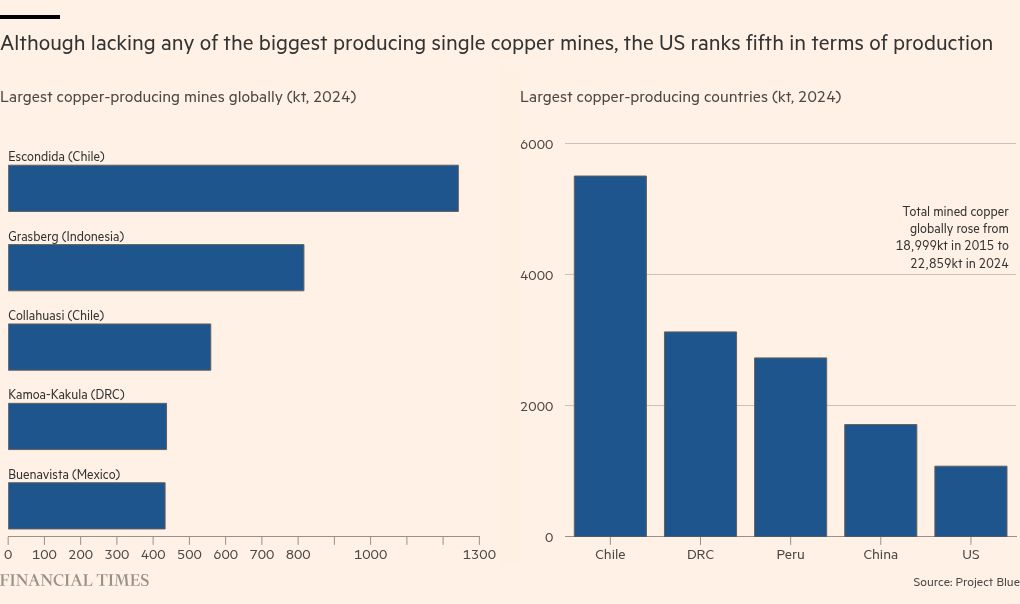

But existing mines, some dating back more than a century, are getting older and less productive, while large untapped deposits are becoming harder to find. In recent years there has only been a “trickle of new mines being built”, says Charles Cooper, head of copper research at Wood Mackenzie.

The International Energy Agency said this year that by 2035, production from existing and planned mines was on track to meet only 70 per cent of global demand. Existing producers are chasing mergers in order to increase their reserves and lower costs.

Analysts are expecting shortfalls as soon as this year, with consultancy Wood Mackenzie forecasting a 304,000-tonne shortfall of refined copper in 2025, a gap it says will widen in 2026. “Mining is the rate-determining step for the energy transition,” says Cooper.

Prices have responded, with copper hitting a series of record highs since October. The benchmark London Metal Exchange price currently stands at more than $11,000 per tonne, compared with around $8,500 two years ago.

“Metal market deficits can’t live for very long,” says Cooper, who notes that past price surges have tended to result in either substitution or increased supply from other sources, such as scrap metal. But he also points out that the technology “hyperscalers” building out data centres are less price sensitive than many of the metal’s traditional industrial consumers. They are already “outbidding grid suppliers on things like transformer units”, he says.

Vineet Mehra, chief executive of IRH Global Trading, says copper is the “new gold” and predicts that prices at recent levels are “here to stay” given the looming imbalance between supply and demand.

Resolution is also a high-profile test case for the Trump administration, which wants to reinvigorate the domestic mining sector and last month added copper to a list of critical minerals vital for the US economy.

Vicky Peacey, the project’s president and general manager, says the administration “has recognised this chronic, decades-long deficit in copper”, and adds that the project “definitely” has bipartisan support.

The looming copper deficit is “exactly why we should bring on new supply sooner rather than later”.

BHP acquired the Magma Copper Company, which operated several mines and a smelter in Arizona, in 1996. But faced with a cyclical downturn in the copper market, it later wound down many of the operations and closed the smelter completely in 2003.

The following year BHP and Rio Tinto, the UK-headquartered miner that operates one of the oldest copper mines in the US, formed Resolution Copper to work out a way to extract the estimated 1.8bn tonnes of copper buried beneath the workings of the Magma mine.

It is one of the largest undeveloped copper deposits in the world — but accessing the ore reserves will require blasting and scooping out a mile-long tunnel from 68 level.

The renewed impetus for such a technically challenging and expensive undertaking is partly down to the push among western nations to break their dependence on China for a host of strategic metals. Beijing has not hesitated to wield its control over the supply chains of key minerals as a weapon in its trade war with the US.

China itself only produces around 9 per cent of the world’s mined copper, but that figure rises to around 20 per cent after taking into account overseas projects it has ownership stakes in, according to Benchmark Mineral Intelligence.

As with rare earth metals, its real grip on the copper market comes at the processing stage. China now controls around half of copper smelting capacity worldwide. The US, by contrast, has just two operational copper smelters.

China is also by far the largest copper consumer, accounting for around 58 per cent of 2025 demand, according to Benchmark. The rapid expansion of its grid network was the single largest driver of copper demand growth in the past two years, according to the IEA.

Despite talk of a slowdown in China’s growth, India and other growing Asian economies are expected to boost global copper demand in the coming years.

But the world’s biggest copper mines are ageing, with ore grades declining and costs inching upwards. Máximo Pacheco, chair of the Chilean state-run copper giant Codelco, says it is becoming “more difficult and more costly to produce copper” each year.

An inability to maintain “operational continuity” and avoid supply disruptions was the “number one risk” under discussion among metals traders and executives in London during the industry’s annual gathering in October, Pacheco adds.

There have been major accidents at three of the world’s largest mines this year, including at Codelco’s El Teniente, while major copper producers including London-listed Glencore and Antofagasta have lowered near-term production forecasts.

Such mishaps have also highlighted the risks of relying on a handful of gigantic mines. “The global supply risks are being concentrated,” says Ekbal Hussain, a remote sensing geoscientist at the British Geological Survey. “We need more copper, but we’re also supplying our copper from bigger and fewer mega mines,” he says, noting that 20 mines produce about a third of the copper mined globally.

The largest of these is Escondida in Chile, where BHP and Rio Tinto are investing billions of dollars to maintain and boost production.

Few believe that maintaining output from existing mines will be enough, but discovering the next generation of Escondidas is getting more difficult. Of the 239 copper deposits discovered between 1990 and 2023, only 14 were discovered in the past decade, according to the IEA.

“The easy things in our industry have been done,” says Kathleen Quirk, chief executive of the major US copper miner Freeport-McMoRan. Miners are having to explore in more remote locations or deeper underground.

“Historically, there’s always been a long list of projects that the industry could invest in globally, but that list has become much shorter,” says Quirk. “It’s a difficult industry [in which] to grow supply.”

Developing known reserves can be politically difficult and expensive. Miners have faced pushback from local communities even in countries such as Chile, where mining contributes around 12 per cent of GDP.

Copper mining is water intensive, and consultancy PwC warned in July that climate change was increasing the risk of drought in key copper mining regions including Chile.

In November, market analysis group CRU said copper miners needed to accelerate the pace at which they approve projects, warning that the world is increasingly counting on “unprecedented” quantities of copper from theoretical mines and those that lack confirmed funding.

There are “shockingly few” major new copper mines in the near-term pipeline, says Albert Mackenzie, a copper analyst at Benchmark Mineral Intelligence. Investors are often unenthusiastic, he adds. “It’s not just that building a new copper mine is challenging, it’s juxtaposing what else you can do with that money.”

There are also problems at the processing stage. In China, the domestic build-out of smelters has been so dramatic in recent years that there is not enough copper ore to feed all the facilities globally. Miners used to pay smelters to process their ore; now it is the other way around.

The prospect of new copper smelters opening outside China in the short term — something western policymakers want, in order to reduce their reliance on Beijing — is unlikely. They are expensive to build, energy-intensive to operate and run on thin profit margins.

BHP, which originally bought Magma in part to gain access to its San Manuel smelter, has not yet said where it will send its share of Resolution’s concentrates. Rio Tinto plans to use its existing facility in neighbouring Utah.

Those living near resource-rich regions are not always happy to have a mine or a smelter complex in their back yard. In Serbia, persistent opposition to Rio Tinto’s planned Jadar lithium mine forced the company this year to shelve plans for the project into which it has sunk millions.

In Arizona, resistance to Resolution has come from some quarters of the San Carlos Apache Tribe, who have spearheaded lawsuits that have stalled the project.

Although the US Supreme Court in May cleared the way for the project to go ahead, a federal appeals court in August halted the crucial “land exchange” process that would enable Resolution to start tunnelling. Rambler of the San Carlos Tribal Council says Resolution’s plans will destroy an area of land, Oak Flat, that certain Apache people consider sacred. Resolution says the mine would cause an area, that includes some of Oak Flat, to sink over time.

But the prospect of jobs, and differences in local traditions, means not everyone living on the San Carlos Apache Reservation agrees with him. “Just look at our reservation,” said William Belvado, a reservation resident, during a recent community meeting. “Do we have quality of life? No . . . It’s hard to see that every day,” he told fellow attendees at the event, which was organised by Resolution.

Poverty on the reservation is clear to see; many houses are tiny, some are garden sheds or trailers fashioned into permanent dwellings. Rubbish and disused items are scattered around many properties, as well as the occasional burnt-out or broken vehicle.

Belvado added that many were open to engaging with the company about the plans. “That doesn’t mean we give up everything.”

Rambler acknowledges that some tribal members work locally for Resolution, as well as for Freeport, and that some of the community is “more open to mining jobs”.

“We’ve done our best to explain to our tribal members the threat to our people’s lives from this mine,” he says. A tribe’s ceremonial grounds are “like a church”, he says. “Christian people would consider them sacred, and nobody would dig under those churches.”

The headaches that come with starting from scratch mean the biggest and richest mining companies typically prefer to buy assets or expand existing mines.

The race for copper drove the biggest mining deal of the year, the proposed $50bn merger of Anglo American and Teck Resources, which have adjacent projects in Chile. The deal would make Anglo Teck the fifth-largest global producer of mined copper, according to analysis by Benchmark.

There is also growing interest in recycling, new technologies and squeezing more copper out of material that was previously considered waste.

BHP chief executive Mike Henry told the FT this year he was considering reopening shuttered copper mines. The company is investigating whether it can extract the metal from waste piles in Arizona, close to Resolution, with other miners including Freeport planning similar work.

“Some of what’s being mined today wouldn’t have been economically viable 10 years ago,” says Benchmark’s Mackenzie. But rising copper prices and better technology “opens up the prospect of mines extending their lives”.

The copper market has also been distorted by US import tariffs, with huge amounts of refined metal shipped to America ahead of the levies taking effect. Benchmark estimates that as a result, the amount of excess inventory now in the US, beyond its usual annual consumption, is greater than the amount of copper used each year by India, the world’s third-largest consumer.

Natalie Scott-Gray, senior metals demand analyst at commodity broker StoneX, predicts that by around 2030, the copper market “is set to go into a structural deficit that will be very difficult to come out of.” In such a scenario, the winners “will be countries that have stockpiled material” or control production capacity.

Such tightness could yet produce surprises on the supply or the demand side, Scott-Gray adds. “But the bottom line will be sustained higher prices.”