Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

US stocks dropped on Monday, led lower by tech companies, as investors scaled back exposure to risky assets on the first day of a key month for markets.

Wall Street’s tech-heavy Nasdaq Composite index fell 0.8 per cent in early trading and the S&P 500 weakened 0.6 per cent. Nvidia, the world’s largest publicly traded company, was down 1.3 per cent.

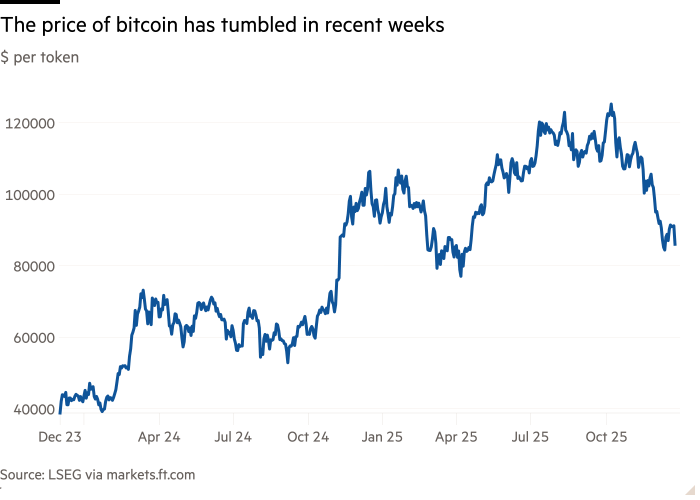

Bitcoin was also under pressure, falling 6 per cent and taking the cryptocurrency’s drop over the past month to more than 20 per cent.

The downbeat start to December follows a shaky November for tech stocks, which broke their monthly winning streak as concerns grew over the valuation of artificial intelligence companies.

Investors said sentiment on Monday was hurt after Bank of Japan governor Kazuo Ueda indicated that the central bank might raise interest rates this month.

The blue-chip Nikkei 225 closed 1.9 per cent while the yield on the Japanese 10-year government bond rose 0.07 percentage points to 1.87 per cent.

The weakness spread to other bond markets, with the 10-year US Treasury yield rising 0.06 percentage points to 4.08 per cent, and the 10-year German Bund yield climbing 0.05 percentage points to 2.75 per cent. Yields move inversely to prices.

Investors are now bracing for a string of US economic data this week, including ISM surveys and ADP payrolls figures, ahead of the Federal Reserve’s decision on interest rates on December 10. Traders are putting the chance of the central bank cutting rates at the meeting at about 90 per cent.

“This week will offer the last real chance to put a December cut from the Federal Reserve into question,” said ING’s Pesole.