This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

BoJ comments rattle global bond markets

Samsung turns to M&A amid AI race

An FT Film on Japan’s pivot back to nuclear

Global bond markets dropped yesterday after the Bank of Japan signalled that it could raise interest rates later this month in a decline that heaped fresh pressure on bitcoin and other speculative assets. Here’s what to know.

Market reaction: Japan’s two-year government bond yield, which is particularly sensitive to rate expectations, jumped above 1 per cent for the first time since 2008 on Monday after Bank of Japan governor Kazuo Ueda indicated that the central bank might raise interest rates this month. Longer-term debt also fell, with the 10-year yield up 0.07 percentage points to 1.87 per cent. Japan’s yen rallied around 0.6 per cent against the US dollar to ¥155.3 as traders sharpened bets on higher rates.

The rise in Japanese yields rippled through global fixed income markets, sparking declines from the US to Germany. The selling in bonds hit risky assets, which generally decline when investors can obtain higher yields from holding haven assets like Japanese and US government debt. Bitcoin slumped 7 per cent, taking the cryptocurrency’s drop over the past month to more than 20 per cent.

Expert insight: Economists noted that the BoJ’s increased hawkishness put it at odds with the government’s ambitious spending plans. “The government is pushing on the accelerator and the BoJ is taking its foot off the accelerator,” said Marcel Thieliant, Asia-Pacific head at Capital Economics. “It’s not consistent with what the government wants, but the BoJ would tell you it’s economic logic.” Read the full story.

Here’s what else we’re keeping tabs on today:

Economic data: South Korea reports November inflation data and Singapore publishes the purchasing managers’ index for the month.

Global economy: The OECD publishes its latest economic outlook.

Five more top stories

1. Construction netting found at the site of a deadly apartment complex fire in Hong Kong last week did not comply with anti-flammability standards, according to a preliminary investigation. “We strongly condemn those involved in the case for killing so many lives in pursuit of petty profits,” said Eric Chan, Hong Kong’s chief secretary, at a press conference yesterday.

2. Indian businesses and states are rushing to adapt to the sudden introduction of what Prime Minister Narendra Modi hailed as one of the biggest overhauls of labour rules since the country’s independence from Britain in 1947. The regulations enacted last month seek to formalise the vast informal sector, but some workers argue it makes it easier to be fired.

3. A court in Bangladesh has sentenced British MP and former City minister Tulip Siddiq to two years in jail in a corruption case involving her aunt, ousted Bangladeshi prime minister Sheikh Hasina. The verdict was delivered in absentia as the accused, including Siddiq, were not in the country. Read more about the case.

4. OpenAI has taken a stake in Thrive Holdings, a private equity group set up by one of its biggest investors, in the latest of a series of circular deals that have enmeshed the $500bn start-up with its customers, suppliers and backers. Thrive Capital, which is run by Josh Kushner, invested more than $1bn into OpenAI in late 2024, whose value has more than tripled since then.

5. McKinsey, Boston Consulting Group and other top consultancies have frozen starting salaries for the third consecutive year as AI starts to reshape the industry, forcing firms to reconsider their traditional “pyramid” structure. The job offers suggest a cautious approach to hiring from firms that are among the largest recruiters of graduates and MBA students.

News in-depth

Samsung last month established its first official M&A team as it fights for a technological edge in the global AI race. Lagging behind peers SK Hynix and Micron, the South Korean conglomerate has faced mounting pressure from shareholders to deploy its cash reserves of Won108.5tn ($74bn) to accelerate its growth in areas including AI, chip design and software. But the six deals completed by Samsung this year have underwhelmed investors, according to analysts.

We’re also reading and watching . . .

The strongman race: Chinese leader Xi Jinping is ending the year in a better position than his American and Russian counterparts, writes Gideon Rachman.

🎬 In Fukushima’s Shadow: An FT film explores how Japan is balancing a traumatic nuclear history with the need for cheap power.

What to buy: There is a once-in-a-generation opportunity in global markets that could deliver strong returns regardless of how the AI mania plays out, argues Ruchir Sharma.

Post-punk prime minister: An attempt to criticise Australian PM Anthony Albanese for wearing a Joy Division T-shirt has fallen flat, writes Nic Fildes.

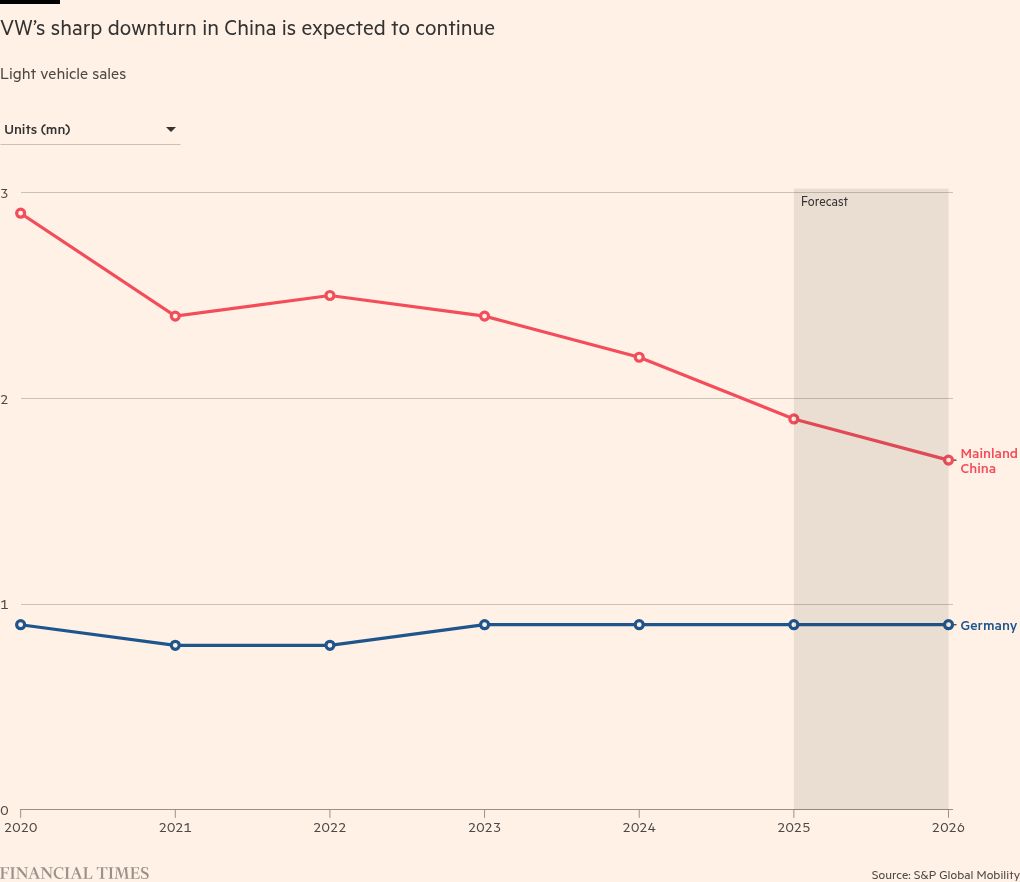

Chart of the day

Volkswagen is struggling to adjust to the rise of electric vehicles, big sales declines in China and lacklustre demand in Europe. A year after revealing landmark cost-cutting plans, some think more retrenchment is needed.

Take a break from the news . . .

Stand-up comedy is not just for laughs; it can improve confidence, teamwork and creativity. More employers are getting in on the joke.