Good morning. It’s good (ish) to be back home after more than three weeks away. Many thanks to my colleague Andres Schipani for stepping in for me last Friday, while I tried to decide if the blatant displays of wealth in Dubai were fabulous or vulgar. (Mostly vulgar, if I can’t afford it).

In today’s newsletter, the proposal for 100 per cent FDI in insurance seeks to clear its final hurdle. But first, the biggest labour reform in decades is here.

Employee code

India ushered in the biggest reform of labour laws in the country, with four new legislative codes coming into effect last week. These were arrived at by essentially compressing and updating 29 former laws, some of which date back to the colonial era. The codes had been passed by parliament in 2020 but hadn’t been implemented because of pushback from some opposition parties and trade unions. The new regulations have been updated to cover contemporary economic developments such as the rise of gig work, business process outsourcing and global capability centres.

The legislation forces companies to do away with informal work contracts and formalise all employment with an appointment letter. It expands coverage of social security and the minimum wage, and gets rid of restrictions on hiring women for certain jobs. Workers will also be able to receive gratuity after just one year of employment instead of five. Employers of gig workers have to now contribute to their social security, and allocate 1.2 per cent of their annual turnover to the same. (There are 10mn gig workers across the country, a number that the government think-tank expects will go up to 23.5mn in 2030.)

The response to the government’s announcement has been mixed. Overall, the reforms are good for big companies, as they have the required structures in place to comply with the rules, and benefit most from simplified regulation. The manufacturing sector in particular has been waiting for these changes for a long while now. Small- and medium-sized companies, however, will bear a high cost of compliance in the medium term and they are not helped by the fact that the rules came into immediate effect with little warning.

Workers, especially those on nonbinding contracts, are more protected. Other employees will take home a smaller pay packet, as social security and pension deductions will increase. But the development that has most worried unions is that some companies will find it easier to fire staff. In some states, a company will only need government approval for mass lay-offs if it employs more than 300 people, up from 100 before. It is telling that the implementation of the new law was announced straight after the results of the elections in Bihar, since a significant number of India’s migrant workers hired by small- and medium-sized companies hail from the state.

While the codes are favourable for certain segments of workers and companies based on their sector and size, its benefits are questionable for others. India’s labour market is fundamentally exploitative because it relies on a large mass of the uneducated poor. We will have to wait and see if this makes their lives better or worse.

Will these reforms benefit employers or employees more? Let me know what you think. Hit reply or email us at indiabrief@ft.com

Recommended stories

Insurance companies are seeking to limit liability from AI agents and chatbots as companies face multimillion-dollar claims.

India tries to see through the fog of pollution data.

A US bankruptcy court has ordered Byju’s founder to pay $1bn.

Real Madrid has plans to sell a 5 per cent stake in the club to investors.

When to shut up in meetings.

Best books of 2025: FT journalists pick their favourites.

Insurance sector to open up

Insurers in India could soon be fully foreign-owned if a new law is passed next month. The government has been looking to increase foreign direct investment in the sector — currently capped at 74 per cent — since at least February, but only published a draft bill for public comment in August. The bill is now listed for discussion in the last parliamentary session of the year, which begins on December 1.

Other than lifting the cap on foreign investment, the proposed legislation also removes requirements that a company’s chair or chief executive and a majority of the board must be resident Indian citizens, and that the company must get permission to repatriate dividends abroad. Insurers who have more than 50 per cent foreign ownership, currently required to ensure independent directors make up half of their board, will now need just three.

These changes add to the general opening up of the financial sector in the country this year, with the Reserve Bank of India approving foreign investment in banks on a case-by-case basis. Two foreign lenders have bought big stakes in Indian banks, with at least one more major deal on the horizon. In insurance, the big shake-up this year was Germany’s Allianz breaking its 24-year-old venture with Bajaj before announcing a new tie-up with Mukesh Ambani-owned Jio.

The relaxation of FDI rules will bring more global players into the domestic market, which currently has 57 companies, of which seven are government-owned. The sector is projected to reach a size of $293bn by 2030, and has been growing at a rate of 17 per cent annually. Three-quarters of the current market is the life insurance segment, with general insurance that covers travel, automobiles and health etc accounting for the rest. But the number of Indians who have insurance coverage is still relatively tiny. Ninety per cent of Indians are not covered for natural calamities and 70 per cent do not even have health insurance. The market is substantially large and the entry of more foreign players, with their deep pockets, is certainly good for the economy and consumers.

Is there room in India’s insurance sector for more players? What do you think? Hit reply or email us at indiabrief@ft.com

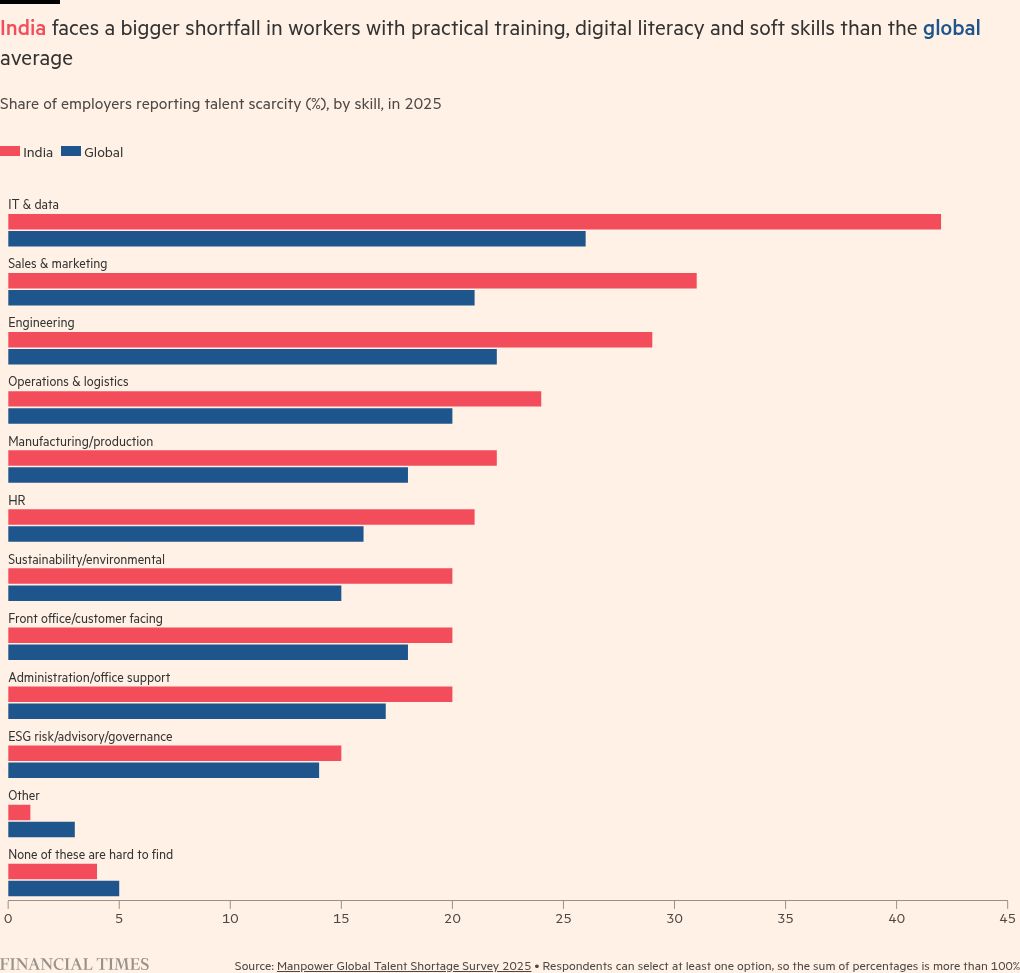

Go figure

India faces a bigger shortfall in workers with practical training, digital literacy and soft skills than the global average.

My mantra

“I believe how you start your morning shapes how you lead your day. A few minutes of yoga or exercise helps me think clearly and sets the tone for the day. I connect with my teams, understand their priorities and align on what truly matters. Those honest, unfiltered conversations bring out the best ideas. Success comes from steady effort, clear purpose and genuine connection. There is no shortcut to hard work.”

Sindhu Gangadharan, MD, SAP Labs India

Each week, we invite a successful business leader to tell us their mantra for work and life. Want to know what your boss is thinking? Nominate them by replying to indiabrief@ft.com

Quick question

The rupee has now touched an all-time low of 89.66 against the dollar. Do you think it will breach 100 in the coming months? Tell us here.

Buzzer round

On Friday, we asked: Which famous artefact was made for the ruling Romanovs in St Petersburg for every Easter Sunday between 1885 and 1916?

The answer is, of course, the beautiful Fabergé eggs. If you have £20mn to spare, you may be able to get your hands on one next month.

Aniruddha Dutta was first with the right answer, followed by Soman Dutta, Dhanush Dinesh, Prasanna Venkatesh, Mahithi Pillai and Samiran Ghosh. Congratulations!

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.