Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Nvidia beat, the planet is saved.

Away from the company’s spectacular revenue growth — you can sell the pickaxes and shovels before people find the gold — the company made an interesting presentational adjustment in its latest results.

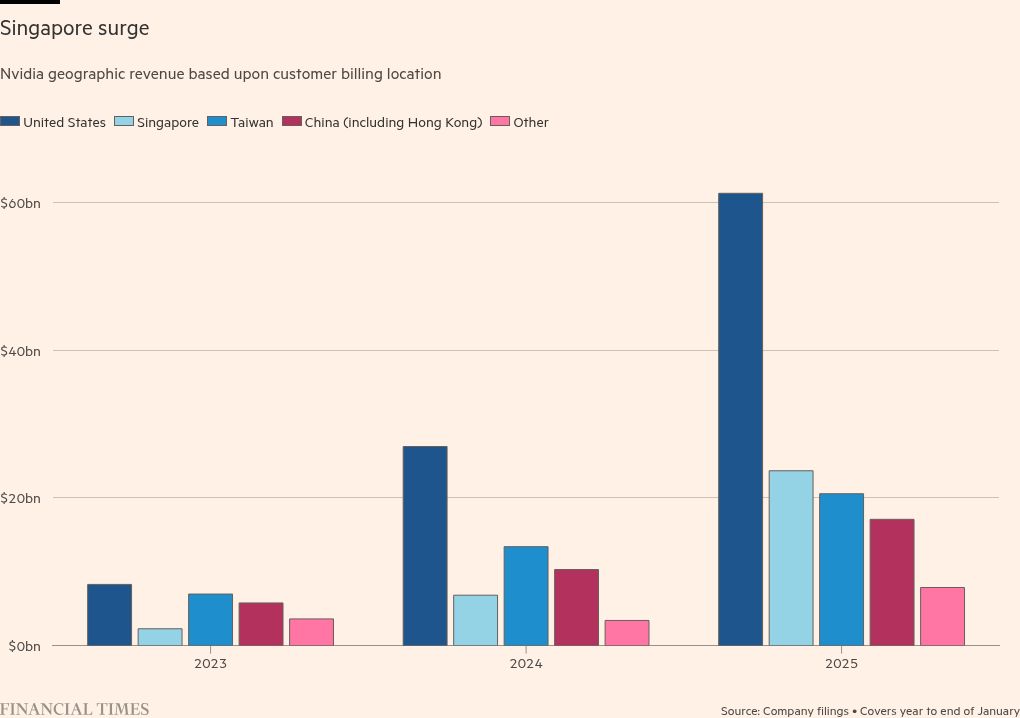

Singapore has been a sore spot for Nvidia lately. The Lion City (state) grew to be the chipmaker’s second-biggest billing location last year:

In its full-year results, the company caveated the figures thusly:

Singapore represented 18% of fiscal year 2025 total revenue based upon customer billing location. Customers use Singapore to centralize invoicing while our products are almost always shipped elsewhere. Shipments to Singapore were less than 2% of fiscal year 2025 total revenue.

After its Q1 “Geographic Revenue based upon Customer Billing Location” results showed Singaporean billing had climbed further — to cover a fifth of all total revenues — the company offered some more details:

Singapore represented 20% of the first quarter of fiscal year 2026 total revenue based upon customer billing location. Customers use Singapore to centralize invoicing while our products are almost always shipped elsewhere. Over 99% of controlled Data Center compute revenue billed to Singapore was for orders from U.S.-based customers.

And after its Q2 “Geographic Revenue based upon Customer Billing Location” results showed a continued increase, Nvidia offered… about the same amount of detail:

Singapore represented 22%, and 21% of the second quarter and first half of fiscal year 2026 total revenue based upon customer billing location, respectively. Customers use Singapore to centralize invoicing while our products are almost always shipped elsewhere. Over 99% of controlled Data Center compute revenue billed to Singapore was for orders from U.S.-based customers for the second quarter and first half of fiscal year 2026.

It’s certainly a surprising way to handle billing. Could something else be going on?

Yes, something else could. As Bloomberg reported in January:

US officials are probing whether Chinese AI startup DeepSeek bought advanced Nvidia Corp. semiconductors through third parties in Singapore, circumventing US restrictions on sales of chips used for artificial intelligence tasks, people familiar with the matter said.

And as the New York Times reported last month:

Commerce Department officials have been investigating whether [Singapore-based data center company] Megaspeed, which has close ties to Chinese tech firms, is helping companies in China sidestep American export restrictions…

Megaspeed illustrates the challenges facing U.S. government officials trying to keep China from accessing powerful A.I. chips. After splitting off from a Chinese gaming company in 2023, Megaspeed set up a subsidiary in Malaysia that quickly snapped up nearly $2 billion worth of Nvidia’s most advanced products. Most of those chips came from the U.S. branch of a Chinese company that has already been sanctioned for providing technology to the Chinese military, according to records obtained through ImportGenius, a trade data platform.

Given this backdrop, FT Alphaville was excited to see the “Geographic Revenue based upon Customer Billing Location” figures for Q3.

Unfortunately, the whole table is gone, replaced by “Geographic Revenue based upon Customer Headquarters Location”. The first column now reads “United States”, “Taiwan”, “China (including Hong Kong)”, and “Other”.

Singapore, meanwhile, is nowhere to be seen. Shame.