Good morning everyone from a smoggy Delhi. Today, I have taken the India Business Briefing baton from Veena after having spent some time in the coal mines — literally. (Stay tuned, more on that coming to you soon.) Normal IBB service will resume next Tuesday when our ever-prescient newsletter editor will be back from the Arabian sands to the choking streets of India’s capital.

In today’s newsletter, with the sharp-eyed help of my colleague Krishn Kaushik in Mumbai, we will see that Tata’s travails are far from over. First, through the Delhi haze, we are playing clairvoyants on the prospects of a trade deal with the US.

Waiting for a deal

Over the past week, the US has announced trade deals with Argentina, Ecuador, Guatemala, El Salvador and Switzerland. What happened to India, whose prime minister is avowedly a “great friend” of Donald Trump? For almost two weeks now we have been hearing, both in New Delhi and Washington, that the much-vaunted India-US trade agreement is almost done.

Is it? I often feel I am in Samuel Beckett’s play when it comes to this deal.

Commerce secretary Rajesh Agrawal said this week that “there are discussions going on” between New Delhi and Washington but provided no timeline for a deal to be sealed.

Just to recap: a deal would conclude months of friction between Washington and New Delhi. While both governments were negotiating a deal, the Trump administration slapped punitive tariffs on India in late August over its purchases of discounted Russian oil, dealing a blow to the world’s fastest-growing large economy. This raised the total duties on India to 50 per cent, among the highest levels in the world and almost double those on south-east Asian countries. India cried foul but continued talks.

India is not a top global exporter, yet it has a high trade surplus in goods with the US, reaching more than $45bn last year. It also has high average tariff levels of its own. All of that has rankled the volatile Trump.

While we wait for the Godotian deal, Indian trade is already feeling the pinch, with the country’s merchandise trade deficit widening to a record high of $41.68bn last month. Part of this is due to a fall in US-bound exports, which dropped nearly 9 per cent year on year to $6.31bn after Trump’s tariffs hit shipments of goods such as textiles, shrimp and gems and jewellery. Official data also showed imports from the US rose to $4.47bn in October from $3.98bn in the previous month — a shift that would no doubt have put a smirk on Trump’s face.

The tariffs have led to a steep drop in container volume of shipments from India to the US. US container imports from the top 10 countries it buys goods from fell 9.4 per cent year on year in October, dragged down by a 16.3 per cent drop from China and (surprise) an 18.5 per cent fall from India, according to data from Descartes, a digital shipping platform. Shipments rose from (surprise again) some south-east Asian trading partners which inked agreements for lower levies with Washington.

Meanwhile, in polluted New Delhi, the wait continues . . .

Is a trade deal between India and the US really nearly sealed? Hit reply or email us at indiabrief@ft.com.

Recommended stories

The “Donroe Doctrine”: Trump’s power play in Latin America

Mukesh Ambani’s Reliance is battling mom-and-pop stores for India’s shoppers

The growing problem with China’s unreliable numbers

India is trying to train a vast pool of poorly skilled workers

The scandal roiling Turkish football

Tata Motors Passenger Vehicles’ Travails

Shares of Tata Motors Passenger Vehicles slid more than 7 per cent early this week over concerns about its Jaguar Land Rover subsidiary, which was forced to halt production temporarily after a cyber attack in August. JLR revenues dropped 24.3 per cent to £4.9bn on the previous year in its most recent results.

The business also slashed the forecast of its operating margins to 0-2 per cent, from 5-7 per cent earlier, due to the cyber attack’s impact. “This was a difficult quarter with disruption from a cyber incident. This is something that is happening to more and more companies that no company would ever wish for,” Richard Molyneux, JLR’s chief financial officer, said.

As JLR accounts for a lion’s share of profits for Tata Motors Passenger Vehicles, worries about its growth crashed the parent’s share price to Rs363 soon after markets opened on Monday, taking it to a seven-month low. Though slightly better since, its shares are still in the doldrums — at the absolute bottom — of India’s blue-chip benchmark Nifty50 index.

Beyond the cyber attack’s financial impact, which the British carmaker has reported will continue into this quarter, JLR is also facing challenges of weaker demand in key markets, including Europe. Demand has also been further squeezed by a new luxury tax in China and a rise in US tariffs on car imports from the UK to 10 per cent, from 2.5 per cent earlier.

While the company said it had since resumed production to normal levels, the disruption resulted in a capital outflow of nearly £800mn. It announced a pre-tax loss of £485mn for the September quarter, compared with a pre-tax profit of £398mn last year. It is still unclear who attacked JLR. But HDFC Securities clearly noted earlier this week that there were “headwinds galore” coming for JLR, as it advised reducing exposure to Tata Motors’ shares.

Go figure

Nvidia shrugged off market anxiety and posted an encouraging set of numbers. The sales of its chips grew even faster than Wall Street anticipated last quarter, reassuring investors that the global AI spending spree is still going strong.

62%

Revenue growth y-o-y

$57bn

Revenue for last qtr

$4.5tn

Valuation

Read, hear, watch

I am devouring Jon Lee Anderson’s new book compiling his extraordinary reporting from Afghanistan, To Lose a War, which was released in the US in August and will be published in the UK in February. I am also closely following from afar the (umpteenth) bailout saga of my native country, Argentina.

Buzzer round

Which famous artefact was made for the ruling Romanovs in St Petersburg for every Easter Sunday between 1885 and 1916?

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right.

Quick answer

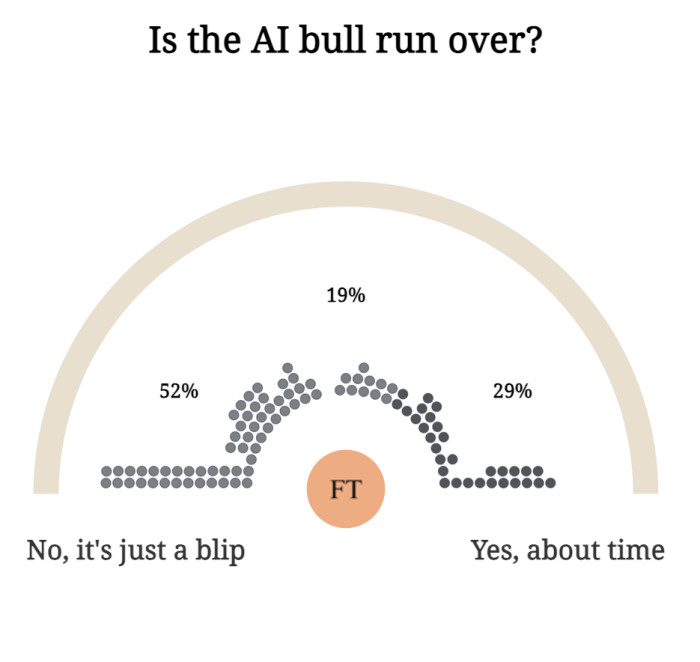

On Tuesday, we asked if you thought the AI bull run was over. Here are the results. More than half of you think it’s just a blip.

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.