Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

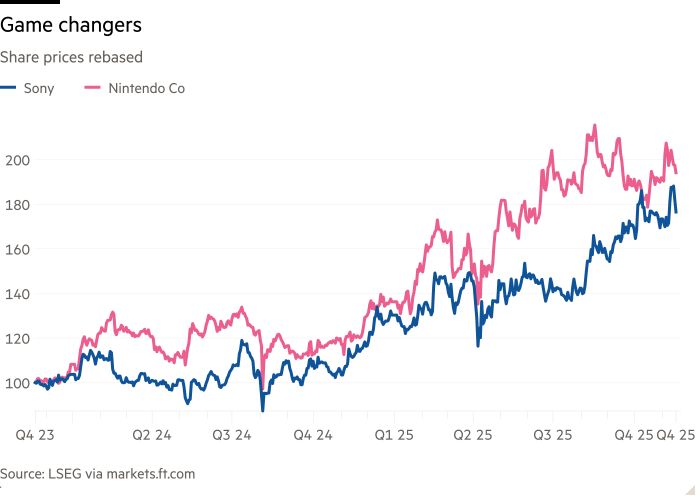

The Nintendo Switch 2 will appear on many a festive-season wish list this year. Already, strong sales of the gaming console have helped drive a strong rally in the shares of Nintendo, the company that makes it. But the stock’s near-50 per cent rally this year also reflects the Japanese group’s shrewd adaptation of a formula that has benefited iPhone maker Apple: turning continuity into a competitive advantage.

For most of gaming history, console makers followed a strict pattern. Each generation of consoles went through a hard reset, typically with a clean technological break from the last. Sony’s PlayStation 5, for example, may look similar to the PS4 but is a very different machine on the inside. Each generation of console would, traditionally, come with a new ecosystem of exclusive games.

The original Switch, launched in 2017, was a big bet for Nintendo following the commercial failure of the Wii U. The hybrid handheld and console — playable through a TV or on the go — added a new twist to portable gaming. The second iteration of the Switch, launched in June, is a different sort of big bet. Instead of leaping into a completely new format Nintendo has chosen incremental innovation. The Switch 2 looks very similar to its predecessor. It does have a sharper display based on OLED technology, a faster processor and smoother performance. But the device is still a hybrid, and games are backwards compatible.

This is closer to the Apple playbook than it is Sony’s. Apple’s products are built on incremental progress; each iPhone generation refines the last, while keeping its attachment to the ecosystem. Incremental innovation brings clear advantages, such as lower research and development spending and a lower risk of commercial failure. Apple’s R&D spend remains steady at around 8 per cent of total net sales for the 12 months to September 27, modest compared with tech peers.

In the gaming wars, Nintendo now seems to be gaining ground on Sony and Microsoft. The 10mn units it sold in the first half exceed the combined first-half console sales of its two rivals. Nintendo now expects to sell 19mn units this year, which translates into a lift to operating profit forecasts of 16 per cent. Profit and sales for the quarter to September were both well ahead of market expectations.

Nintendo shares trade at 42 times forward earnings, a steep premium to global gaming peers, reflecting growing earnings expectations, and a strategy that is working. The message extends beyond gaming. In a sector addicted to reinvention, Nintendo is demonstrating that radical innovation is not always a pre-requisite for progress.