This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

Former Bangladeshi leader guilty of crimes against humanity

Japan tries to calm feud with China

The FT’s favourite books of 2025

We start in Bangladesh, where a special court has sentenced former leader Sheikh Hasina to death in absentia for crimes against humanity over her role in a deadly crackdown during an uprising that toppled her government last year. Here’s what to know.

The verdict: Sheikh Hasina was found guilty yesterday by Bangladesh’s International Crimes Tribunal of three charges relating to the killing of student protesters, as well as two of overseeing the crackdown, for which she was sentenced to life imprisonment. Justice Golam Mortuza Mozumder said it was “crystal clear” that Sheikh Hasina “gave incitement to her party Awami League”. He added: “Furthermore, she expressed that she ordered to eliminate the student protesters.”

Key details: According to the UN, as many as 1,400 people were killed, most by security forces, in last year’s uprising, which brought to an end Sheikh Hasina’s 15-year rule. The 78-year-old was being tried in absentia, having fled to India after her regime collapsed. The interim government in Bangladesh, led by Nobel Peace Prize laureate Muhammad Yunus, has requested her extradition, but New Delhi has not issued a formal response.

Sheikh Hasina’s response: The former prime minister has repeatedly denied responsibility. After the verdict she said: “The verdicts announced against me have been made by a rigged tribunal established and presided over by an unelected government with no democratic mandate. They are biased and politically motivated.”

Read the full story from our reporters in Dhaka and New Delhi.

Here’s what else we’re keeping tabs on today:

Economic data: Hong Kong reports October jobs figures.

US-Saudi ties: President Donald Trump hosts Crown Prince Mohammed bin Salman at the White House for talks expected to focus on defence, nuclear co-operation and Saudi investments. Ahead of the visit, Trump’s family business and its Saudi partner announced plans to build a luxury Maldives resort that uses blockchain technology to attract investment.

Five more top stories

1. Japan has dispatched a senior envoy to try to ease tensions with China as stock markets in both countries fell after Beijing issued a travel warning to its citizens over the weekend. Shares in Japanese companies plunged on the prospect of a sudden decline in the number of Chinese tourists, among the largest sources of foreign visitors. Here’s more on Tokyo’s effort to the calm the feud.

Japan GDP: Japan’s economy shrank at an annualised rate of 1.8 per cent in the latest quarter, ahead of a major stimulus package expected this month.

2. India has announced it will dramatically increase purchases of US liquefied petroleum gas, as New Delhi seeks to ease trade tensions with Washington and win relief from Trump’s punitive tariffs. One analyst said there was “no economic rationale” for India to import LPG from the US. “The gains will be political rather than economic.”

More India trade news: The EU is preparing to reject a demand from India to be exempted from its carbon border tax, a move that will complicate efforts to seal a trade deal between the two by the end of the year.

3. US prosecutors are investigating a group of telecoms companies after BlackRock’s private credit unit HPS Investment Partners said it lent them hundreds of millions of dollars against receivables that appear to be fake. The Department of Justice is examining entities linked to Bankim Brahmbhatt, a low-profile executive behind a clutch of companies that borrowed large sums from one of the biggest names in private credit.

4. UBS chair Colm Kelleher and US Treasury secretary Scott Bessent have privately discussed moving the Zurich-based bank’s headquarters to the US. The talks are part of an ongoing effort by Kelleher to put pressure on the Swiss government to back down over proposed capital requirements that would force UBS to hold an additional $26bn of capital.

5. Amazon is seeking to raise $12bn in its first US bond sale in three years. Amid an expensive arms race to build AI infrastructure, many Big Tech groups have pivoted to funding large construction projects with debt rather than spending their cash reserves. Read more about the borrowing spree.

Interview: Klarna CEO Sebastian Siemiatkowski

Klarna chief Sebastian Siemiatkowski is an AI evangelist with his buy now, pay later group claiming it has used the technology to cut more than half of its workforce in recent years. But Siemiatkowski — who holds shares in prominent AI companies, including OpenAI, through his family office Flat Capital — told the FT that the huge sums being poured into data centres to power AI models made him “nervous”. Read the full interview.

We’re also reading . . .

‘The Number’: Many bankers’ retirement fund targets reflect a deep sense of financial insecurity, writes Craig Coben.

Pricey tickets: UK ministers plan to ban the resale of tickets for live events above their original cost, in an aggressive crackdown on resellers.

Advice to CEOs: Beloved author Joyce Carol Oates hit a nerve when she called Elon Musk “uneducated” and “uncultured”. It led Emma Jacobs to think about chief executives and their reading habits.

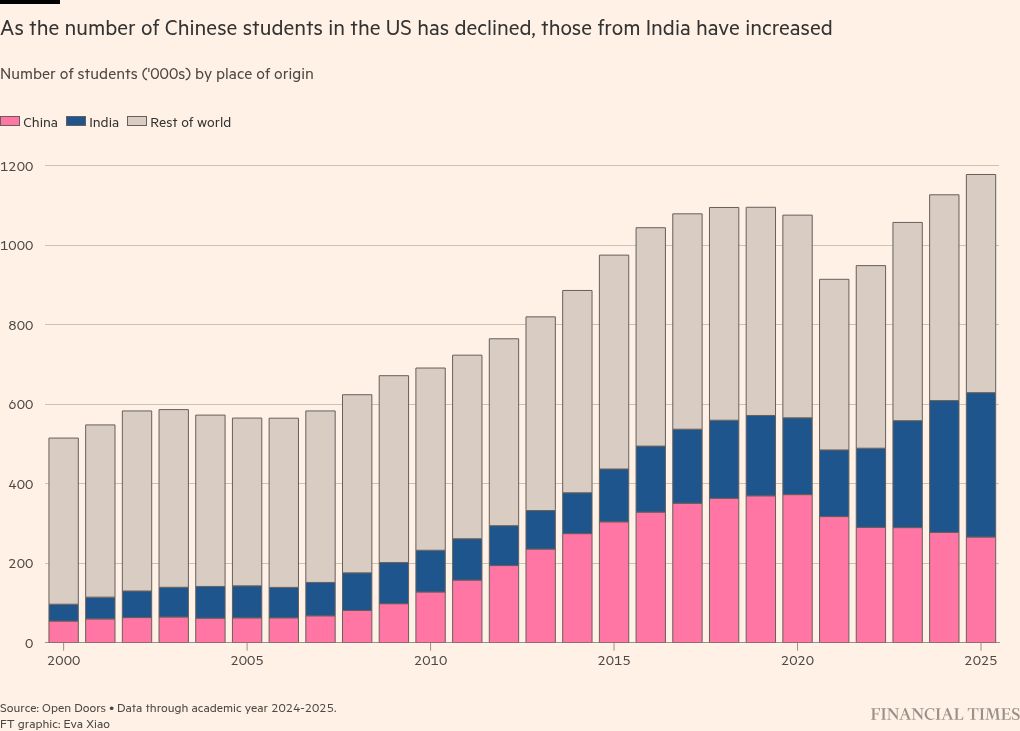

Chart of the day

The number of new international students in US universities fell 17 per cent this year, one of the sharpest ever declines in foreign enrolments amid Trump’s tough policies. India remained the largest country of origin for all foreign students in the US at more than 30 per cent, ahead of China at 23 per cent.

Take a break from the news . . .

As we near the year’s end, the FT has kicked off its 2025 review of books, featuring our favourite titles from business and politics to art, food and fiction. You can also nominate your favourite read and we’ll publish a selection of the best responses on FT.com.