Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Japan is one of the world’s largest net creditors. Its institutional investors’ overseas holdings pushed the country’s net external assets, which include holdings of foreign securities, to a record last year, according to official data, creeping past Y533tn ($3.4tn). Life insurers are among the largest investors and, for decades, their savings have helped steady global markets. What happens when that flow reverses?

Last month, yields on Japan’s 30-year government bond surpassed the record high of 3.28 per cent reached in September. That may not seem very high for some markets, but for Japan it is a big deal. Sovereign yields have stayed near zero and domestic yields have been suppressed by the Bank of Japan’s ultra-loose policy for almost three decades.

Until now, Japanese institutional investors have poured capital into global credit in search of returns. US Treasuries and European sovereigns have been particularly favoured. The result has been to push global borrowing costs lower than they could otherwise have been.

But now, with local yields rising, domestic investments are becoming more attractive than some international alternatives. That is in part because the yield that foreign instruments offer Japanese investors is eroded by the cost of hedging dollar exposure. That reasoning is already being reflected in portfolios. Half of the top 10 Japanese life insurers have revealed plans to cut overseas debt. Dai-ichi Life, Taiyo Life and Daido Life are among those that have cut foreign debt holdings as returns on yen assets improve.

That may be bad news for global credit markets that have become used to the steady demand of Japanese investors. But for local life insurers, this shift helps simplify their investing process. Higher local yields improve investment returns on their portfolios of yen-denominated assets and reduce the need to take on foreign exchange or duration risk.

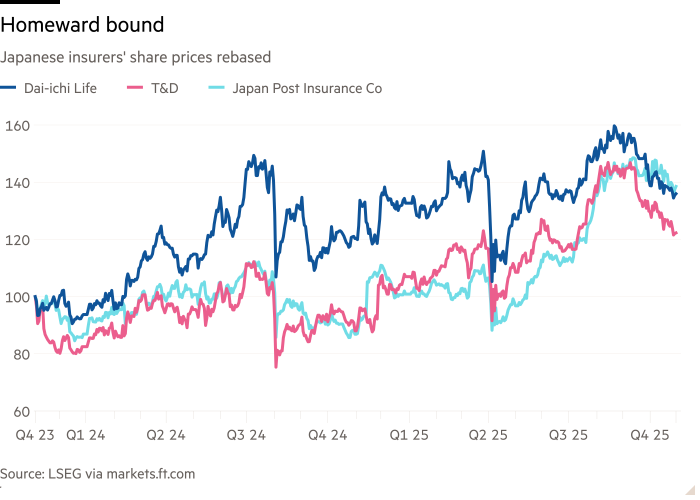

That also means better returns on their core bond portfolios, lower earnings volatility from foreign assets and a profitability boost. Shares of Dai-ichi Life, the largest listed life insurer in Japan, are up 30 per cent from their April low, and trade at 1.6 times tangible book. This is in line with US and European peers. Historically, Japan’s insurers have traded at steep discounts to their global counterparts owing to their poor profitability, with returns on equity as low as half those of US rivals.

As funds move back home, that should mean better long-term return potential and signal a clearer strategic direction for the sector — even if foreign markets, deprived of a long-standing source of support, may be sorry to see them go.