This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

Singapore falls out of favour with wealthy Chinese people

US government shutdown hits air travel

Louis Vuitton’s ship-shaped Shanghai shop

Singapore has long been a popular destination for rich Asians trying to set up family offices and secure residency. But an increasing number of wealthy Chinese people are trying to relocate to the Gulf as the Asian city-state tightens scrutiny of applicants.

What’s happening: In the past year, there has been a rise in enquiries from Chinese nationals eager to relocate to Dubai and Abu Dhabi, according to private bankers and advisers to the ultra rich. “They are attracted [to the Gulf] by the ability to get residency status and live and enjoy stability,” said Mike Tan, Standard Chartered’s Singapore-based global head of wealth planning and family advisory.

A stricter Singapore: The city-state “has very restrictive immigration rules — they want to ensure the right people come in,” said an adviser to wealthy families in the city-state. “It is relatively easy to set up a family office and get employment passes, but much harder to get residency and citizenship.” Meanwhile a money-laundering case, believed to be Singapore’s largest, involving individuals linked to a gang from China’s Fujian province prompted greater scrutiny of individuals and flows.

Read more about the wealthy Chinese people opting for the Middle East over Singapore.

Here’s what else we’re keeping tabs on today:

COP30: The UN Climate Change Conference begins in Belém, Brazil.

Syrian president in Washington: Ahmed al-Sharaa meets Donald Trump at the White House.

Monetary policy: The Bank of Japan publishes the summary of opinions from its last rate-setting meeting

Five more top stories

1. European carmakers are rapidly losing market share globally as Chinese rivals enter a new phase of expansion and innovation, said the head of the world’s biggest operator of car-carrying ships. Lasse Kristoffersen, chief executive of Wallenius Wilhelmsen, told the FT there was “massive growth” in Chinese shipments around the world amid Beijing’s domestic crackdown on price cuts.

2. Trump administration officials yesterday warned that US air travel would slow to a “trickle” and US economic growth could turn negative if the country’s federal government shutdown continues for much longer. The shutdown, now the longest in US history, could trigger shortages of goods and snarl supply chains, warned Treasury secretary Scott Bessent.

Interview: The mounting problems facing poorer Americans are leaving the world’s most important economy exposed to risks of a downturn, a top Federal Reserve official has warned.

3. BBC director-general Tim Davie resigned yesterday after days of criticism over the public service broadcaster’s coverage, including misleading edits of a Trump speech in a documentary. Here’s more on the controversy.

4. Viktor Orbán’s nemesis has vowed to bring Hungary back into the western fold if he comes prime minister after spring elections. Read the FT’s interview with Péter Magyar, whose upstart Tisza party has a comfortable lead in opinion polls ahead of April’s parliamentary elections.

5. Private equity groups are seizing on the break-up of Europe’s last industrial conglomerates as they buy up the non-core businesses the companies are offloading. Buyout groups see opportunities to substantially improve divisions that have not yet passed through private equity ownership.

News in-depth

As you round the corner on Shanghai’s Shimen Second Road, a giant ship appears like an apparition. “The Louis”, a cruise liner-shaped exhibition space and store, is the brainchild of Louis Vuitton and an attempt to navigate the choppy waters of China’s luxury market. Once the driver of global growth, it is now a source of uncertainty for the world’s biggest brands. Will the huge crowds drawn to the ship be willing to spend?

We’re also reading . . .

FT Magazine: Christopher Eppinger kept trading Russian oil when sanctions meant others stopped. The 31-year-old made $250mn in 30 months.

AI voice phishing: Just as we learnt to treat emails with caution, we must now learn to doubt a human-sounding voice, writes Nell Norman.

Vibe shift: Zohran Mamdani’s election win and a politically incorrect cookbook show that Americans are embracing candour over caution, writes Jemima Kelly.

Chart of the day

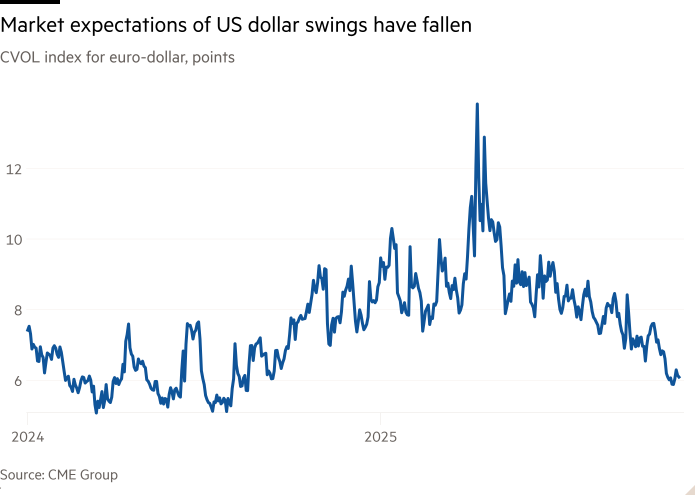

Currency markets have moved beyond the “Trump shock” that sparked big gyrations earlier in the year, as measures of dollar volatility tumble to levels last seen before the US presidential election.

Take a break from the news . . .

Filmmakers Shih-Ching Tsou and Sean Baker spent 25 years on Left-Handed Girl, a joyride of a family saga set amid Taipei’s chaotic night markets. “People in the US didn’t know about Asian cinema,” Tsou told FT film critic Danny Leigh. “And they didn’t want to watch movies with subtitles. That was what we kept being told anyway.” But the pair never gave up — and now the film is Taiwan’s entry for the Oscars.