Hello, this is Kenji in Tokyo, where US President Donald Trump just swept through this week as part of his tour of east Asia. The visit put quite a bit of stress on ordinary people as 18,000 police officers were mobilised and major highways closed off in the country’s capital during his three-day stay.

When this newsletter comes out, Trump will be on his way back to the US, having wrapped up his tour with one of the most anticipated events: a face-to-face meeting with Chinese President Xi Jinping in Seoul. The US president told reporters that the hour-and-40-minute talk had yielded agreements on fentanyl, soybeans and rare earths, which should help soothe investor nerves.

The US leader’s trip, which kicked off in Malaysia on Saturday, has produced a number of headlines, including the signing of a peace accord between Thailand and Cambodia. Several agreements on trade, tariffs and business were also made, and details of the $550bn investment deal between the US and Japan started to emerge, including the joint development of rare earth mines.

Around the time Trump was leaving Tokyo’s Haneda Airport on board Air Force One, the Japan Mobility Show was kicking off at Tokyo Big Sight, just a few kilometres away. Journalists got an advance look at the event, which opens its doors to the general public on Friday.

One of Trump’s major grievances against Japan has been over automobiles, as he claims that various non-tariff measures are blocking American cars from entering the Japanese market.

While not going into depth about the reasons for that, no US automakers — like General Motors, Ford Motor or Stellantis-owned Chrysler — were here presenting new models or sharing their marketing strategies at Japan’s most eye-catching auto exhibit. But auto manufacturers from other countries, including BMW, Mercedes-Benz, Hyundai and Kia, held press conferences on Wednesday.

Among those non-Japanese names, BYD has grabbed a good amount of media attention. The Chinese automaker, which is making its second appearance at the Tokyo show, introduced two new models for next year — a T35 small truck and the Racco, an electric kei-style minicar — both tailored for the Japanese market.

Liu Xueliang, BYD’s Asia Pacific general manager for auto sales and president of its Japan operation, told reporters that the new models are a clear signal of how the Chinese company is “fully committed to Japan”.

According to Liu, BYD sold 7,123 passenger cars in Japan during the last two years and 500 buses over the last decade. While the numbers do not look so substantial, its performance is something to keep an eye on, as Japan is just the latest market where Chinese automakers are making great leaps against the backdrop of overcapacity and fierce price wars at home.

Major American automakers are starting to express concern about the progress of Chinese vehicle manufacturers, despite the US virtually shutting them out of its own market. “Competition is getting tougher, namely the Chinese [automakers] are expanding globally,” Ford CEO Jim Farley has warned.

Revving up

While BYD and global automakers are promoting themselves at the Tokyo Mobility Show, other Chinese peers are building up their war chests in Hong Kong. Nikkei Asia’s Kenji Kawase has been following a series of new shares listings on the city’s bourse, where four mainland Chinese auto sector companies on Monday and Tuesday announced plans to raise up to a total of $3.5bn.

The largest was by Seres Group, a Chinese electric vehicle maker partnering with Huawei Technologies, which intends to raise 13.17bn Hong Kong dollars ($1.69bn), if the pricing is set at the top of the range.

Following Seres, robotaxi companies Pony.ai and WeRide said they are looking to take in as much as HK$7.55bn and HK$3bn, respectively, to invest in enhancing their self-driving technology.

All of them, including intelligent auto parts provider Ningbo Joyson Electronic, are already listed either on the Nasdaq or in Shanghai. They are taking advantage of market conditions and filling up their coffers by equity financing in Hong Kong, amid ongoing tectonic shifts in the industry over electrification, smart cars and autonomous driving. Nvidia, for example, is planning to roll out 100,000 robotaxis with ride-hailing company Uber starting in 2027, according to Nikkei Asia’s Yifan Yu.

Accelerated ambitions

Silicon Valley investors, including Peter Thiel’s Founders Fund, have invested more than $100mn in a secretive US start-up with a bold plan to challenge the dominance of Taiwan Semiconductor Manufacturing Co and ASML in cutting-edge chipmaking.

San Francisco-based Substrate, founded in 2022 by James Proud and his younger brother Oliver, plans to use particle accelerators to make chips much more cheaply than today’s state-of-the-art equipment, writes the Financial Times’ Tim Bradshaw.

The start-up has attracted funding from big-name investors including Founders Fund, General Catalyst and Valor Equity Partners, despite the huge logistical and financial challenges Substrate faces to succeed in one of the most technically complex industries in the world. Its fundraising valued the company at more than $1bn, Substrate said.

Proud, who was born in London but is now an American citizen, said he was driven by a desire to help the US beat China in the race for global technological dominance.

“The company itself is very ideological,” Proud said. “The US needs to have advanced semiconductor production and we need to do it at high volume.” He said “foreign monopolies” holding “the two main choke points” on chip production was a “glaringly scary dependence”. Substrate is aiming to produce chips “with a cost structure that enables [the US] to compete against China,” he added.

Ups and downs

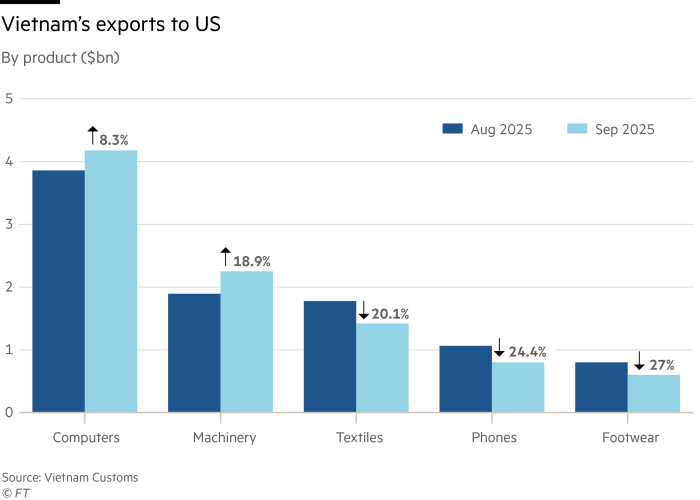

Concerns that Trump’s “reciprocal” tariffs would take a heavy toll on the export-dependent economy of Vietnam are starting to fade. The US tariff rate on Vietnamese imports is 20 per cent — down from an initially threatened 46 per cent — while the levy for transshipments stands at 40 per cent, in order to close a loophole for Chinese goods destined for the US to avoid higher tariffs.

Overall exports from the south-east Asian country have remained strong, though a closer look at the data since August 7 by Nikkei Asia’s Mai Nguyen and Atsushi Tomiyama shows that the results are mixed.

Products in lower value-added sectors, such as textiles and footwear, have been hit hard, including Nike and Adidas products. Meanwhile, higher value-added manufacturing of goods such as computers, machinery, optical products, automotive parts and solar panels has been thriving.

This is “exactly where Vietnam as a country wants to be”, said John Campbell, director of industrial services at real estate company Savills’ Vietnam office. He noticed a “big uptick in inquiries again” for companies looking for manufacturing sites in September.

Great mines . . .

One of the most notable highlights of President Donald Trump’s visit to Japan from a #techAsia perspective was an agreement on rare earths.

Before Trump’s arrival, US Ambassador to Japan George Glass on Saturday revealed that part of Japan’s $550bn investment commitment “will be directed to revive and develop America’s mining and ore processing”, Nikkei Asia’s Jada Nagumo and Kenji Kawase reported. This followed China’s move to sharply tighten export restrictions on rare earths and related products, an area of the supply chain the country has long dominated.

And one of the tangible outcomes of the first face-to-face meeting between Trump and Japanese Prime Minister Sanae Takaichi is a deal that included an agreement for the two countries to mobilise public and private sector support in their efforts to “accelerate the secure supply of critical minerals and rare earths”, Shotaro Tani and Mitsuru Obe write.

Separately, Turkish President Recep Tayyip Erdogan recently announced that his country possibly has 12.5mn tons of rare-earth reserves, which could be a potential game changer in attempts to break China’s hold on the materials, Nikkei Asia’s Sinan Tavsan reports. If this find is confirmed, Turkey would have the world’s third-largest reserves after China and Brazil, according to data from the United States Geological Survey.

Suggested reads

Nvidia supplier SK Hynix has already sold next year’s chips on AI boom (FT)

Honda halts production in Mexico due to chip shortage (Nikkei Asia)

Nexperia faces ‘existential threat’ after Dutch seizure, Chinese owner warns (FT)

Samsung shakes off AI memory woes but race to innovate is far from over (Nikkei Asia)

Chinese carmakers make headway in UK, with BYD in lead (Nikkei Asia)

Kawasaki Heavy tests prototype autonomous helicopter as ‘flying truck’ (Nikkei Asia)

M&S ends IT service desk contract with Indian provider after cyber attack (FT)

Nidec put on special alert by TSE over accounting issues; stock falls (Nikkei Asia)

China’s leadership vows to step up push for ‘self-reliance’ in tech (FT)

#techAsia is co-ordinated by Nikkei Asia’s Katherine Creel in Tokyo, with assistance from the FT tech desk in London.

Sign up here at Nikkei Asia to receive #techAsia each week. The editorial team can be reached at techasia@nex.nikkei.co.jp