Good morning. This is an important week on the reality show called . . . well, current reality. On Thursday, US President Donald Trump will meet his Chinese counterpart Xi Jinping. Markets around the world are pinning their hopes on a trade deal between the two countries. Look out for our coverage in Friday’s edition of this newsletter.

By the way, I’ll be in London from November 3 to 18 and Tee and I would love to meet any of you based in the city! Send us an email if you’d like to catch up and we’ll work something out.

Market value

Indian stock markets are nearing record highs, so why doesn’t it feel that way? Benchmark indices Sensex and Nifty are 0.5-1 per cent shy of their all-time highs, but the surge has been primarily driven by a narrow set of stocks including Bharti Airtel and State Bank of India. Even the explanations for the rise are rather tenuous. Last week, hope that a trade deal with the US was imminent was attributed as the reason for market optimism, and this week it is the Federal Reserve’s interest rate decision.

A more hopeful development is that inflows from foreign portfolio investors finally turned positive this month (thus far), though India is poised to witness record outflows for the year. If the sentiment towards emerging markets is turning and the Fed eases interest rates, then the markets will see a run-up as money sloshes in, despite muted domestic economic conditions.

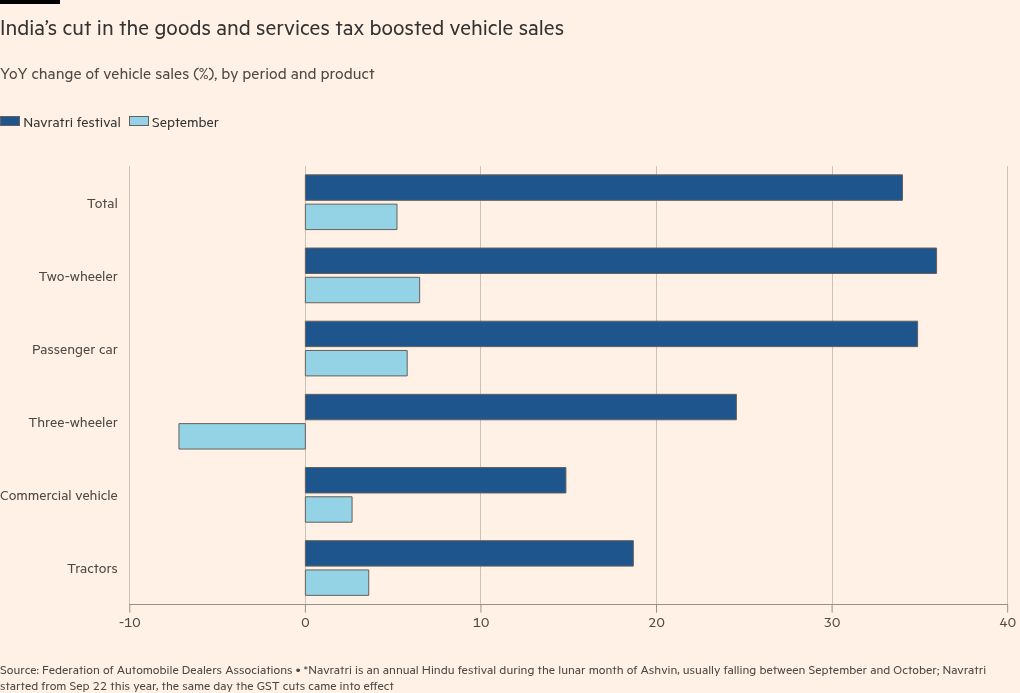

Corporate results for the quarter that ended in September have been a mixed bag. The reforms in the goods and services tax came into place only on September 22, and while it has certainly buoyed car sales, it is too early to know what its cross-sectoral impact has been.

IPOs are the booming segment of the market. But here too the underlying facts paint a different picture from the headline numbers. Some 79 public offers hit the market in the first nine months of the year, raising more than $11bn. A clutch of big names are expected to go public before December, lifting hopes that the Indian IPO market will bag more than $20bn this year. But performance of the listed stocks have been less than stellar. Almost half the new listings are trading well below the price at which they debuted, and even big names like Tata Capital did not witness a big listing bump up. The Indian arm of the South Korean white goods manufacturer, LG, and the home services company, Urban, were the significant exceptions to this trend.

So what is the forecast for the Indian markets now? While a liquidity-fuelled run-up in stocks is a possibility, market fundamentals continue to be murky. We will have to wait for the end of this quarter to get more insights into the economy. But the immediate outlook is not promising: there is no trade deal with the US so far, the rupee is hovering around the Rs88 mark to the dollar, GDP growth is around 6.6 per cent, and there are no indications of a market wide pick-up in consumption. Stock markets often run ahead of the economy. For now, only the market is running — the economy is hobbling.

What is your outlook on the Indian stock market? Hit reply or email us at indiabrief@ft.com

Recommended stories

M&S has ended its IT service desk contract with TCS after the cyber attack.

The US expects China to delay rare earth export controls as a trade deal nears.

HSBC is provisioning $1.1bn for a lawsuit by investors who lost money over Bernard Madoff’s Ponzi scheme.

Argentina’s Javier Milei has won big in midterm elections.

Trump is raising tariffs on Canada over a TV ad quoting Ronald Reagan. Did the former president “love tariffs”?

What’s wrong with dating apps?

AI rules

Last week, the information ministry published stringent guidelines to prevent the misuse of artificial intelligence on social media platforms. The new rules mandate that AI companies and social media platforms clearly tag any content that is generated by this technology. They also specify a 10 per cent rule: the disclaimer should occupy at least 10 per cent of the visible surface area of the content — which means 10 per cent of the pixels for images and characters of text. For audio, the warning must appear in the first 10 per cent of the clip. The guidelines are now open for public comments.

The regulations hold AI companies, such as OpenAI, Perplexity etc responsible for this, in effect making them “intermediaries”. This means they will be treated on par with social media platforms, which will have to secure a declaration from users about whether uploaded content has been “synthetically generated”.

Although some platforms such as Instagram and YouTube have begun to label AI content, this is often done as a response to user complaints, and not as a proactive measure to maintain authenticity. Until now, the only true recourse to identify or prevent AI fakes has been reporting cases to the police or judiciary. In recent months, several Bollywood actors have filed such cases in order to prevent their likeness being used, after a surfeit of AI-generated videos began to flood social media. With the new guidelines, the government is hoping to combat a rapidly proliferating problem that poses serious dangers in the run-up to elections.

These guidelines do make business harder for tech companies and content creators, who risk being banned from platforms if they fail to comply. There is also criticism that the regulation has been drafted without a full understanding of the technology and is therefore clunky and difficult for companies to follow. But with a market of more than a billion people in India, the government is right to put consumers first. Tech companies should take responsibility for what they’re helping to generate and have certainly made enough money to put the necessary systems in place. The creator economy, too, is mature enough now to start being more responsible.

Do you think these guidelines are an over-reach by the government? Hit reply or email us at indiabrief@ft.com

Go figure

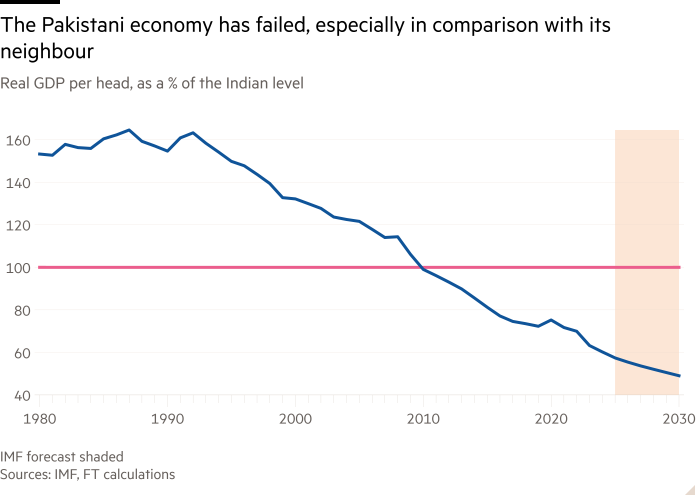

Pakistan’s Asim Munir, Trump’s “favourite field marshal”, is confidently wooing global powers, but faces far tougher challenges closer to home. Can he fix a nation whose economy is failing, especially when compared with India?

My mantra

“I don’t believe I need to do everything. Delegating empowers the team so we move faster, smarter and are able to execute quicker. Most importantly, it helps identify the next leaders.”

Andrew Holland, head, new asset class, Nippon India MF

Each week, we invite a successful business leader to tell us their mantra for work and life. Want to know what your boss is thinking? Nominate them by replying to indiabrief@ft.com

Quick question

Do you think Trump and Xi will arrive at a mutually beneficial “good deal” this week? Tell us here.

Buzzer round

On Friday, we asked: Which dish originates in Nepal and Tibet, is made of flour, water and (usually) a meat filling, and comes in two shapes — half moon and full moon?

The answer is . . . of course delicious, can’t-get-enough momos!

Neeraj Gupta was first with the right answer, followed by Aniruddha Dutta, Gladson Joy, Nitin Lall, Prasanna Venkatesh and Mahithi Pillay. Congratulations! Very pleased to see a lot of new names this week.

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.