Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Indonesia’s economic slowdown is hitting a consumer activity often described as the country’s national pastime — smoking.

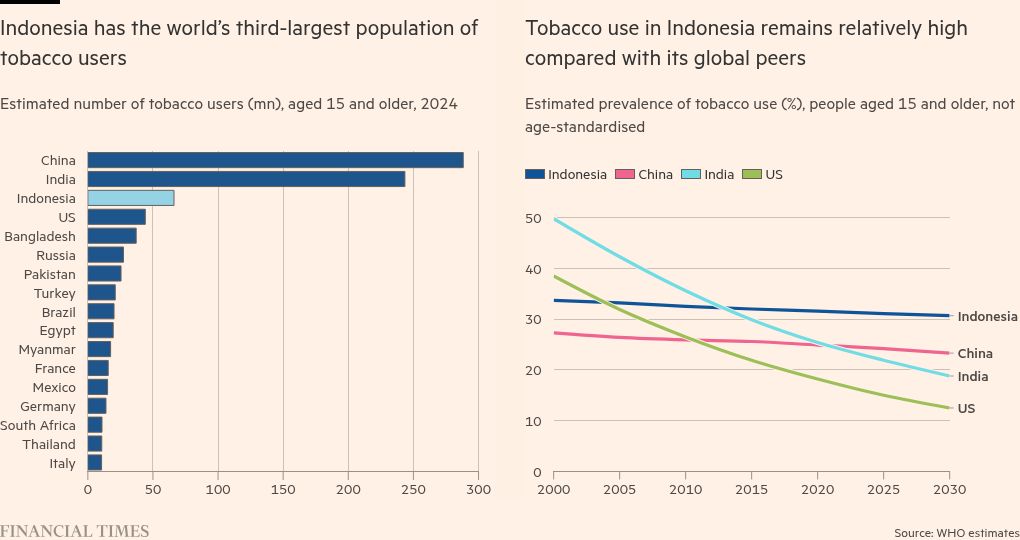

Smokers in Indonesia, the world’s third-largest tobacco consumer after China and India, are switching in large numbers to cheaper illicit cigarettes amid weaker purchasing power and a sluggish job market, analysts and industry figures say.

Illegally produced cigarettes can be more than 60 per cent cheaper than the legal variety as they are not subject to high excise duties — making a significant impact on household spending at a time of deepening economic woes in south east Asia’s largest economy.

“When cigarettes are expensive and consumers are jobless, how can they afford to buy?” said Sarkia Adelia, an equity research analyst at Panin Sekuritas. “The middle- to low-[income groups] are shifting to cheaper options.”

Indonesia has an estimated 66mn tobacco users aged 15 and above, according to an October report by the World Health Organization, and millions more child smokers out of an overall population of 285mn.

Cigarettes and tobacco account for an average of 6 per cent of monthly household expenditure, more even than education, according to government data. The clove-laced kretek cigarettes are the most popular.

Still, the tobacco industry was facing “a structural slowdown”, said Sarkia.

Indonesia’s two biggest cigarette producers, Philip Morris-owned Hanjaya Mandala Sampoerna and Gudang Garam, have taken a hit to their sales and share prices in recent months.

This comes as Indonesia grapples with a broad-based slowdown. A long-standing focus on capital-intensive commodities industries has failed to create high-paying jobs and weakened the manufacturing sector, which has laid off thousands of workers this year.

Many people have shifted into the informal sector, which pays poorly and offers minimal social protection. Informal jobs now account for 60 per cent of total employment.

That has resulted in weakening purchasing power that has hit sales of a wide array of consumer goods — from cars to pizza — and contributed to a shrinking middle class.

While cigarettes from Sampoerna and Gudang Garam now cost at least Rp2,000 ($0.12) per stick, illicit cigarettes can cost as little as Rp600 each.

“People choose to down trade to cheaper alternatives and the cigarette sector is not immune,” said Willy Goutama, an analyst with Maybank Sekuritas.

He added: “Household consumption has been pretty weak due to the fact that our labour market quality is deteriorating.”

Cigarette manufacturers first started to feel the pinch in 2020, when the government began raising excise duties to boost state revenue and curb smoking. The duties have increased by 67.5 per cent over the past five years, and now account for three-quarters of the price of cigarettes, analysts said.

The decline in sales could affect government revenue at a time when Indonesia’s finances are under pressure from President Prabowo Subianto’s social welfare plans. Maybank’s Goutama said Indonesia’s fiscal revenue may decline by 1 per cent for every 10 per cent decline in excise tax revenue or legal cigarette sales.

The government collected Rp216.9tn ($13bn) in tobacco excise duties last year, accounting for about 7.5 per cent of total state revenue. Finance minister Purbaya Yudhi Sadewa said this month that the government would not raise duties on tobacco products for 2026, partly to curb the use of illegal cigarettes.

Indonesia was preparing alternative strategies to maintain state revenue while ensuring the sustainability of the tobacco industry, he said, according to state news agency Antara.

Major producers are not optimistic about demand.

Market leader Sampoerna’s sales for 2024 dropped 3.7 per cent to 80.8bn cigarettes. Sales have continued to decline in the first half of this year, recording a 1.5 per cent fall.

Gudang Garam, meanwhile, said “the Indonesian tobacco industry is currently in poor health”.

In an update to investors and media in September, the company’s director and corporate secretary Heru Budiman said “purchasing power remains depressed and shows no convincing signs of improvement”.

“Restoring profitability can be achieved by raising prices, but . . . [doing so] when smokers still have cheaper alternatives risks further reducing sales volume,” he added.