Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

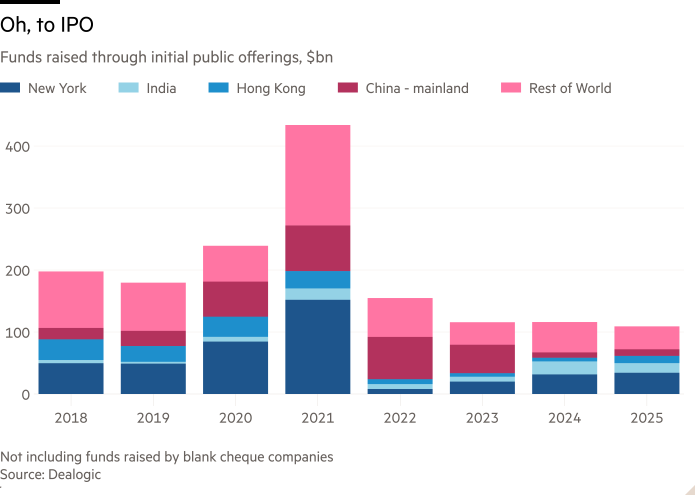

Superlatives are not prerequisites for a thriving equity market, but they do tend to help. New York’s two giant exchanges and Hong Kong, this year’s leading venues for initial public offerings, respectively boast record index values and big gains. India, right behind them in capital raising, has a very different mood: not too hot, not too cold.

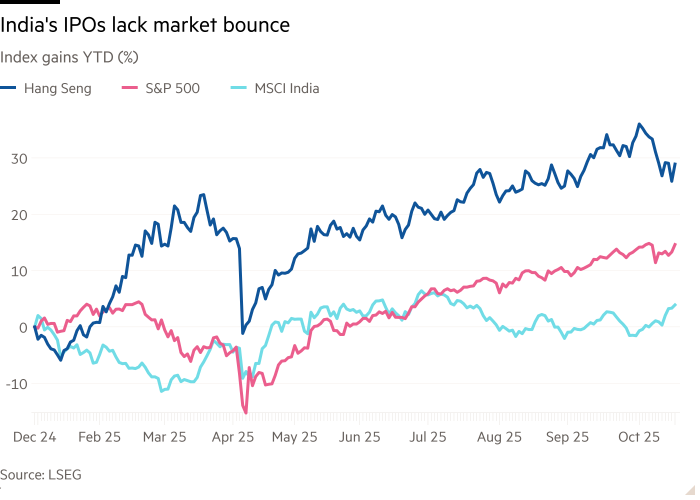

Certainly, when markets are abuzz, companies thinking of issuing stock are more likely to take the plunge. This year, Hong Kong’s Hang Seng is up 28 per cent, helping spur almost $12bn in first-time floats and much more in new listings, while New York has raised about $35bn for IPOs as the S&P 500 hits a series of records. The Bombay Stock Exchange and the National Stock Exchange of India show there is a middle way: they have raised $15bn in total, even though the MSCI India has gained less than 4 per cent.

India had a slow start to the year, owing to a decelerating economy, US tariffs and a short conflict with Pakistan. Yet even though other global markets have recovered from April’s trade terrors, India’s benchmark stock index has lagged those of its main rival financial centres. Its goods face a current headline US tariff of 50 per cent, among the world’s highest; half of that punitive levy relates to its buying of Russian oil.

Nonetheless, this year’s IPO haul looks likely to surpass last year’s record $21bn. Last week marked the high point for IPOs so far this year, with two $1bn-plus floats from Tata Capital, a non-bank lender, and then LG Electronics’ Indian arm. Shares in the latter jumped 50 per cent on their debut.

Granted, exaggerated first-day performances can be a sign that something is amiss. In LG’s case, though, the more likely reason was a small free float and a modest valuation relative to peers. Investors can hardly be accused of chasing the next big thing, either: of India’s IPOs since January 2024, the average gain to date — before LG — has been just 4 per cent, with about as many underwater as have gained, according to Bernstein analysts.

India’s relatively steady progress up the IPO league tables in recent years suggests some maturing of its capital markets rather than a one-off boom. About two-thirds of the funding for floats has been domestic, says Bernstein, helped by a tax break-inspired push by local savers into mutual funds. Local funding helps lessen any reliance on flighty foreigners while deeper markets should help attract further investment as those with the money feel confident the market will provide an exit route.

Of course, markets don’t offer fairy tales forever — there is the risk that valuations do get inflated, or that Trump-related tariff politics become even more inimical to India’s interest. But for now, Mumbai’s capital markets do seem to be operating just right.