Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The west must be prepared for higher wind energy costs if it rejects Chinese companies from its industry, said an executive at one of China’s biggest turbine manufacturers.

Kai Wu, Goldwind’s vice-president, said it was “fully understandable” that foreign governments want to deepen their local supply chains and create employment opportunities.

But he warned that China’s cost advantage in turbine manufacturing had grown “huge” at about “40 per cent, at least” compared with western rivals. Greater turbine costs result in higher electricity prices as the cost of installation is passed on to consumers.

“I always ask them: are you ready to sacrifice the cost of energy?” Wu, who leads Goldwind’s international division, told the Financial Times. “Everybody wants to have the best salary and the lowest workload, but it’s not reality.”

Countries around the world are struggling to execute decarbonisation policies while reducing their economic and technological dependence on China over national security concerns. Western officials have been highly critical of Beijing’s industrial policy, which they allege has led to overcapacity and below-cost products.

Last year, the EU launched a subsidy investigation into Chinese wind turbine companies. The bloc is also planning to make it more difficult for Chinese operators to take part in public tenders and auctions for renewable subsidies. In the UK, officials have been reviewing the security implications of Chinese-manufactured technology.

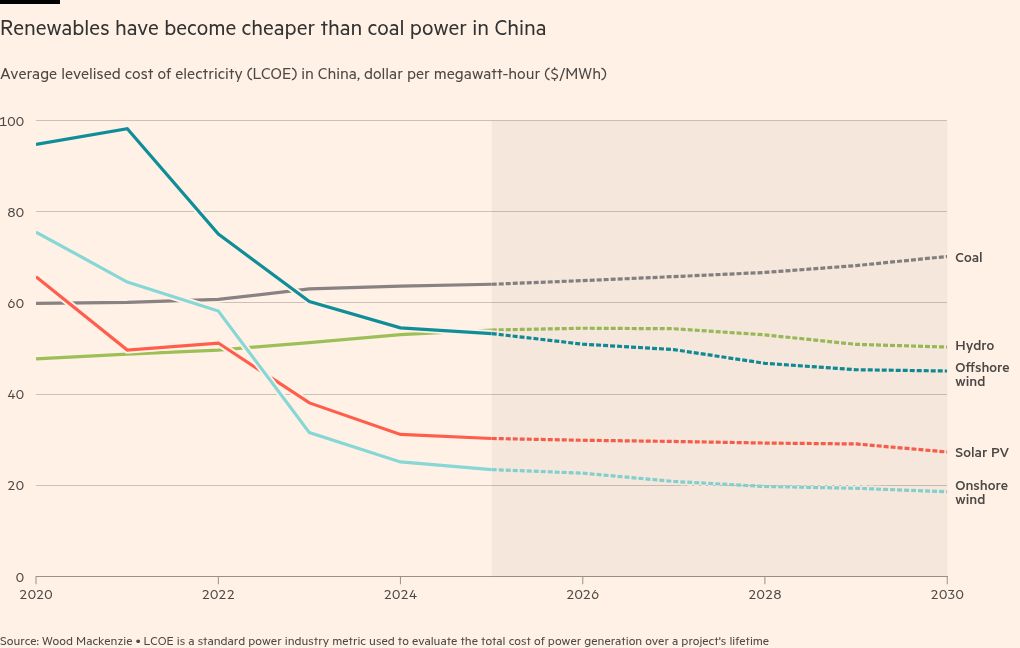

China’s clean energy investment reached more than $625bn last year, almost doubling since 2015, according to International Energy Agency data. Companies in the country produce more than 80 per cent of the world’s wind turbines, solar panels and energy storage batteries. State support, fierce local competition and technological breakthroughs have resulted in steep falls in costs.

Wu called for more international wind industry collaboration and stressed that Chinese companies had much to learn from Europe, including the bloc’s sophisticated financing and technical standards for wind developments.

Wu said that, compared with China, wind projects in the west took longer to develop and were more expensive to build. He noted that, while some western engineering graduates seek a salary as high as $140,000, he could hire “at least three” for the same rate in China.

He argued that China’s advantage over the west in renewables was partly the result of its comparatively late development, which provided the opportunity to leapfrog technologies.

“We cannot say China is good and Europe is bad, or Europe is good, and China is bad. We have to see the ‘time’ difference,” said Wu.

Wood Mackenzie forecasts that Chinese wind turbine manufacturers will dominate the industry over the next decade as a result of strong domestic growth and aggressive overseas expansion plans. The consultancy forecasts Chinese companies will capture about 27 per cent of installed capacity outside China, mainly in emerging markets. In Europe and the US, companies, such as Vestas, Siemens Gamesa and Nordex, are expected to dominate the market.

In China, Goldwind and its peers are increasingly turning their focus to offshore wind power installations, which are more expensive and technically challenging but are more powerful.

Speaking at a recent Beijing forum with climate-vulnerable countries — a group that includes 74 nations with more than 1.8bn people — Wu said financing for projects remained “a real problem”.

“For wind power, turbine manufacturers are constantly improving and innovating . . . but there is also a lot of infrastructure,” he said. “Our road transport costs, our construction costs — if many of these costs don’t come down, technological innovation alone cannot solve the problem,” he added.

Additional reporting by Jana Tauschinski in London

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here.

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here