Stay informed with free updates

Simply sign up to the Equities myFT Digest — delivered directly to your inbox.

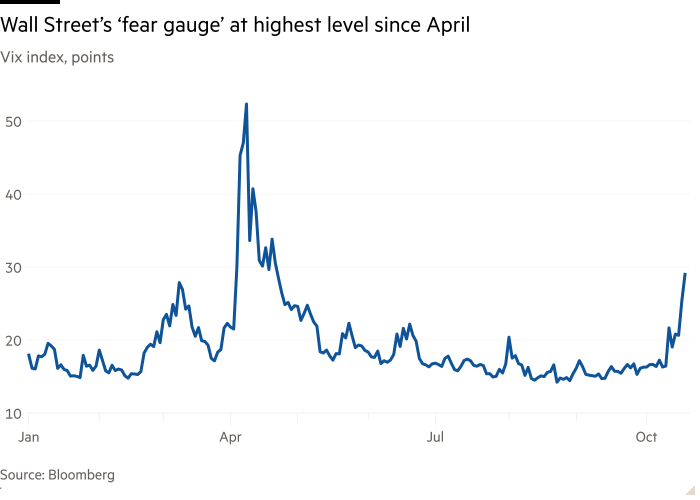

European and Asian shares slid on Friday and Wall Street’s “fear index” touched a five-month high as investors responded to concerns about US regional banks.

But US stocks rose in morning trading, with the S&P 500 up 0.2 per cent. Stock futures had rebounded from earlier losses, helped by comments by President Donald Trump about managing Washington’s trade tensions with Beijing.

Bank shares led a 0.7 per cent decline in the Stoxx Europe 600 index, with Deutsche Bank down 4.5 per cent and Barclays falling 3.9 per cent.

Asian markets also fell, with Hong Kong’s Hang Seng index shedding 2.5 per cent and mainland China’s CSI 300 index falling 2.3 per cent.

The moves followed Thursday’s heavy sell-off in US regional bank shares, after two American lenders, Western Alliance Bank and Zions Bank, disclosed that they were exposed to alleged fraud by borrowers.

The Vix index of short-term volatility in US stocks, often called Wall Street’s “fear index”, climbed as high as 28.99 points on Friday morning, its highest level since April, before slipping back to 24.56.

S&P 500 futures fell as much as 1.5 per cent but recovered after Trump suggested that Washington would overcome trade tensions with China. About an hour before market opening in New York, they were flat.

Trump indicated in an interview with Fox Business that his planned additional tariffs of 100 per cent on Chinese imports might not be in place for long.

Asked whether the tariff would stand, he said: “No, it’s not sustainable, but that’s what the number is” — comments that were initially seized on by the markets.

Trump subsequently said of the elevated tariff: “It could stand but they forced me to do that; I think we are going to do fine with China.”

The disclosures by Western Alliance and Zions fuelled a 6.3 per cent drop in the KBW US regional banking index on Thursday, and added to jitters over the health of credit markets following the failures of auto lender Tricolor and car-parts maker First Brands.

That has led traders to reduce risk amid broader worries of a bubble in artificial intelligence stocks that has powered US markets to a series of record highs.

“When you’re already worried about the AI bubble and the US-China trade wars coming back, you can’t afford to have this kind of newsflow,” said Arun Sai, a senior multi-asset strategist at Pictet Asset Management. “With First Brands, Tricolor, investors are starting to see a pattern.”