Good morning. Donald Trump said Prime Minister Narendra Modi has pledged that India would stop buying Russian oil. India responded with a measured statement, making no such promises but offering to expand procurement from the US. Does this mean a trade deal is nowhere near? Tell me what you think.

The festival season is in full swing, with gift laden cars causing traffic snarls in all big cities. I am running away to quiet(er) Kerala to celebrate with my family. We will not have an edition of this newsletter on Tuesday, October 21. Wishing you love and light and all things sweet this Deepavali.

Alphabet AI

Google will invest $15bn over the next five years to build an AI data centre in India. Set up in Visakhapatnam, the 1GW unit is built in partnership with India’s Adani Group and Airtel. The choice of the southern port city as a location, while unusual, is strategic as the data centre will connect to 15 countries across the world — including Australia, Singapore and Malaysia — via subsea cable.

This unit is expected to create more than 6,000 direct jobs, and follows other US tech giants such as Amazon and Microsoft, who are investing $6.8bn and $3bn in Indian data centres.

The investment is a big win for Andhra Pradesh, which has a target of developing 6GW of data centre capacity in the next four years. Thus far, the states of Maharashtra, Tamil Nadu and Telangana had cornered most of the business, with the local governments offering duty waivers on electricity consumption and generous land subsidies. For Google, the Andhra Pradesh government lobbied heavily to iron out regulatory issues, especially to avoid applying Indian laws to the data being processed offshore. Google was also, understandably, wary of India’s proclivity for retrospective taxation.

Corporations, as well as the administration, are betting big on data centres. While India generated about 20 per cent of global data, it has only 3 per cent of data centre capacity. Multinational companies have been the biggest investors so far, but large Indian companies are also now beginning to show up with big cheques. Last week, Tata Consultancy Services chief executive K Krithivasan said the company plans to invest $6.5bn over the next six years to build 1GW in data centre capacity.

However, even as states fall over themselves to attract investments, what is lacking is a clear policy on how to mitigate the environmental damage these large centres are capable of. Although the new centres are pivoting towards renewables for energy generation, they still place significant strain on the grid. Water is an even more serious problem. Data centres use more water than they replenish, even if alternatives such as aircooled chillers are used to stop equipment from overheating. States like Andhra Pradesh are already prone to droughts and a massive data centre will only make this situation worse.

I’m not arguing that India shouldn’t be allowing these investments, but that it is imperative that a national policy on resource usage be drawn up at this early stage, so that problems can be mitigated before they become catastrophes. Neither the central government nor the regional states have prioritised this. A man versus technology conflict is inevitable — but without any safeguards, it will arrive sooner rather than later.

Do you think India should have an environment and resource policy ready for data centre investments? Hit reply or email me at indiabrief@ft.com

For more on AI, sign up for The AI Shift: John Burn-Murdoch and Sarah O’Connor explore how the technology is transforming the world of work in our new weekly newsletter.

Recommended stories

The FT investigates how the Trump companies made $1bn from crypto.

Banks caution over the bubble in financial markets.

The US revoked visas of six people who “celebrated” Charlie Kirk’s death.

Morgan Stanley has overtaken rival Goldman Sachs in equities trading.

How high-end restaurants went global.

Silver bullet

All that glitters is not gold — because it’s silver. The sudden escalation in demand has resulted in a strange phenomenon in the Indian markets, where silver funds are quoting at a massive premium to the already record high prices as they struggle to acquire physical stocks of the asset.

On Wednesday, Tata Mutual Fund became the fifth fund house to temporarily suspend new investments into their silver-backed exchange traded fund, joining HDFC, ICICI and others. Even in the domestic metal market, silver is trading at a premium of about 10 per cent over its global rate. In London, silver touched a record high of $53 per ounce this week, an 85 per cent gain this year.

The surge in demand for silver is driven by two factors. One, it is seen as a proxy for gold, which is also trading at a record high of $4,179 an ounce. This month, the wedding season in India is also a contributor to global prices, as customers switch to wearing silver since gold is so prohibitively expensive now. Two, its use has significantly increased in industries such as electronics and solar panels.

Despite this sharp run up, most analysts are bullish about silver prices in the medium term. Brokerage house Motilal Oswal has a target of $75 an ounce for 2026, even though they think prices will consolidate around $50-55 in the near term. Industrial use accounts for almost 60 per cent of silver output and this is unlikely to ease off in a hurry, even if the more price-sensitive segment — jewellery consumption — softens.

Even though gold grabbed the headlines, inflows into silver funds have also been strong, with investments in Indian ETFs growing 60 per cent this year. Silver’s popularity as the au courant asset is best illustrated by the fact that in the last couple of months, even “finfluencers” have been extolling their followers to get into this game. By stopping new inflows, fund houses have stopped new investors from participating in this rally — but also protected them from paying an inflated value for the metal. These funds will reopen only when the availability of physical silver becomes easier. But the situation is unlikely to improve, with India just one of several countries in the global race for precious metals and minerals. It will be difficult to get a piece of this action anytime soon, no matter what our favourite influencer tells us.

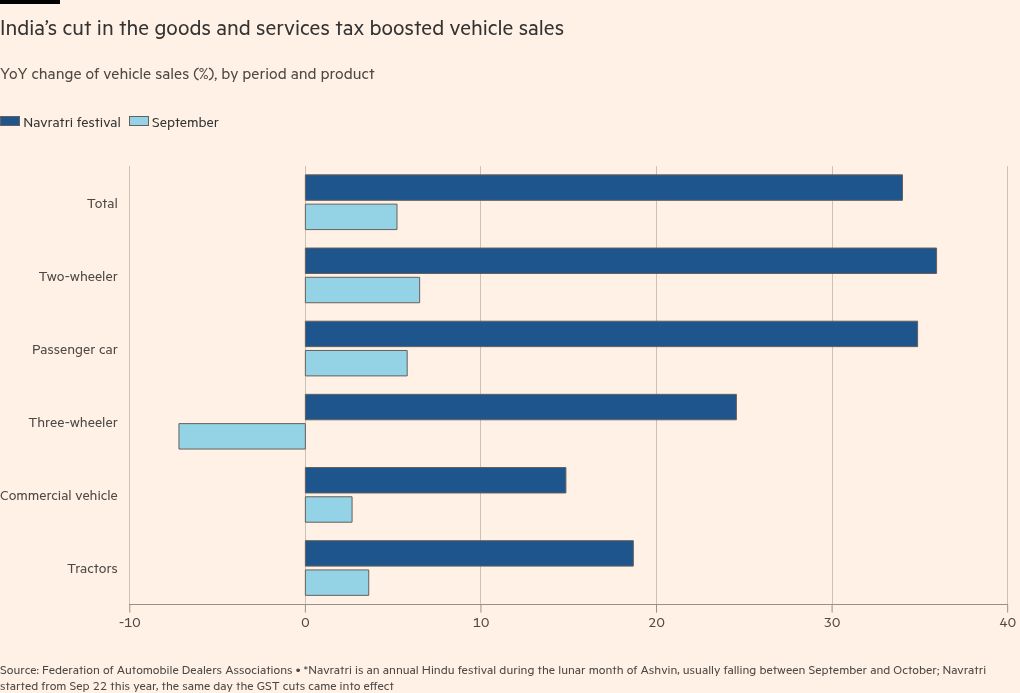

Go figure

Vehicle sales were the biggest beneficiary of the cuts in India’s goods and services tax. The new taxes took effect on September 22, after Modi promised households a $28bn bounty from what he dubbed the “GST Savings Festival”.

Read, hear, watch

It’s been (yet another) busy week and I haven’t been able to read or watch very much. However, I did enjoy this episode of The Daily, an interview with three puzzle editors from the New York Times. I do the mini crossword, aim for genius on the Spelling Bee most days, and solve the main crossword four or five times a week, with diminishing success. I abandoned Wordle after losing my streak. But Connections really makes me want to hurl my phone at a wall.

Do you have a favourite? Write to me. And thank you for the show recommendations last week.

Buzzer round

The global popularity of which product has sent Japanese farmers into a tizzy as they struggle to keep up with demand?

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right.

Quick answer

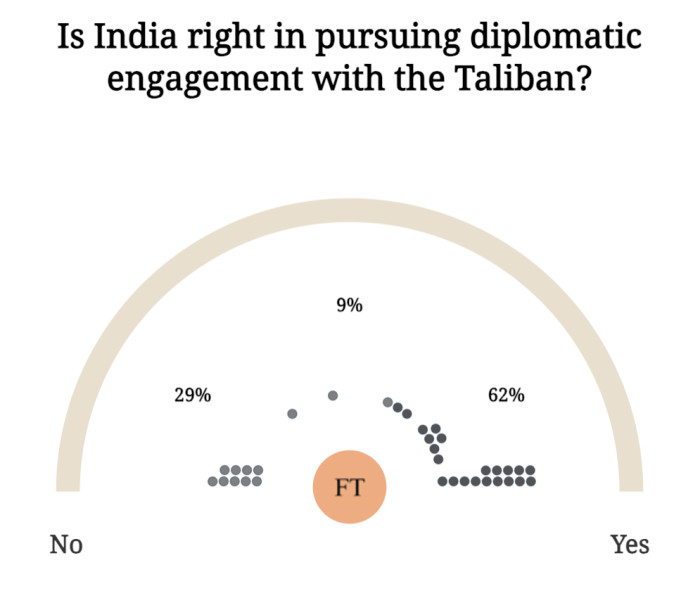

On Tuesday, we asked if India was right in pursuing diplomatic engagement with the Taliban. Here are the results. Some 62 per cent of you think it is. I was betting on a more even split!

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.