Within days of Prime Minister Narendra Modi’s cuts to India’s goods and services taxes coming into effect, Udit Thakkar and his fiancée went hunting for bargains in car showrooms in Mumbai.

“We thought this would be a good time to go for a new car . . . we will get a good benefit in taxation,” said the 27-year-old, who expects to save Rs150,000 ($1,688) on a vehicle costing about Rs2mn thanks to the latest tax cuts.

Shoppers have long been lured by discounts during colourful celebrations in the run-up to the annual Diwali festival. But this year’s festivities have been turbocharged by Modi’s sweeping overhaul of national GST rates, aimed at cutting through a confusing web of classifications and creating demand in the world’s most populous country.

In a national address last month, Modi promised households a $28bn bounty from what he dubbed the “GST Savings Festival”.

He has also urged citizens to buy Swadeshi — locally made products — as US President Donald Trump’s 50 per cent punitive tariffs squeeze export industries and threaten to put a damper on the world’s fastest-growing large economy.

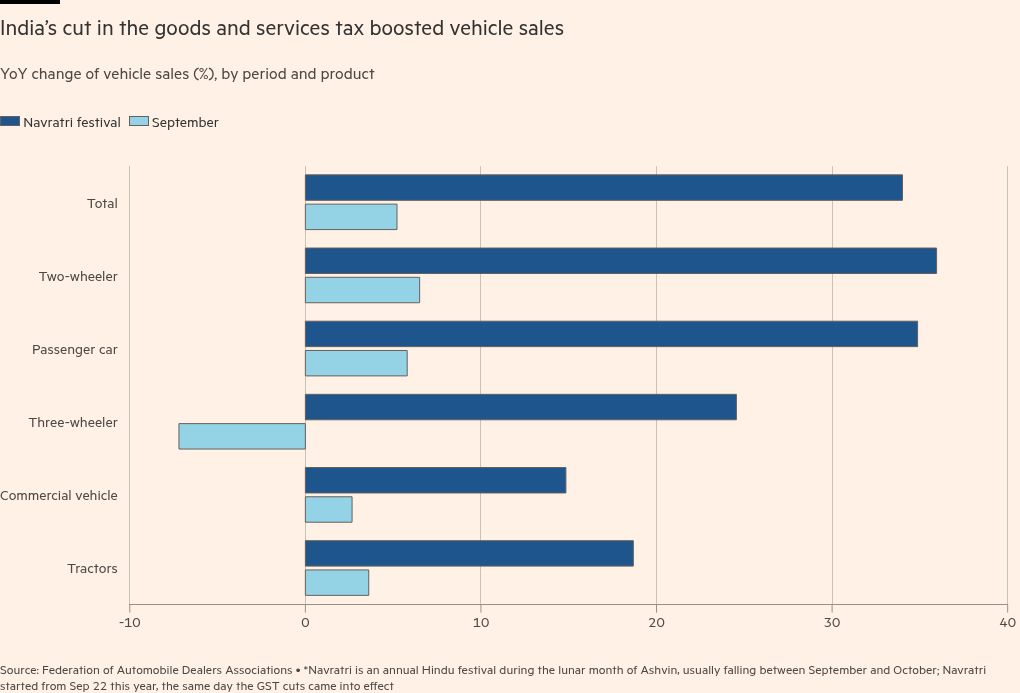

The new taxes took effect on September 22 and “the kind of demand we see in the festive season this time around will hopefully surpass some of the more sombre expectations that people had at the beginning of the financial year”, said Aastha Gudwani, chief India economist at Barclays.

Sales of big-ticket items are expected to get the biggest boost. “There will be some segments where this impact will be more visible, most likely automobiles followed by white goods,” she added.

Indian companies are banking on a spending spree to revive lukewarm recent earnings.

Analysts at Nomura said retailers reported sales growth of between 25 and 100 per cent in the week after the new rates came into effect against the same period last year. The Japanese bank pointed to “pent-up festive demand across segments” and “record-breaking” spending.

Maruti Suzuki, India’s biggest carmaker, recorded 75,000 unit sales in that week and was continuing to receive about 18,000 bookings a day, with inquiries doubling to 80,000 daily from last year, according to Nomura. Tata Motors, Hyundai and two-wheeler market leader Hero MotoCorp also expected double-digit growth during the season, Nomura said.

In Goa, a major tourist destination, a billboard featuring a smiling Modi thanked his government for “slashing GST rates”. The reform included reducing taxes on stays in some cheaper hotels from 12 per cent to 5 per cent.

Modi’s government has also slashed taxes on some hospitality sector inputs, including food products — from 5 per cent to zero — and air conditioners, from 28 per cent to 18 per cent.

“That will give a boost, a massive boost,” said Jack Ajit Sukhija, president of the Travel and Tourism Association of Goa and owner of two hotels in the state’s capital, Panaji.

“Savings on essentials may increase discretionary spending in leisure and hospitality, aiding broader economic growth,” the Hotel Association of India said in a statement.

Whether Modi’s “Diwali gift” can counterbalance the drag from global trade tensions remains to be seen. India’s labour-intensive export industries, including textiles and gems, have been among the hardest hit by Trump’s new tariff regime, which imposed levies as high as 50 per cent.

Reserve Bank of India governor Sanjay Malhotra this month cautioned that GST reductions “will not be able to offset completely” trade war shocks.

Some consumers delayed purchases until the tax cuts came into effect, and the Indian arm of household goods group Unilever said they expected growth in the “low-single” digits for the quarter ending in September.

“While this measure supports long-term consumption, we have seen a transitory impact in the form of disruption at distributors and retailers across channels to clear existing inventories with old prices,” Mumbai-based Hindustan Unilever said.

Small retailers have also reported difficulty in passing the benefit of the tax cuts to consumers.

“Since the decision came without any prior warning, we have a lot of old stock,” said Raju Shah, whose Mumbai stationery shop was filled with items still stamped with outdated prices.

Shah said distributors had also not “passed the benefit — it might take some time”.

High household debt might deter some consumers, even after a tax cut for high earners earlier this year. “The hope was that this increase in personal disposable income was going to aid domestic consumption,” said Gudwani at Barclays. “But that did not happen because most of that was likely used for savings.”

Still at the Mumbai Maruti Suzuki dealership, decorated with balloons, garlands and fairy lights for the upcoming Diwali festival, there was already ample evidence that the GST reforms were having an impact.

Festival spending had “exceeded our expectations”, with bookings up by 60 per cent to 70 per cent from last year, according to a dealership manager, who was not authorised to speak to the press. But easy sales were still hard to squeeze out of India’s notoriously cost-conscious shoppers, he said.

“If a customer walks in here and I offer him a car at Rs500,000, he’ll definitely go to some other dealer and try to get it at Rs490,000,” he said. “That competition will always be there.”