Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Opposition parties in Japan are in talks to build a coalition to seize control of parliament and block the ruling party’s new leader, Sanae Takaichi, from becoming prime minister.

The discussions about whether opposition parties can unite around an alternative candidate for prime minister follow the abrupt collapse on Friday of the 26-year-old coalition between the Liberal Democratic party and its junior partner, Komeito.

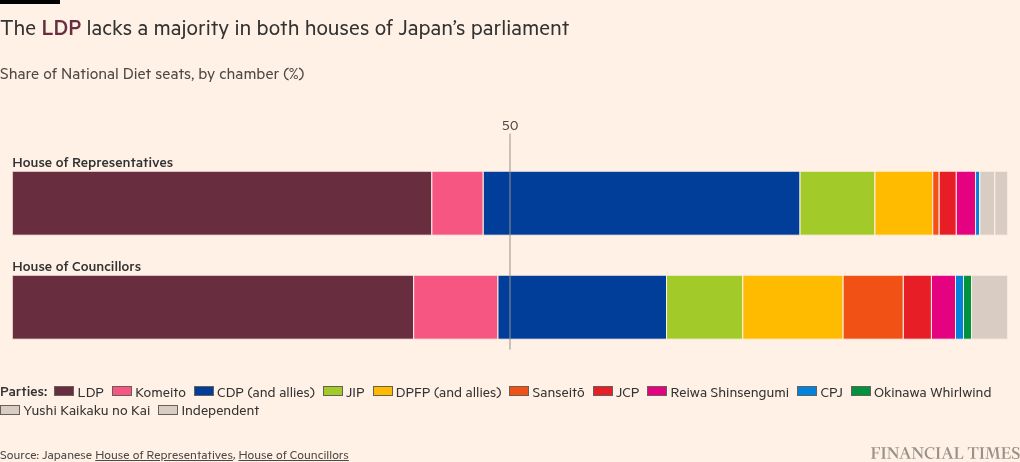

The disintegration of the ruling bloc, which had already lost outright control of both chambers of parliament through two successive elections, complicates Takaichi’s route to becoming prime minister — an ascent that depends upon a vote in parliament later this month.

The LDP is still the largest party in both houses but Takaichi’s path to the premiership now depends on whether the arch conservative can secure the support of the Japan Innovation Party — the third-largest party in the lower house.

Under the parliamentary system, in which MPs vote for a prime minister by name and victory is secured with a simple majority, opposition parties could jointly propel an alternative candidate into office.

On Sunday, Yoshihiko Noda, the leader of the Constitutional Democratic Party of Japan which is the second-largest party in the lower house — it has 148 seats against the LDP’s 196 — indicated that he was open to backing a prime minister outside his own party.

“This is a rare opportunity,” Noda said in a TV interview. “We can change the government now if [the opposition parties] can co-operate by overcoming our differences and finding common ground.”

In particular, Noda appeared prepared to support a potential prime ministerial bid by Yuichiro Tamaki, a 56-year-old former finance ministry official, who leads the Democratic Party for the People, which controls 27 seats in the lower house.

Tamaki met Takaichi the day after she became leader of the LDP to begin talks on a possible alliance, but after the collapse of the coalition he told reporters that those discussions had become “largely meaningless”.

In a TV interview on Sunday night, Tamaki said: “The collapse of the LDP-Komeito coalition, which has been the norm until now, marks a change that will go down in the history of Japanese politics. With so many changes happening in both the world and Japan right now, it seems that the style of politics that has continued until now may have reached its limits.”

Pelham Smithers, a longtime Japan analyst, said that while the opposition parties could unify behind Tamaki, the LDP could still bring the JIP on board and securing its support would be easier without Komeito in the coalition.

The prospect of weeks of political upheaval and a rare shift in the power balance of Japanese politics is likely to hit Tokyo-listed stocks when trading resumes on Tuesday after the three-day weekend.

Fund managers said they were braced for a sharp unwind of the so-called “Takaichi trade” — a big rally in factory automation, defence and artificial intelligence-related stocks which followed Takaichi’s October 4 victory and propelled the Nikkei 225 Average to an all-time high last week.

Bruce Kirk, Japan equity strategist at Goldman Sachs, said: “Investor feedback so far has been divided between those who see it a much-needed catalyst that will create a more stable centre-right coalition with clear policy alignment on areas like defence and economic security, and those who worry about its potential to completely derail positive sentiment on Japan.”