Hello and welcome to the working week, and a new earnings season. But more of that later.

Dare we feel optimistic? If all goes to plan Monday should bring news of the last of the Israeli hostages being freed from the Palestinian territories as a ceasefire in Gaza takes hold after two years of conflict.

Once the hostages are freed Israel will release almost 2,000 Palestinian prisoners, 250 of whom are serving life sentences, and allow a wave of aid into Gaza, which is suffering widespread starvation. However, the bigger challenge will be implementing the second phase of US President Donald Trump’s plan, getting Hamas to disarm and Israel to withdraw its troops from the enclave. The US has committed to sending 200 soldiers to Israel to monitor the ceasefire, along with observers from Egypt, Qatar and other regional forces. Plenty of potential pitfalls lie ahead as FT columnist Gideon Rachman notes in his latest podcast.

Meanwhile, there is a bromance brewing in the White House where Argentine President Javier Milei is due to visit Trump on Tuesday. The US Treasury last week intervened in Argentina’s currency market for the first time to help Trump’s ally and prop up the peso. Milei will no doubt use this week’s meeting to gain further support after his government fell into political crisis, threatening his party in upcoming midterm elections.

The UK’s party conference season draws to a close with the leadership speeches from the Scottish National party gathering in Aberdeen, where the hope is that Reform’s success north of the GB border will split the unionist vote, playing into the SNP’s hands at next May’s Holyrood elections.

The political weekends with an unprecedented election in Bolivia, where for the first time in 20 years the ruling leftwing Movimiento al Socialismo will not be in the running. Instead the centrist candidate Rodrigo Paz, the son of former president Jaime Paz Zamora, will go head to head with the leading conservative Jorge Quiroga. The economy, with inflation running at a 40-year high, has been central to campaigning.

The next seven days are going to involve a lot of news about banks, whether it be the ones on Wall Street reporting quarterly figures or the World Bank, which along with the IMF will host the Annual Meetings event that attracts central bankers, politicians and economists to Washington.

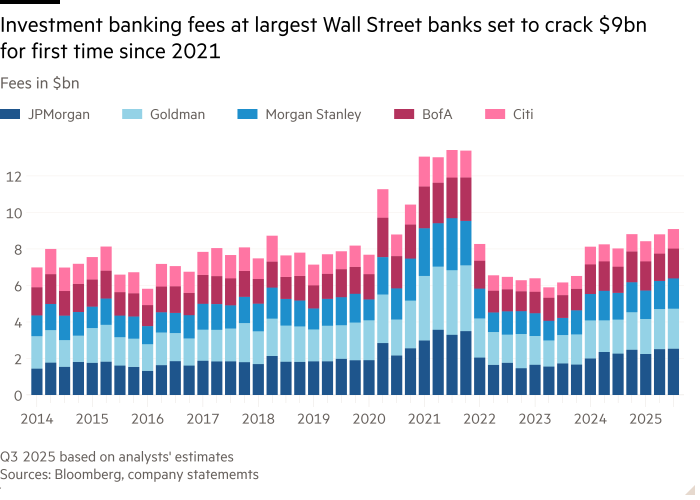

There is optimism about what Citigroup, Goldman Sachs, JPMorgan Chase, Bank of America and Morgan Stanley will reveal when they announce numbers this week with expectations that revenues will top $9bn for the first time since 2021 in the third quarter, as the long predicted wave of dealmaking shows signs of finally flourishing under the Trump administration. The big themes are investment banking pipelines and the growing backlog, the health of the credit portfolio — including any pockets of stress — and how much of a tailwind banking deregulation under Trump might provide.

Elsewhere Nestlé will report third quarter sales figures, its first results filing since Philipp Navratil took over as chief executive from Laurent Freixe in September. Investors will be looking to see whether increased marketing spend has had any positive impact on the food producer’s real internal growth and updates on the potential sale of some VMS bands.

The run of economic data will be muted by the US public holiday for Columbus Day on Monday and the ongoing federal shutdown, which has already led to the postponement of the US inflation data due this week. But expect numerous updates on inflation, from China, the EU and the UK. The latter will publish labour market data and a monthly GDP estimate. More details on those and other items below.

One more thing . . .

I’m not much of a gamer — just ask my kids — but Microsoft is cranking up the hype machine for the launch of the first ever Xbox-branded handheld consoles. I couldn’t tell you if this is something to get excited about, but fortunately the FT can.

Is there a console game that will ignite my passion for challenging my kids on their Nintendo Switch? Email me at jonathan.moules@ft.com or, if you are reading this from your inbox, hit reply.

Key economic and company reports

Here is a more complete list of what to expect in terms of company reports and economic data this week.

Monday

Opec monthly oil market report

Canada: Thanksgiving Day. Financial markets closed

Israel: Simchat Torah Eve. Financial markets closed

UK: Heathrow September traffic figures

US: Columbus Day public holiday. Financial markets closed

Results: HCL Technologies Q2, Rio Tinto Q3 operations review (10:30pm UK time)

Tuesday

IMF publishes its latest World Economic Outlook report, containing analysis and projections of the global economy for the near and medium term

Alan Taylor, external member of the Bank of England’s Monetary Policy Committee, presents remarks and a fireside chat with FT columnist Gillian Tett at Kings College, Cambridge, on ‘diversion ahead’

IEA monthly oil market report

Australia: last rate-setting meeting minutes published

Germany: September Consumer Price Index (CPI) and Harmonised Index of Consumer Prices (HICP) inflation rate data

UK: October labour market figures. Also, BRC-KPMG Retail Sales Monitor

US: Johnson Redbook Retail Sales Index

Results: Aeon HY, Ashmore Q1 assets under management statement, Bellway FY, BlackRock Q3, BP Q3 trading statement, Citigroup Q3, discoverIE HY trading update, Domino’s Pizza Q3, Goldman Sachs Q3, IntegraFin Q4 trading update, Johnson & Johnson Q3, JPMorgan Chase Q3, LVMH Q3 revenue, Mitie HY trading update, Oxford Instruments trading update, Publicis Groupe Q3, Reach Q3 trading update, Robert Walters Q3 trading update, TomTom Q3, Wells Fargo Q3, YouGov FY

Wednesday

Bank of England deputy governor, financial stability, Sarah Breeden is a panellist at the Fintech Foundation 2025 DC Fintech Week in Washington

Bank of England Deputy Governor for Markets and Banking David Ramsden speaks in a panel event at the Single Resolution Mechanism 10th Anniversary Conference in Brussels

Federal Reserve Bank of Australia governor Michele Bullock takes part in a fireside chat at the Nomura Research Forum in Washington

Alex Thursby steps down as Rank Group chair at the end of the company’s annual general meeting

China: September CPI and producer price index (PPI) inflation rate data

EU: August industrial production figures

Japan: revised August industrial production and retail sales figures

US: Beige Book published.

Results: Abbott Laboratories Q3, ASML Q3, Bank of America Q3, Entain Q3 trading update, Jupiter Fund Management Q3 trading update, Morgan Stanley Q3, PageGroup Q3 trading update, PNC Financial Services Group Q3, Progressive September earnings, Rank Q1 trading statement at AGM, Rathbones Q3 IMS

Thursday

Microsoft launches its new Xbox handheld devices, the ROG Xbox Ally and ROG Xbox Ally X

Australia: September labour force survey data

UK: Monthly GDP estimate and Index of Services

Results: ABB Q3, Bank of New York Mellon Q3, Charles Schwab Q3, Croda Q3 sales update, CSX Q3, GB Group HY trading update, Infosys Q2, Interactive Brokers Q3, KeyCorp Q3, Kinnevik Q3/9M, M&T Bank Q3, Marsh McLennan Q3, Nordea Bank Q3, Sabre Insurance Q3 trading update, Snap-On Q3, Taiwan Semiconductor Manufacturing Company Q3, Travelers Q3, Travis Perkins Q3 trading update, United Airlines Q3, US Bancorp Q3, Videndum trading update, Whitbread HY, XPS Pensions Group HY trading update

Friday

Bank of England chief economist Huw Pill speaks at the Institute of Chartered Accountants in England and Wales Annual Conference

EU: September Harmonised Index of Consumer Prices (HICP) inflation rate data

UK: September insolvency figures

US: September new residential housing starts

Results: American Express Q3, Fifth Third Bancorp Q3, Huntington Bancshares Q3, Pearson 9M trading update, SIG trading update, SLB Q3, State Street Q3, Truist Financial Q3, Yara Q3

World events

Finally, here is a rundown of other events and milestones this week.

Monday

China: President Xi Jinping to attend the opening ceremony of the Global Leaders’ Meeting on Women in Beijing, where he will deliver a keynote speech

UK: Scottish National party conference concludes with a speech by party leader and Scotland’s First Minister John Swinney. Separately, commemorations will be held for the 100th anniversary of the birth of Margaret Thatcher, former Conservative prime minister and Britain’s first female premier

US: IMF and World Bank Annual Meetings Week begins in Washington

Tuesday

UK: Ed Miliband, secretary of state for energy security and net zero, and Liberal Democrat leader Ed Davey speak at the Energy UK Annual Conference in London.

US: President Donald Trump is expected to welcome Argentina’s President Javier Milei to the White House

Wednesday

Belgium: Nato defence ministers meet in Brussels to discuss the conflict in Ukraine, chaired by Nato secretary-general Mark Rutte

EU: Foreign Affairs Council with defence ministers meets in Brussels to discuss security policy in the bloc

Japan: extraordinary session of the Diet expected to elect the prime minister.

UK: Frieze Art Fair and Frieze Masters 2025, the largest contemporary art event in Britain, opens to the public. Also, the Royal Albert Hall hosts The Grand Sumo Tournament, running until Sunday

Thursday

ShakeOut Day, when millions of people across Japan, western Canada, New Zealand and California among other places will participate in earthquake drills

Iceland: 2025 Arctic Circle Assembly, with an expected audience of more than 2,000 people from more than 60 countries, opens in the Harpa Concert Hall and Conference Center in Reykjavik. This year’s event runs until Saturday

UK: multiple major awards events. The 2025 Mercury Prize Album of the Year winner will be announced at a ceremony in Newcastle, the first time this event has been held outside London. Separately, the RIBA Stirling Prize for Architecture winner will be announcement, celebrating Britain’s best new buildings

Friday

Saturday

UN Security Council Resolution 2231 will expire today, unless extended. The Security Council unanimously adopted the resolution endorsing the Joint Comprehensive Plan of Action, or the Iran nuclear deal, in 2015

Peru: thousands of people are expected to march through Lima’s streets, following the procession of the Sacred Image of the Lord of Miracles, the country’s largest religious celebration