Good morning. On Wednesday, Prime Minister Narendra Modi opened Gautam Adani’s $2bn airport in Mumbai’s suburb of Navi Mumbai. Is this a sign of Adani’s rehabilitation after fraud allegations were raised in the US? Tell me what you think.

I had a great time at the Global Fintech Fest. My panel discussed if AI payments can be the future of global ecommerce. We had some excellent perspectives from around the world — especially Asia, the Middle East and Mexico. It was also great to meet some of you before and after the session. I was gobsmacked by how big the conference was, it is the kumbh mela of fintech for sure.

Trust worthy

What is going on at the Tata Group? The boardroom battle has now got so serious that even the government is getting involved. On Wednesday, four members of the board — including Tata Trusts chair Noel Tata and Tata Sons chair N Chandrasekaran — met home minister Amit Shah at his residence in Delhi, according to two people who work with the group. They were also joined by finance minister Nirmala Sitharaman.

The key issue seems to be the deeply divided board. After Ratan Tata died last October, his half-brother Noel took over as chair of Tata Trusts, the holding entity that owns 66 per cent of Tata Sons. Noel has since been unable to assert his control over the board, which is divided into two factions that are unable to agree on strategy and governance issues. The Reserve Bank of India’s demand that Tata Sons publicly list its shares is reportedly another significant source of tensions, with the Shapoorji Pallonji group that holds 18.4 per cent of Tata Sons pushing to go public in order to unlock the value of its holdings. But Noel Tata and his supporters are not keen on doing so. Tata Sons has so far resisted listing, and missed the RBI’s deadline last Tuesday.

These storms in the boardroom are not new for the Tata Group. In 2016, Ratan Tata waged a crusade and managed to remove Cyrus Mistry, who is from the Shapoorji Pallonji family, from his position as chair of Tata Sons. The parties took the dispute to the courts. In 2021, the supreme court upheld Mistry’s removal.

But this most recent squabble comes at an especially difficult time for several of the group’s companies. Its aviation business is dealing with the aftermath of the crash of AI171 in Ahmedabad in June, while Tata Motors-owned Jaguar Land Rover was hit by a cyber attack last month. The group’s crown jewel, TCS, is under pressure in its biggest market, the US, where Trump’s tariffs, the surge of AI and the pressure on H1B visas are wreaking havoc on the IT sector.

My colleagues Chris Kay and Krishn Kaushik reached out to Tata Sons, Noel Tata’s office and Shapoorji Pallonji. But none of them responded to their requests for comments.

What is especially curious is the government’s involvement in the workings of a private trust. New Delhi’s explanation is that the group is so large that it has systemic significance in the Indian economy, and therefore the government is right to be concerned. It is also understood to have told the members of the trust to solve their disputes internally and discreetly. The government’s words seem contrary to its actions though. There are few things less discreet than a high profile visit to a ministerial residence.

One of the reasons cited for Tata Trusts’ reluctance to list Tata Sons is that it does not want external scrutiny into its business operations. While Tata Sons remains a private company, the government should not be trying to tell it how to run itself. It is not the home minister’s job to tell business organisations how they should manage their operations and governance. Corporate India, which has increasingly been reticent in speaking up against the administration, should be more vocal in pushing back against this.

Do you think the government should get involved in the affairs of private companies? Hit reply or email me at indiabrief@ft.com

Recommended stories

Israel has approved Trump’s plan for Gaza ceasefire and hostage release.

Brace for a market melt-up. Even “good” bubbles burst, writes the FT’s Katie Martin.

Carmakers are falling back in love with petrol. Also, Ferrari has halved its EV targets as profit guidance disappoints.

Can the World Economic Forum save itself?

Dark chocolate is being rebranded — but is bitter really better?

For moguls, 94 is the new 54.

Visa limits

Talks on the free trade agreement between India and the UK have kicked into the next gear.

At a meeting with Modi in Mumbai yesterday, UK Prime Minister Keir Starmer announced that 64 Indian corporations would invest £1.3bn in the UK, creating 7,000 jobs across sectors including engineering, technology and the creative industries. Starmer was less vocal, however, on what he could do in return. When asked if he would allow more visas for the smartest talent from India, he said this was not “part of the plan”.

Indians are the top nationality receiving UK work visas, with just under 28,000 in the year to June. Even though the trade deal is expected to boost the UK’s GDP by £4.8bn a year, the number of visas will probably remain the same.

Starmer’s plans for the deal are ambitious. He is travelling with 125 UK chief executives, cultural leaders and vice-chancellors of universities. The delegation, dubbed “the largest-ever government trade mission to India”, includes the heads of Rolls-Royce, BT, Diageo, BP, British Airways and the London Stock Exchange. In return, India laid out the red carpet. You couldn’t walk 10 steps in Mumbai this week without running into Starmer’s face on a hoarding (speaking from experience).

The British prime minister is trying to balance a political tightrope of bringing more business from India without triggering increased immigration anxieties back home. But for Indian companies, especially those in the services sector, his reluctance to raise visa numbers is bad news. The sector is already facing stress from Donald Trump’s rejig of the H1B system in the US. India has not mentioned anything about this so far, and the readout after the meeting focused on a £350mn missile deal and opening up the nuclear sector to private investment. Opening up the Indian market for foreign products is great, but India should seek reciprocity from western countries for its service industry as well.

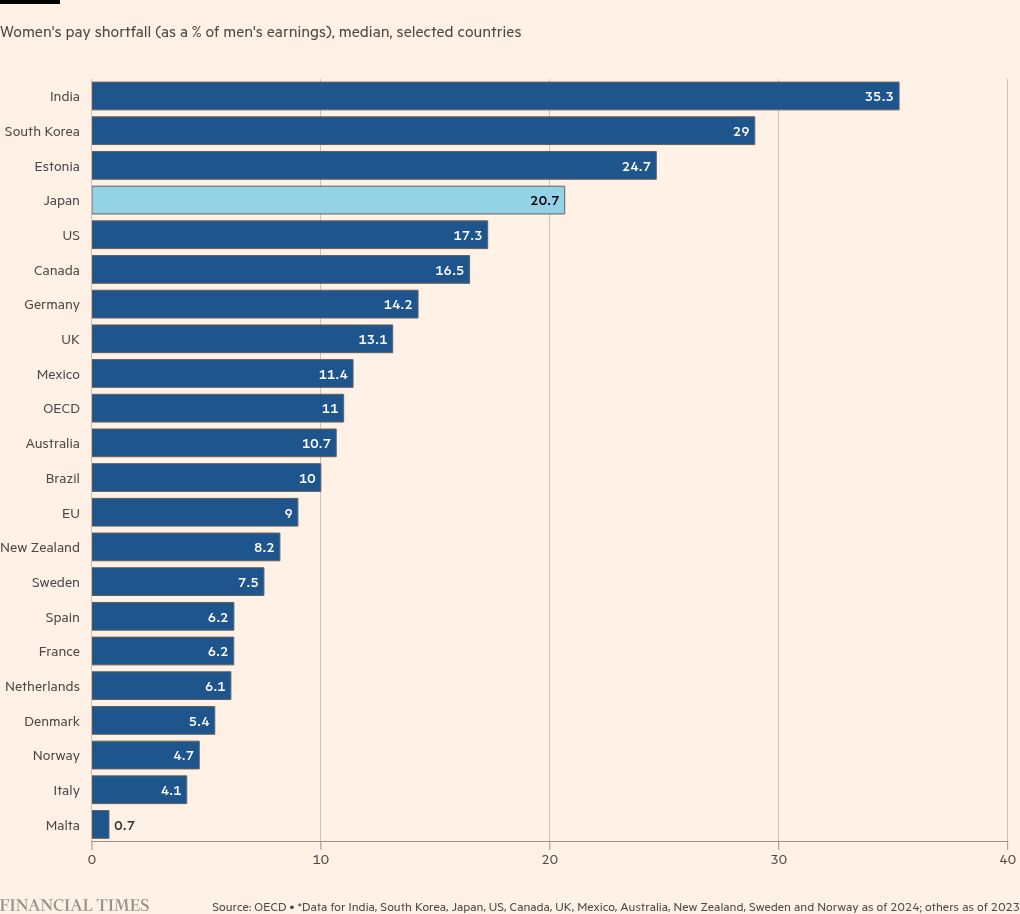

Go figure

India’s gender pay gap is the highest among peer countries.

Read, hear, watch

I have just started Ian McEwan’s What We Can Know, a novel about climate change and technology set in 2119. In researching a poem, a literature scholar from the future paints the picture of the time we are living in. The FT’s Jon Day called it McEwan’s most entertaining novel in years. Fingers crossed.

I am also working my way through the various seasons of the TV series Fargo (on Amazon Prime). I must confess I love its stylised violence. However, Season 3, which I’m currently on, is so far a bit underwhelming. Send me your recommendations.

Buzzer round

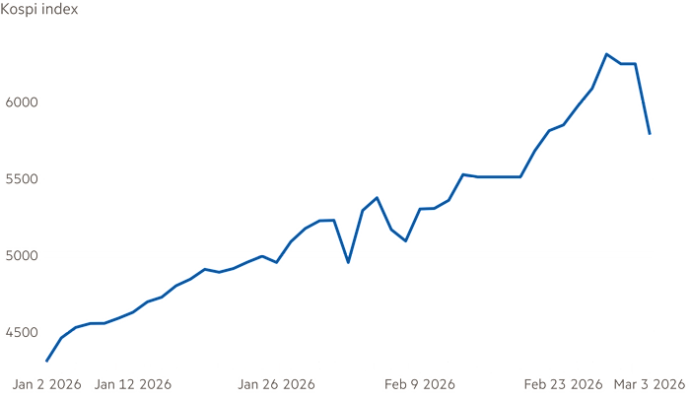

How will Japan’s Sanae Takaichi make history when she is sworn in later this month?

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right.

Quick answer

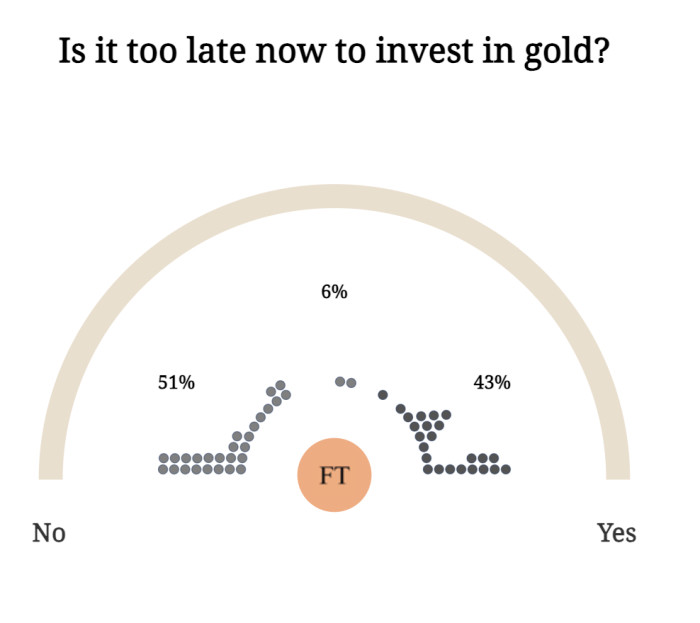

On Tuesday, we asked if you thought it was too late now to invest in gold. Here are the results. More than half of you think it’s not!

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.