Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

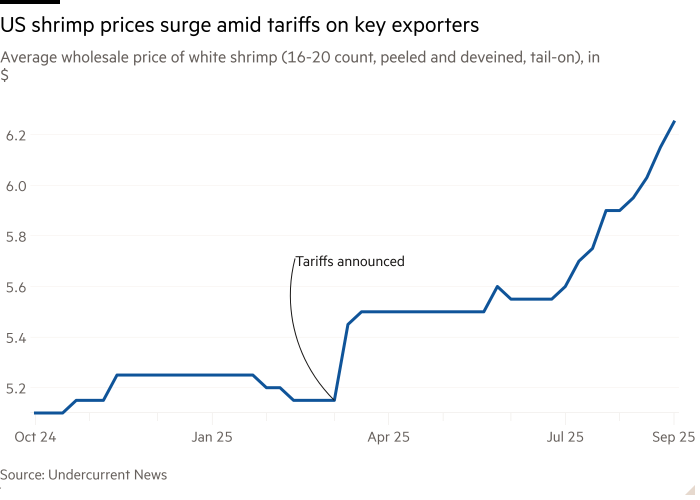

US shrimp prices are surging amid tariffs on the country’s largest supplier, India, making the crustacean one of the first foods to see major price impacts from Donald Trump’s trade policy.

The price of the most popular seafood in America is “going up not gradually, but quite drastically”, India-based shrimp importer Avanti Feeds warned last month. Imports from Ecuador, another major exporter, have a 21.9 per cent average tariff.

The average wholesale price of a pound of peeled and deveined tail-on white shrimp rose to $6.25, a 21 per cent increase since April. Trump imposed a 25 per cent tariff on India this summer over its purchases of Russian oil, which he doubled to 50 per cent in August.

Restaurants that tapped into US diners’ affection for shrimp to drive footfall in recent years are now trying to adjust, as fears over the country’s slowing economy push consumers to eat more meals at home.

Red Lobster last month retooled its well-known “Endless Shrimp” promotion into “Ultimate SpendLESS Shrimp”, a $15.99 plate with three shrimp dishes. The previous iteration, which gave diners unlimited servings of two shrimp entrées of their choice for $20, contributed to the seafood chain’s $11mn loss in the third quarter of 2023 and eventual bankruptcy.

Red Lobster chief executive Damola Adamolekun said in a statement that the new deal was “smarter, more sustainable and still packed with the unbeatable value and delicious flavours our guests have come to expect”.

Americans’ demand for shrimp has increased in recent years amid a broader shift to high protein diets that has also driven increased consumption of beef and chicken. Shrimp has a similar amount of protein but fewer calories.

While restaurants and grocers have largely been able to cushion consumers from price increases by pulling forward imports of frozen shrimp before the tariffs took effect, some of those stockpiles are now running out, said Gary Morrison, head of strategy at seafood commodity price reporting agency Undercurrent News.

Andy Diamond, president of Angry Crab Shack, said the 24-location seafood boil chain had purchased extra frozen shrimp ahead of the tariffs and stored it for months in an effort to hold down menu prices. But now that their stock is running out, the chain is weighing trimming its labour costs, switching seafood suppliers, as well as raising prices across the menu to account for increases on shrimp.

“We tried to delay this as much as possible but the reality is that shrimp prices are going up,” Diamond said. “The last thing we want to do is make the restaurant not attractive for families that are looking for value.”

Olive Garden owner Darden Restaurants said it is working on measures to offset the price surge, chief financial officer Raj Vennam told analysts last month. The Italian casual dining chain credited its limited time Calabrian steak and shrimp bucatini dish for boosting same-store sales growth last quarter.

Cheesecake Factory and Cracker Barrel also said shrimp dishes drove sales in recent months.

Shrimpers in Louisiana and Florida hailed the tariffs as a lifeline to their industry where imports had lowered wholesale prices in recent decades, but their seasonal catches are not a substitute for the 90 per cent of the US shrimp supply that is farmed abroad, according to the US seafood trade association, the National Fisheries Institute.

The trade body’s chief strategy officer, Gavin Gibbons, warned that consumers should not expect to see deals for much longer, as grocery stores and restaurants adapt to the new trade regime.

Felix Lin, chief executive of restaurant supplier HF Foods Group, said he told customers: “You need to change your menu offerings, you change your ingredient or selectively, you need to start thinking about increasing your menu price as well.”

Food suppliers have absorbed “anywhere from 70 per cent to 80 per cent” of the added costs of the tariffs, Lin added.

Others, Gibbons said, seem to have stopped serving it entirely. Restaurant servings of shrimp have fallen 7 per cent in the 12 months ending in August as prices increased, according to data from market research firm Circana.