Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

“This time it’s different” can be a dangerous phrase. Optimistic investors have been calling for an end to the so-called Korea discount — the persistent undervaluation of South Korean companies compared to global peers — for more than two decades, with little to show for it. But recent efforts to reform the country’s notoriously poor corporate governance are giving foreign investors new hope.

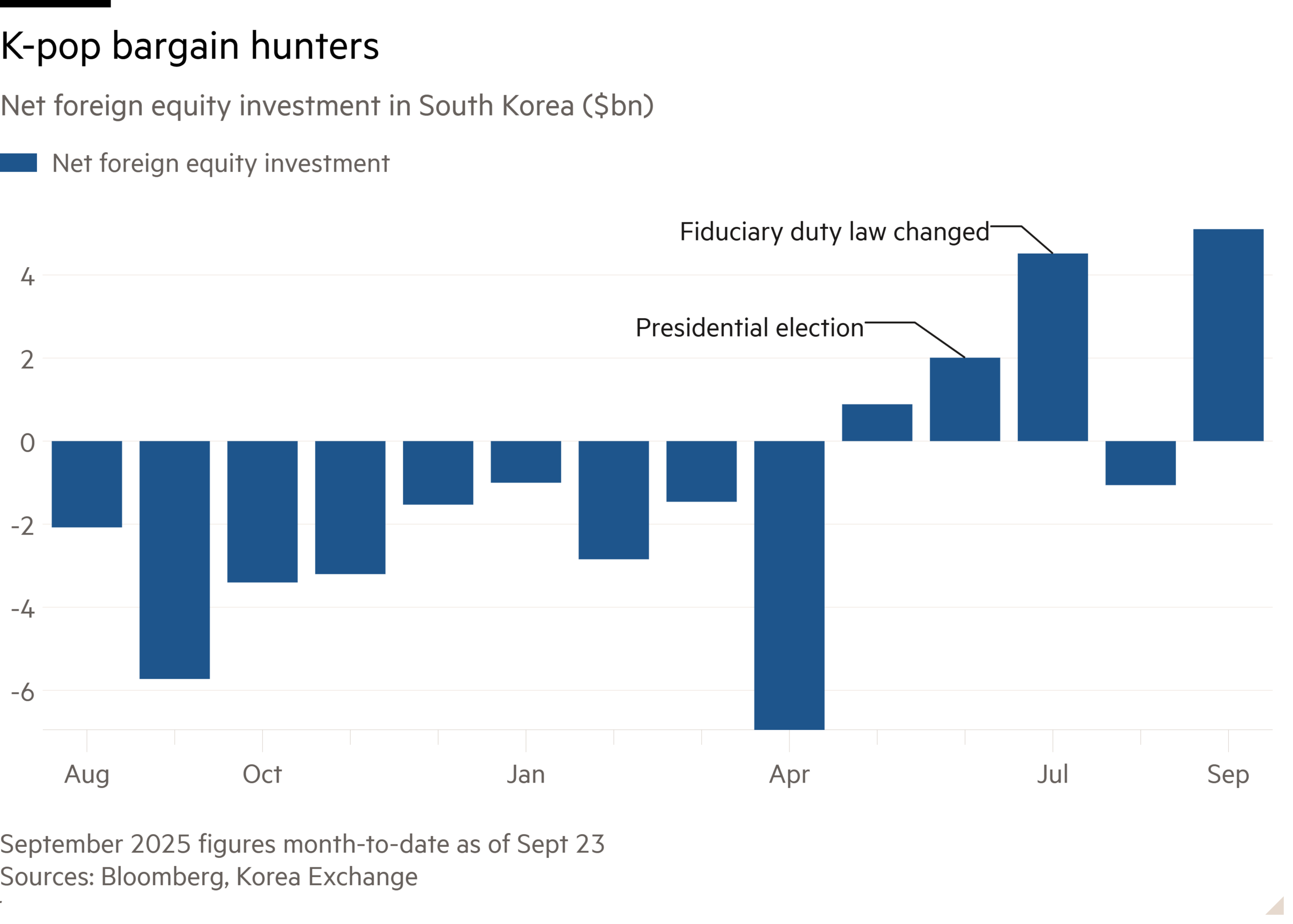

Seoul’s benchmark Kospi index is up 40 per cent year to date, and earlier this month hit a record high. The rally started with local investors, but is now being boosted by an influx of cash from elsewhere. Foreign investors have made more than $11bn in net purchases of Korean stocks since the start of May, according to Korea Exchange data.

Politicians and investors alike are hoping South Korea can emulate Japan, where a long campaign to improve governance helped stocks break through the records set at the height of the 1980s bubble. Evidence since President Lee Jae Myung’s election victory in June has been encouraging, but resistance to reform from vested interests could make it a bumpy ride.

One of the first concrete signs of progress was the extension, in July, of corporate directors’ fiduciary duty to include minority shareholders. Further measures, such as forcing companies to cancel shares held in corporate treasuries or introducing a mandatory offer for minority shareholders during takeovers, would help to end what Federated Hermes calls “endemic mistreatment” of minority investors.

One way South Korea differs from Japan is the dominance of family-controlled firms. Outsiders may assume that everyone would welcome higher valuations, but Korean tax laws encourage controlling families to keep share prices low. Business groups are already lobbying against the reform of treasury shares, arguing that it would make companies vulnerable to hostile takeovers.

The average discount to net asset value at large conglomerates has narrowed from 57 per cent earlier this year to around 43 per cent, according to CLSA. Recent gains suggest that any delays or watering down of proposals could cause a pullback.

Contrast the recent experiences of LG — the conglomerate best known for electronics — and chemicals group KCC. Shares in LG’s holding company rose 5 per cent last month when it announced plans to retire all of its treasury shares by next year. KCC dropped 12 per cent last week when it disappointed investors with plans to cancel only a small portion of its treasury stock.

Even Korea bulls concede there are challenges. As UK hedge fund Asset Value Investors noted recently, “our lessons from Japan are that the road to governance reform is a long and winding one”. But given the extent of the remaining discount, and a president who has staked his reputation on closing the gap, even imperfect progress could lead to some solid gains.