This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

Hong Kong bank staffing rebounds

China opens way to WTO reform

India’s polo-playing steel tycoon

Big global banks have relocated senior managers to Hong Kong and are boosting teams in response to a surge of stock listings and dealmaking in the Asian financial hub.

What to know: Deutsche Bank, JPMorgan, Standard Chartered, Citigroup and DBS have started hiring in the city to meet growing demand for banking and wealth services, according to people familiar with the situation. While analysts said that bank staffing was not at pre-pandemic levels, the city’s finance sector has been gaining impetus as a result of the surge in Chinese companies using the territory as an offshore funding venue. The number of companies applying for a Hong Kong initial public offering hit an all-time high in the first six months of this year.

Bankers return from Singapore: Kher Sheng Lee, co-head of Apac at the Alternative Investment Management Association, said some finance professionals who had moved to Singapore from Hong Kong at the height of the pandemic were beginning to return. “Some crisis-era moves were tours of duty to keep jobs, not permanent exile — they were corporate mandates to seed new Singapore offices,” Lee said. Read the full story.

Here’s what else we’re keeping tabs on today:

Economic data: Australia reports Labour market figures and Japan publishes August services PPI inflation rate data.

Japan: The Bank of Japan publishes minutes from its July monetary policy meeting.

Climate diplomacy: The World Climate & Biodiversity Summit is held in New York on the sidelines of Climate Week NYC and the 80th Session of the UN General Assembly.

Five more top stories

1. China will drop its claim to benefits available to developing countries in trade negotiations under the WTO in a move that follows long-standing US objections to the practice. China’s Premier Li Qiang announced the plan to refrain from claiming “special and differential treatment” on the sidelines of the UN General Assembly meeting in New York, potentially removing one barrier to much-needed reforms of the WTO.

2. One person was killed and at least two others were injured in a shooting at a US Immigration and Customs Enforcement office in Dallas that the FBI said appeared to be an act of targeted political violence. The incident comes a fortnight after rightwing activist Charlie Kirk was assassinated while speaking at a university campus in Utah.

3. New Zealand has brought in a Swedish economist to run its central bank as it seeks to end a period of turmoil at the top of the institution and steer the country away from the brink of a “double-dip” recession. Anna Breman, who has been first deputy governor of the Sveriges Riksbank in Sweden since 2019, will become the first female governor of the Reserve Bank of New Zealand when she takes up the role in December.

4. China’s biggest electric-truck maker says it is targeting growth overseas in a fresh challenge to the global auto industry. Liang Linhe, who leads the electric trucking division of Sany Group, a construction and mining equipment behemoth, told the FT that the “biggest challenge” in the global push was that many countries’ electricity infrastructure lagged behind that of China.

5. Prime Minister Giorgia Meloni’s government is considering a freeze in Italy’s retirement age of 67, a move critics warn would put renewed pressure on the country’s improving but still fragile public finances. Italian labour unions are demanding a halt to automatic increases linked to life expectancy under a crisis-era pension law.

News in-depth

On India’s polo fields, Naveen Jindal’s teammates call him “Captain Cool”. Off field, the 55-year-old chair of Jindal Steel is making grand plays in business, including a bid for the floundering steel assets of German industrial group Thyssenkrupp that has put him in direct competition with Czech billionaire Daniel Křetínský. A successful takeover would vault Jindal, who owns India’s fourth-largest steel producer, into the upper echelons of the world’s leading steelmakers. Read more about India’s polo-playing steel tycoon.

We’re also reading . . .

Korean companies: South Korean investment in the US is in peril after an immigration raid on a Hyundai-LG plant in Georgia, writes Haeyoon Kim.

Far-right cellist: A German lawmaker and professional cellist regularly chats by phone with one of Vladimir Putin’s advisers — and sees nothing wrong with it.

Necessary appeasement: Surrendering to Trump on trade is worth it to keep the US engaged in Europe’s security, Janan Ganesh argues.

Chart of the day

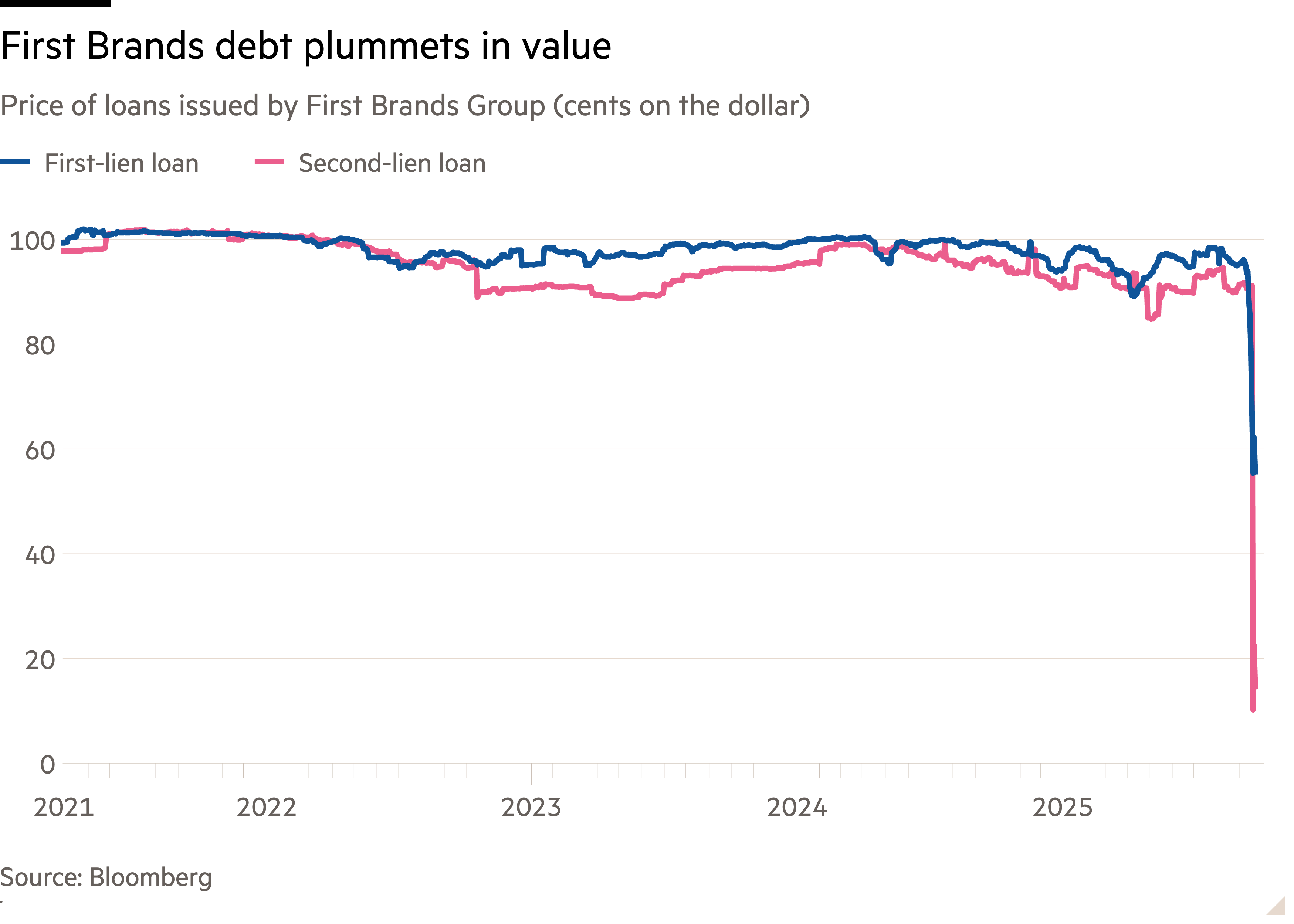

US debt investors have raised the alarm over lax lending standards in credit markets after the unravelling of Tricolor Holdings and First Brands Group, two companies that just weeks ago were deemed to be in strong health.

Take a break from the news . . .

The shortlist for the 2025 Booker Prize for fiction has been announced. But this year’s crop is dominated by established names with proven literary clout, with neither a debut nor even a second novel in sight. Here are the FT critics’ reviews of the shortlisted books.