Stay informed with free updates

Simply sign up to the Chinese economy myFT Digest — delivered directly to your inbox.

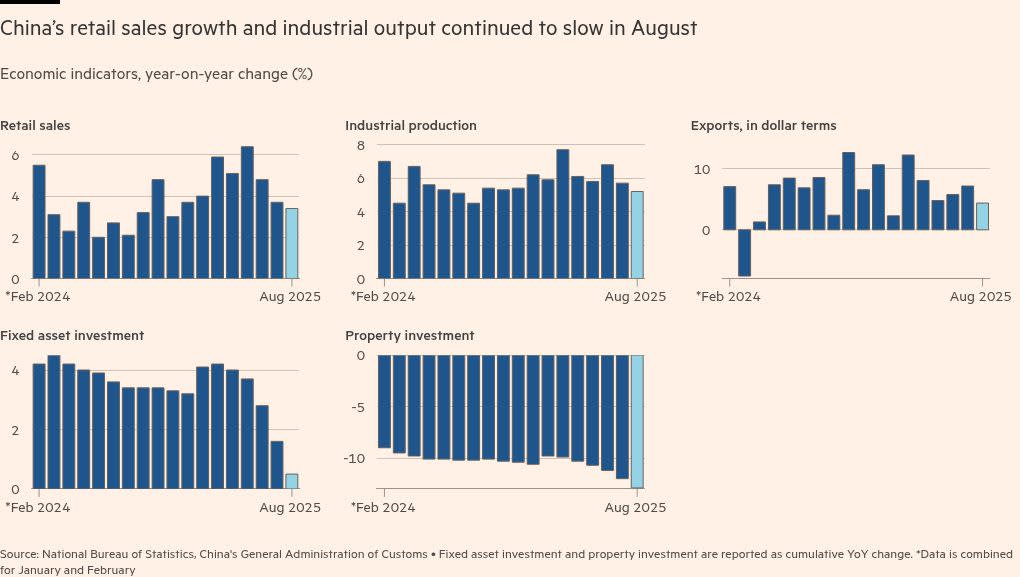

China’s economy has shown signs of a general slowdown, with retail sales and industrial output growing at the most subdued rate this year amid the strains from a trade war with the US and domestic weaknesses.

Retail sales rose 3.4 per cent year on year in August, data from the National Bureau of Statistics showed on Monday, falling short of analysts’ forecasts of 3.9 per cent and July’s 3.7 per cent gain.

Industrial output grew 5.2 per cent last month against a year earlier, slowing from a 5.7 per cent expansion in July. Both figures were the slowest pace of growth since November 2024.

Fixed asset investment growth for the year to date slowed to 0.5 per cent, less than the 1.4 per cent forecast by economists and the 1.6 per cent figure from January to July.

“With officials tightening oversight of industrial overcapacity and the fading tailwind from export frontloading ahead of US tariff hikes on other economies, industrial production growth is set to ease,” Moody’s Analytics said ahead of the data release.

China has relied heavily on trade for the past few years to weather a persistent slowdown in the property market and weaker household demand.

Exporters rushed to ship goods to the US in the first half of the year to pre-empt President Donald Trump’s tariffs. The two sides have agreed a series of reprieves in levies that had reached as high as 145 per cent, the latest in August, to allow for further negotiations.

US Treasury secretary Scott Bessent on Sunday met Chinese vice-premier He Lifeng in Madrid for a fourth round of trade talks, which are expected to continue later on Monday.

But with the threat of higher tariffs weighing on exports to the US, which fell by a third last month, Beijing has turned to domestic demand to help drive economic growth.

Policymakers have unveiled a series of stimulus plans, including childcare subsidies for families and subsidised loans for consumers. The government has also begun cracking down on industrial producer deflation by encouraging consolidation in industries plagued by overcapacity and fierce price competition.

Producer prices, which declined 2.9 per cent year on year in August, have been mired in deflationary territory since October 2022.

Analysts are concerned that measures to address overcapacity — dubbed “involution” in Communist party jargon — could lead to a decline in investment as factories are consolidated.

Goldman Sachs said the anti-involution drive had contributed to the sharp fall in fixed asset investment growth in August, alongside a military parade in Beijing, construction restrictions and weather events

Goldman said the data suggested slightly stronger GDP growth in the third quarter than its target of 4.6 per cent. China’s economy grew 5.2 per cent in the second quarter, and policymakers have set a full-year growth target of about 5 per cent.

The bank added: “Given sluggish domestic demand and continued weakness in labor and property markets, we believe incremental and targeted easing is still necessary in coming quarters.”

Other official data released on Monday showed house prices dropped 2.5 per cent year on year against a 2.8 per cent decline in July, while unemployment during the month was 5.3 per cent, compared with 5.2 per cent in July.

Yuhan Zhang, principal economist at The Conference Board’s China Center, said “short-term price movements for key industrial materials, such as cement and steel, also signal continued pressure on China’s real estate sector”.

He added: “Improved macroeconomic conditions and stronger consumer confidence, particularly regarding employment and income, are essential drivers for meaningful price stabilisation.”

Data visualisation by Haohsiang Ko in Hong Kong