Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Stocks in Japan, South Korea and Taiwan ended the week at record highs on Friday as investors bet Asia’s chipmakers would benefit from an artificial intelligence boom and interest rate cuts in the US.

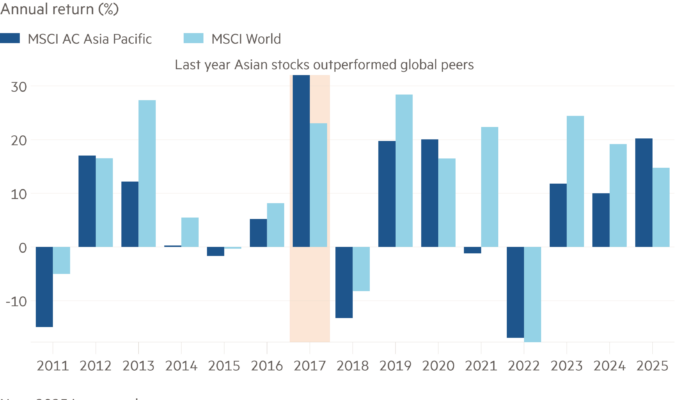

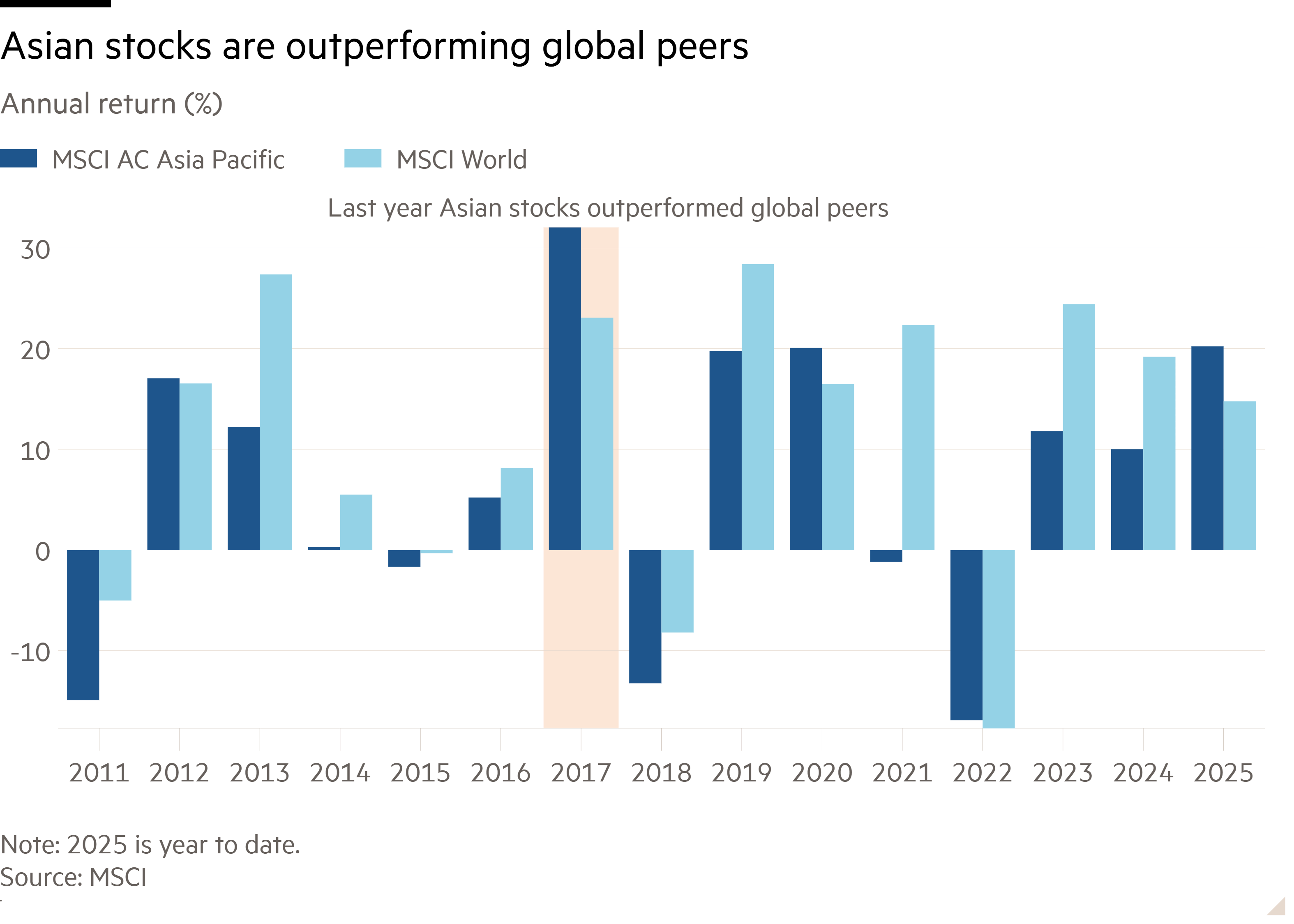

The surge in the three markets has driven the MSCI Asia-Pacific benchmark near an all-time high. The index is outperforming the MSCI World gauge, which only tracks developed markets, by the widest margin in eight years.

Asian equities followed a rally on Wall Street, where the S&P 500 closed at a record high on Thursday. Investors widely expect the US Federal Reserve to cut interest rates next week after August data showed slowing jobs growth.

US rate cut expectations and dollar weakness were benefiting Asian stocks, said Xin Yao Ng, investment director for Asian equities at Aberdeen. “Both of these are useful for Asia especially on the emerging Asia side.”

The tech-heavy bourses of Japan, South Korea and Taiwan have ridden a wave of investor enthusiasm for AI, as the countries include semiconductor groups crucial to the technology.

Shares of South Korean chipmaker SK Hynix jumped 7 per cent on Friday to an all-time high after the company announced a milestone in its AI chip development.

Japan and South Korea have also been buoyed by optimism over corporate governance reform drives meant to increase shareholder returns.

Foreign inflows into South Korean equities have risen since the country amended its commercial code in July to make explicit company directors’ duty to shareholders.

In Japan, foreign investment inflows rose sharply after US President Donald Trump’s “liberation day” tariffs announcement in April spurred investors to look outside the US.

While the S&P 500 is trading at record highs, it is underperforming other developed markets in a sign that investors are shifting assets out of the US into regions such as Europe and Asia.

The US is “expensive, everyone is really long and other things are doing better”, said Joshua Crabb, head of Asia-Pacific equities at Robeco. “People are having a look around.”

Christopher Wood, global head of equities strategy at Jefferies, noted that big US tech companies had invested heavily in AI infrastructure and warned that their high equity valuations may not be justified.

“The nature of the businesses is changing,” he said. “They’re going from asset light to asset heavy, and they’re all converging on the same space.”

Global equities have also been helped by a weakening dollar, with an index tracking the US currency against global peers down 10 per cent in the year to date.

Nicholas Smith, Japan strategist at CLSA, noted that Japan had a net international investment position of $3.5tn and that investors could start to repatriate assets on signs that the yen would no longer weaken against the dollar.

“The big pot is the vast amount of Japanese money that got pushed offshore by zero yield at home. And the tipping point comes when the yen doesn’t weaken any more,” said Smith.