Good morning. I’m back from a short break and have taken the India Business Briefing baton from my fellow Mumbai-based colleague Krishn, who deftly covered for Veena during her own well-deserved holiday. Thankfully for everyone, normal (and award-winning) service will resume next Tuesday.

This week, New Delhi’s foreign correspondent corps (including the FT’s own Andres Schipani) have rushed to cover the dramatic anti-government “Gen Z” protests in Nepal. The street turmoil that led to the prime minister’s resignation is just the latest to hit one of India’s smaller neighbours in recent years, with multiple regime changes across a volatile region where China is increasing its influence.

Today’s newsletter will discuss the launch of Apple’s super slim iPhone Air and India’s role in making it. But first, I’ll attempt to decode the confounding diplomatic dance between Washington and New Delhi and mixed signals from Donald Trump.

‘A special relationship’

What a difference a week makes. When I left Mumbai to attend a friend’s wedding, India-US ties were at their lowest in years. Trump had just followed through on his threat of a 50 per cent tariff against Indian goods — punishment, in part, for New Delhi’s continued trade in Russian oil. Markets wobbled, officials sulked, and some wondered if the relationship had broken beyond repair.

Fast-forward a few days and the mood music is strikingly different. Trump posted on social media on Tuesday that trade talks with India were continuing and that he looked forward to speaking with his “very good friend” and counterpart Narendra Modi in the coming weeks. He added he was confident a deal could be reached “for both of our great countries!” Modi was quick to reciprocate and called for “a brighter, more prosperous future for both our peoples”.

This reset in tone and top level bonhomie was not inevitable. It was certainly missing during weeks of mutual fuming, where Modi had ignored Trump’s calls and bristled at the US president’s warmth towards Pakistan. Trump complained about the Indian leader’s resulting love-in with Xi Jinping and Vladimir Putin in China. But there were already signs of a thaw last Friday, when Trump declared that the two countries shared “a special relationship” and there was “nothing to worry about”.

As a Brit, I’m inured to the hollow bandying about of “special” relationships with the US and anyone tempted to breathe easy will no doubt remember Trump’s mercurial streak. On the very same day that Trump extended his olive branch to Modi, he also leaned on Brussels to slap tariffs of up to 100 per cent on both India and China. Washington, he told EU officials, was ready to “mirror” any European tariffs in a bid to choke off Russian oil sales. Given that, it may be a while before we see any throwback to the carefully choreographed camaraderie of a few years ago: The “Howdy Modi” rally in Texas, for instance, and Trump’s tour of the world’s largest cricket stadium in Ahmedabad, which carries the Indian prime minister’s name.

Dismissing his earlier row with Modi, Trump had said: “We just have moments on occasion.” But these moments have already upended labour-intensive industries in India, damaged New Delhi’s trust in Washington and reversed decades of diplomacy drawing the world’s most populous country closer to the US.

Is this a sign of a breakthrough in the tiff between Modi and Trump? Or is India about to be hit harder? Hit reply or email me at indiabrief@ft.com

Recommended stories

India’s banks want to break into the M&A game.

Youthful anger at political “nepo babies” drives Nepal protests.

Watch the FT’s latest film on how more than $200bn was allegedly stolen from Bangladesh during the Hasina regime.

Did Israel’s Qatar strike go too far?

Trump halts Korean deportations to encourage them to train Americans.

Join 250+ policymakers, industry executives and investors at the Energy Transition Summit India in New Delhi on September 16 and 17. Register for a free digital pass here or enjoy 20 per cent off your in-person pass here.

Apple’s ‘screwdriver work’ in India

In another reminder of India’s precarious and complex position in Trump’s tariff web, Apple this week unveiled its iPhone 17 line-up and the super skinny 5.6mm iPhone Air, hailed by Tim Cook as the company’s “biggest leap ever”. US-bound phones are set to be assembled in the south Asian nation. Apple also held prices steady despite Trump’s trade wars threatening its vast global supply chain.

India is a key country in that network. Apple’s growing presence here has generated headlines, not least in the FT, as some production has shifted away from China. The process began back in 2017 and sped up during the coronavirus pandemic as the company sought to shield its supply chain. For Modi’s government, Apple has become a showcase for its pitch to lure more manufacturing investment and create factory jobs.

But Apple’s India bet has not been universally celebrated. Earlier this year the FT reported on plans to move assembly of all US-sold iPhones to India by 2026. That triggered an outburst from Trump, who snapped: “We are not interested in you building in India.” Cook has since worked hard to placate the president, with some success. For now, India’s electronics exports are currently exempt from Washington’s sky-high levy imposed on the country’s other shipments such as diamonds, shrimp and apparel.

Still, questions linger over how much of the iPhone’s value India is really capturing. Research outfit BMI noted last month that Apple’s Indian production lines continue to rely heavily on inputs from China. The FT’s former south Asia bureau chief John Reed has pointed out in this very newsletter that some have dismissed the iPhone plants in India, run by Foxconn and Tata Electronics, as doing “screwdriver work”. For all the fanfare around the iPhone 17 launch, Apple’s next big leap in India looks some way off.

“With activity limited to final assembly, India will only capture a tiny fraction of the total value of producing the iPhones,” according to BMI. “Plus, tariff uncertainty means Apple is unlikely to move quickly to set up higher value-added operations in India.”

Do you think India can move up the iPhone value chain? Hit reply or email me at indiabrief@ft.com

Go figure

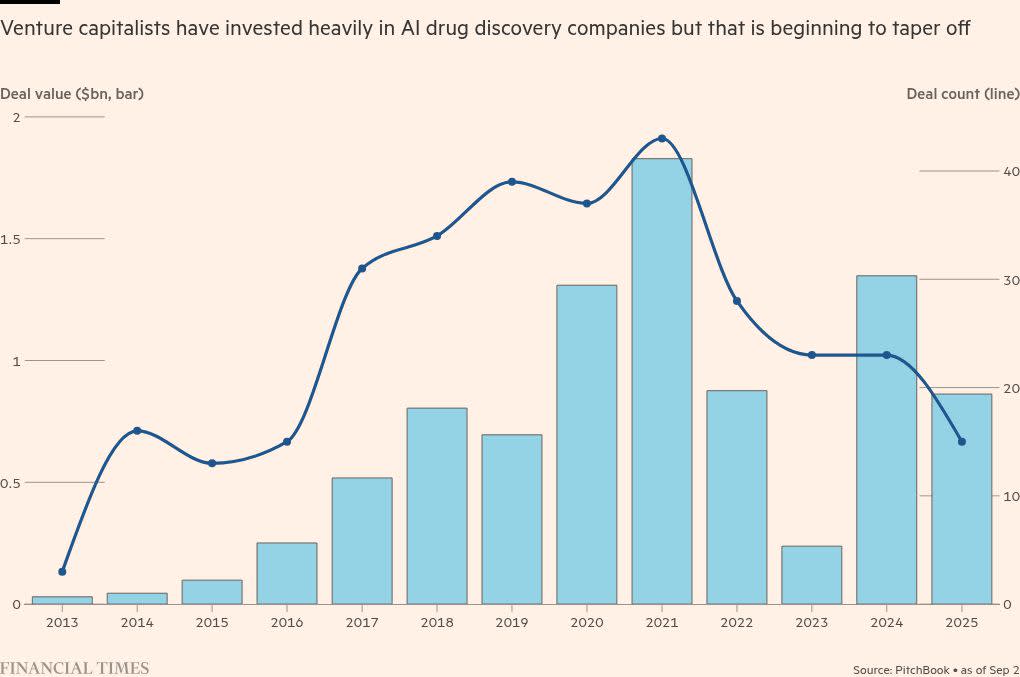

Artificial intelligence promised to dramatically reduce the time it took to discover new medicines. But now funding for AI drug discovery companies, which increased from $30mn in 2013 to a peak of $1.8bn in 2021, has tapered off as many sceptics ask: where are the drugs?

Read, hear, watch

Unlike Veena, I haven’t managed to snag a copy of Arundhati Roy’s memoir. Instead I’ve been chipping away at my existing and teetering reading pile, most recently The Wager by New Yorker writer David Grann, a rollicking tale of an 18th-century sea voyage gone horribly wrong, which I tore through after a friend’s long-ago recommendation. Only after finishing did I discover Martin Scorsese is adapting it for the big screen, once again with Leonardo DiCaprio in tow after their take on another Grann book: Killers of the Flower Moon. Shipwrecks, mutiny and Scorsese? Count me in.

Buzzer round

What was the name of the failed plan hatched by an elderly media mogul, who partly inspired the HBO show Succession, to wrest future control of the family business empire from some of his children?

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right.

Quick answer

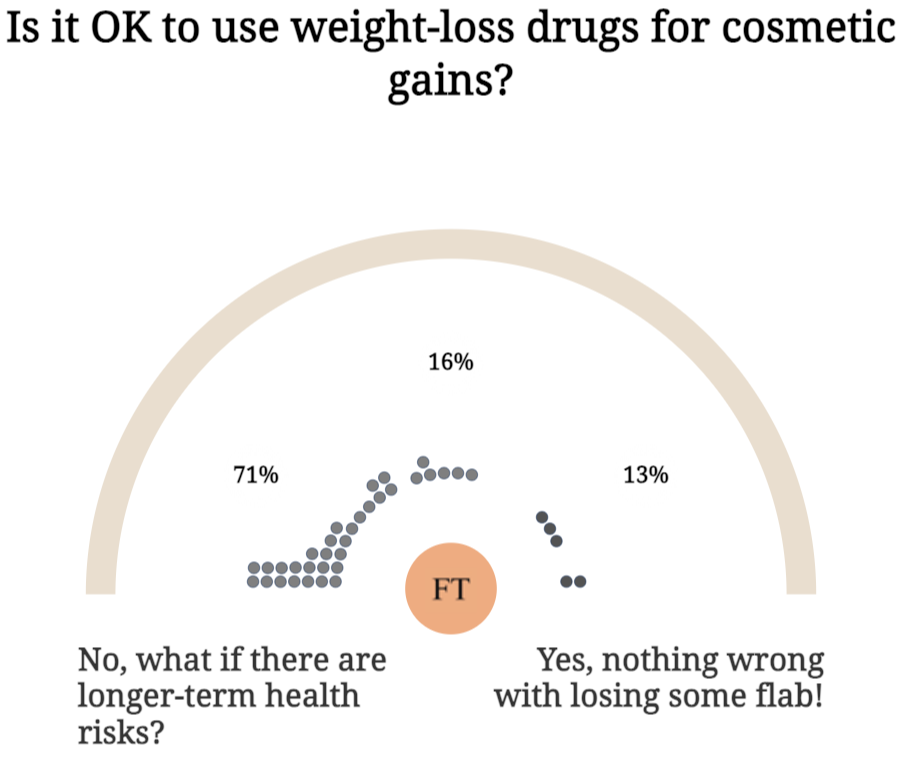

On Tuesday, we asked how you felt about using weight-loss drugs for cosmetic reasons. Most of you were not comfortable with risking unknown long-term effects for the sake of vanity.

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.