Stay informed with free updates

Simply sign up to the Electric vehicles myFT Digest — delivered directly to your inbox.

BYD has predicted a bloodbath in the Chinese car industry in the wake of Beijing’s crackdown on aggressive discounts, warning that roughly 100 carmakers needed to be “pushed out” of the hyper-competitive market.

China’s car industry has been at the forefront of President Xi Jinping’s attacks on cut-throat price wars stemming from excessive manufacturing capacity.

Government officials have blamed aggressive discounting, known as neijuan or “involution”, in various industries for exacerbating deflation.

Without the ability to offer discounts to attract customers, “some of the original equipment makers will be pushed out”, said Stella Li, BYD’s executive vice-president, on the sidelines of the Munich motor show. “Even 20 OEMs is too much.”

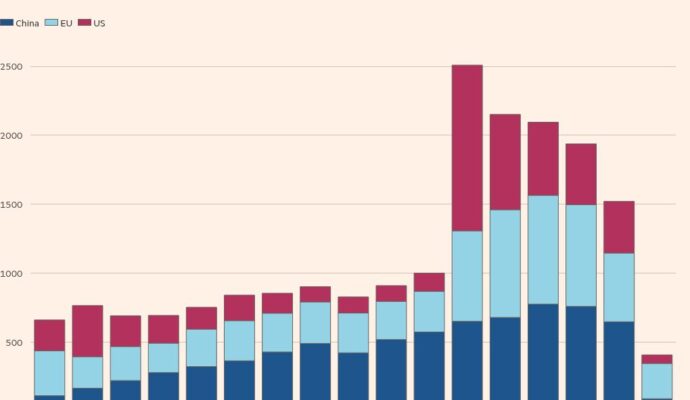

Until now, about 130 manufacturers have jostled to capture share in the world’s largest car market for pure battery electric vehicles and plug-in hybrids.

However, Li and other global car executives are now forecasting a drop in the number of companies, following a remarkable period of rapid sales growth and a decline in prices of electric vehicles made in China.

129

The number of brands selling EVs and hybrids in China last year

Of the 129 brands selling EVs and hybrids in 2024, consulting firm AlixPartners estimates that 15 will remain financially viable by 2030. BYD rival Xpeng has previously predicted the world’s car industry will shrink to only 10 companies over the coming decade.

Li said BYD would benefit from reduced price competition, arguing that customers would be more likely to choose cars based on other criteria such as technology and driving experience.

However, BYD, which competes with Tesla for the crown of world’s largest electric-vehicle manufacturer, was not completely shielded from the domestic pressures created by the government, according to analysts.

The group reported lower than expected net profit and revenues for the second quarter, hit by Beijing’s crackdown on long-term supplier payment practices and discounting.

Citi has slashed its forecasts for BYD’s annual sales — from expectations of 5.8mn cars this year, 7.2mn next year and 8.4mn in 2027 — to 4.6mn, 5.4mn and 6mn, respectively. That compares with sales of 4.3mn units last year.

Li played down concerns about the government campaign’s longer-term impact on BYD’s performance but acknowledged that more Chinese companies were likely to seek growth overseas as intense competition in the domestic market persists.

“I think our profit will still remain strong,” said Li. “I think you will see more Chinese companies come overseas, but the overseas market is not that simple.”

BYD and other Chinese brands have been rapidly expanding their sales in the UK and other European markets by offering affordable EVs and plug-in hybrids with advanced software and other technologies. State-owned Changan has also recently launched in the UK as part of its overseas push.

Li said BYD remained on track to start manufacturing vehicles in Europe through its plant in Hungary from later this year, although scaling up production will take longer.

In a separate interview, Tianshu Xin, who heads the joint venture between Chinese EV start-up Leapmotor and Stellantis, said the company was not in any rush to localise production in Europe despite Brussels’ higher tariffs on imports of electric vehicles made in China.

Leapmotor is considering producing its B10 electric sport utility vehicle at a Stellantis plant in Spain but Xin said the company was able to sell vehicles made in China at competitive prices as it was able to use Stellantis supplier and dealer networks.

Producing cars in Europe was “super complicated”, Xin said. “The [labour] cost is so high and the energy is so high.”

Additional reporting by Gloria Li in Hong Kong