Good morning. As Veena mentioned on Friday, Andres Schipani and I will be filling in for her this week as she is off gallivanting in Europe, so bear with us if we can’t match her award-winning wit and style.

The weekend was largely news-free in India, but what drew attention was a softening of rhetoric between the Indian and US leaders. Donald Trump told the press that he would “always be friends” with Prime Minister Narendra Modi, just a day after the US president had moaned that India was lost to China. Modi responded by saying he deeply appreciated and fully reciprocated Trump’s “positive assessment” of bilateral ties.

Many see this as a potential off-ramp for the spiralling of a once blooming relationship. But nobody in New Delhi seems to really know what the man in Washington is thinking. Let us know if you feel the geopolitical pundits are overthinking this exchange.

From India, we are working on stories about global artificial intelligence giants looking at India as a new battleground and the growing EV race in two-wheelers, and Andres, who has just come back from a week of reporting in Dhaka, will have more to share on Friday.

‘Tirade of tariffs’

Tariffs and taxes continue to dominate most conversations in India, with government officials hoping that the rationalised rates of Goods and Services Tax (GST) will cushion some of the economic impact of Trump’s 50 per cent tariffs.

The country’s chief economic adviser V Anantha Nageswaran said at an event in Mumbai on Friday that the new GST rates will give consumption a fillip. But whether the effective tax cut will be significant enough to fully offset export losses from tariffs is a “matter of calculations”, he said. Finance minister Nirmala Sitharaman also told local media over the weekend that the government was working to provide support to sectors worst-hit by the “tirade of tariffs” and would not leave the exporters “high and dry”.

While daily essentials are direct beneficiaries of the reduced taxes, sectors such as gems and jewellery, one of the most badly affected by US tariffs, will find some relief from slashed rates on imported diamonds and jewellery boxes. Similarly, taxes on auto parts — another sector that exports heavily to the US — have also been reduced, which can ease production costs for carmakers. However, India’s largest export is not goods, but services, led by the nearly $300bn IT services. Trump’s trade adviser Peter Navarro, who has repeatedly attacked India for its Russian oil imports, recently advocated for tariffs on “all outsourcing”. Any action on that will make India’s troubles even more dire. New Delhi nevertheless seems to remain hopeful of resolving issues with Washington.

The tariffs affect more than half of India’s over $85bn annual exports to the US, and Nageswaran has estimated that if they continue, GDP growth could be pulled down by 0.5 to 0.6 percentage points. This makes domestic growth all the more crucial, and the government hopes the cuts to GST — a nearly Rs480bn ($5.6bn) hit to tax revenue — will help. But with wages across most sectors largely stagnant over the past five years, and concerns about a slowing economy, consumers could still hold back — that is, if the private sector even passes on the tax cuts in the first place.

Do you feel the government can convince Indians to start spending more through new tax rates? Hit reply or email me at indiabrief@ft.com

Recommended stories

Yet another Japanese prime minister steps down.

Lea Ypi on how to think about surveillance.

Hilton and Marriott are leading a push by global hotels into India’s smaller cities.

Former Reserve Bank of India governor Duvvuri Subbarao on the country’s north-south divide.

The Trump family’s complex and growing business interests in the Gulf.

How Tokyo became an unexpected haven for China’s middle class.

Join 250+ policymakers, industry executives and investors at the Energy Transition Summit India in New Delhi on September 16 and 17. Register for a free digital pass here or enjoy 20 per cent off your in-person pass here.

Insurance war

India’s hospitals and private health insurance companies are involved in a tussle that has moved from a stare-down contest to a full-blown conflict.

Some of the largest health insurers have blocked cashless services at some of the largest hospital chains, and vice versa. Insurers claim that private hospitals inflate costs for insured patients, sometimes charging more than three times the rate paid by uninsured ones. Hospitals, in turn, claim insurers have not revised their rates since as far back as 2017.

The Association of Healthcare Providers of India, the industry body for private hospitals, said insurers’ demands for lower rates were unsustainable. The group’s deputy director-general Sunil Khetarpal told me that they wanted to resolve the issue amicably, but the insurers “should sit across the table and have a dialogue”. Insurers, however, along with the regulator for the broader insurance sector, are pushing the government to set up a second regulator to oversee hospitals, rein in burgeoning healthcare costs and curb fraud.

When the government announced the new GST rates last week, some of the loudest cheers were for the removal of the 18 per cent tax on health insurance premiums. The industry’s gross premium income rose to $4.4bn in the financial year ending March 2025, compared with $3.8bn the previous year. But the industry could lose this 10 per cent annual growth if the hospitals and insurers can’t find common ground.

With healthcare costs and insurance premiums rising and medical inflation hovering around 10 per cent annually, neither the large hospital chains nor the health insurers are winning much public sympathy. The high stakes for the sector aside, the fight offers little hope of relief for ordinary Indians — no matter which side comes out on top.

If you have any thoughts on this tussle, please share with us. Hit reply or email me at indiabrief@ft.com

Go figure

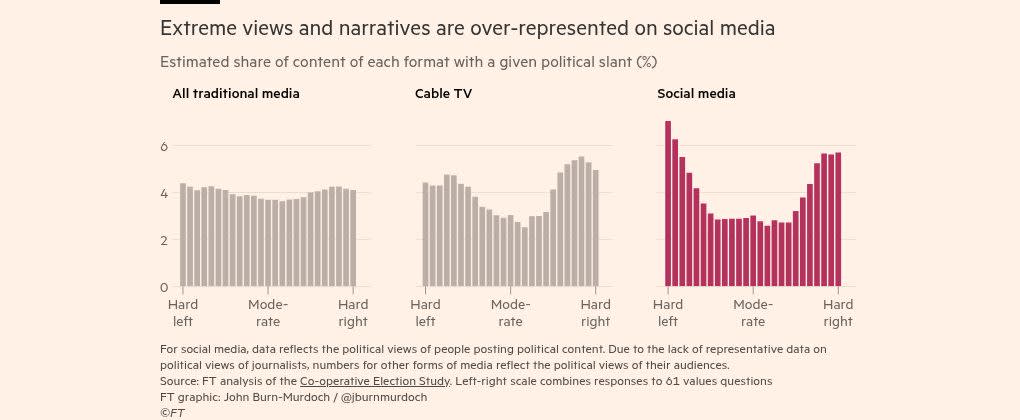

In the age of social media, the establishment no longer controls the narrative, writes my colleague John Burn-Murdoch.

My mantra

“Personally, what keeps me going is being consistent in trying to do some physical work, sleep, nutrition and having some fun. I am big into watching sports and movies.”

— Saurabh Govil, CHRO, Wipro

Each week, we invite a successful business leader to tell us their mantra for work and life. Want to know what your boss is thinking? Nominate them by replying to indiabrief@ft.com

Quick question

My colleague Claer Barrett has written a thoughtful piece about the rising cost of weight-loss drugs and if they are worth paying for.

While these treatments can be lifesavers for the obese, there is a large population using them to shed a few extra pounds. It has prompted dinner table debates on whether these drugs should be used for cosmetic gains when their long-term effects are still unknown. What do you think? Take part in our poll below.

Buzzer round

On Friday, we asked: Which gibberish viral word, which could mean “cool”, “bad” or be used with no real meaning as a joke, entered the Cambridge dictionary this year?

The answer is . . . skibidi, which is one of the 6,000 new words added.

Ram Teja was the first with the right answer, followed by Yaman Singhania, Aniruddha Dutta and Ranjan Kumar Sinha. Congratulations!

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.