Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

China’s summit with Russia and North Korea this week and the military parade that followed contained plenty to shock, from new missile technologies and drone submarines to what appeared to be autonomous robot wolves. But investors in energy may notice a different threat: potential progress on a new Russia-China natural gas pipeline that could, if it goes ahead, leave US suppliers out in the cold.

The Power of Siberia 2 pipeline is a huge project that would bring 50bn cubic metres of natural gas to China per year, starting perhaps in the early 2030s. Such infrastructure investments are usually backed by a decades-long supply contract which binds buyers and sellers.

The issue for other countries is that cheaper Russian imports to China — in volumes that could increase to 60 bcm if some extensions on other routes are factored in — would displace much of the liquefied natural gas China was expected to buy from elsewhere. The potential flows are roughly equivalent to the amount the UK consumes, and would meet a big chunk of China’s expected demand growth of about 150 bcm in the period, as estimated by Bernstein analysts.

This should concern the US, which is already the biggest exporter of the fuel in the world. Moreover, the country has a lot of new liquefication capacity already under construction and further potential besides.

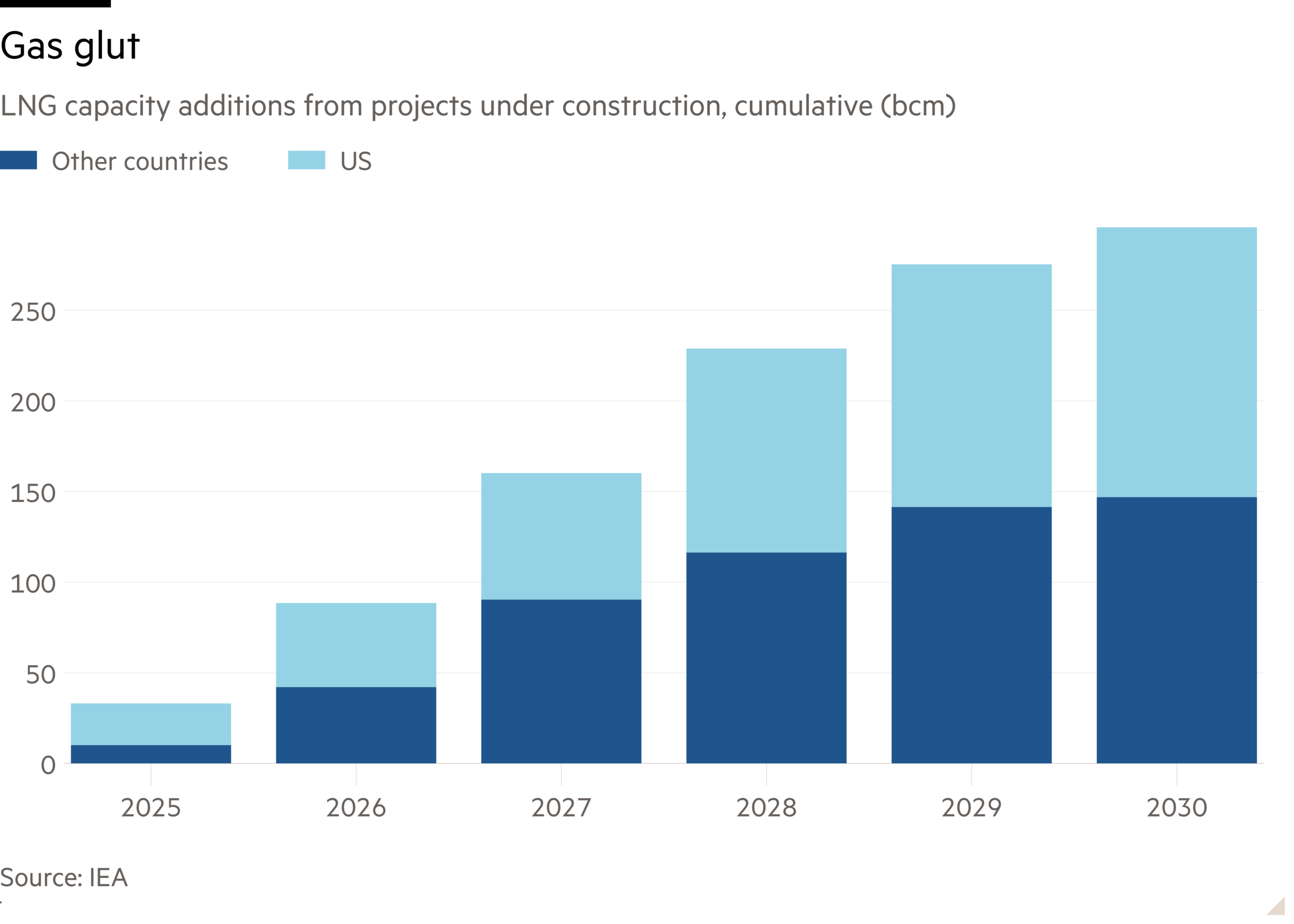

Even without Power of Siberia 2, there was already a risk of superfluous LNG sloshing around the system. The International Energy Agency reckons that projects under construction will add almost 300 bcm of annual LNG capacity to the system by 2030, of which about half comes from the US. That is more than the demand expected to grow in the period, creating a glut until potentially the early 2030s. A new Russia-China pipeline would extend that glut, keeping prices lower for longer.

In the short term, US LNG developers such as Cheniere and Venture Global have some protection from these shifts in supply. They tend only to start construction when much of their capacity has already been sold under long-term contracts. Oil companies such as TotalEnergies and Shell and traders such as Vitol and Trafigura account for more than 40 of new LNG contracted volumes from 2021, thinks Wood Mackenzie, a consultancy.

Those who have bought it, however, may find themselves more exposed — especially if they have not secured “back-to-back” contracts to sell their LNG on to industrial and retail gas users.

Longer term, Power of Siberia 2 would cause problems for the developers too. About 250 bcm of potential LNG projects are still on the drawing board, according to consultancy Baringa. In a world in which China uses ever more Russian gas, many of these would struggle to get built. At current European gas prices, that is almost $90bn a year of lost revenue for US industry — money that could, literally, end up going down the pipes.