Good morning from Delhi where we are finally seeing the first rays of sunshine after more than a week of relentless rain.

I have been busy this week talking to leaders across various industries in preparation for the FT’s energy transition summit on September 16-17. I’ll be moderating panels on three topics: financing for renewable energy, what Indian states are doing, and lower carbon solutions for heavy industry. I’d love to see you at the event — you can register for a digital or in-person pass.

I will be away next week, on a quick holiday to Belgrade (it met both my criteria — a place I haven’t been to before, and did not have to get a visa to visit). Send me recommendations if you’ve been! My colleagues in the FT’s India bureau — Krishn Kaushik and Andres Schipani — will be stepping in while I am away.

GST 2.0 is here

After a marathon meeting, the central and state governments have agreed to overhaul India’s goods and services tax regime, a move that finance minister Nirmala Sitharaman said would make consumers’ lives better.

Rates for a wide swath of products have indeed been rationalised. In the new system, most products will be classified into two categories: 5 per cent for essential goods and 18 per cent for everything else, and the 12 and 28 per cent rates have been done away with. Everything from butter and chocolates and shampoos to tractors and air conditioners will cost less. Of course, nothing is ever quite so simple, so there is a third rate — 40 per cent — for sin goods and luxury items. A long sought demand, that the premium paid on health and life insurance be made tax-free, has also been met.

More importantly, the government has tried to simplify some procedural complexities in the system, especially the inverse duty structure that is applicable in industries whose raw materials are taxed higher than the final product. This involves a complicated formula for computation of refunds that had the best tax experts in the country in a tizzy. The new rules will come into effect on September 22, just as the festival season moves into a higher gear.

The politics of the tax cuts are also interesting. Everyone wants to take the credit for these reforms, even though states — especially those not ruled by the BJP — also want to be compensated for their loss of revenue. It’s unlikely they will get what they want. In the past few months, Modi’s government in New Delhi has been facing heat, including from its core base, on issues from blending ethanol in petrol to re-establishing ties with China. Their hope is that these cuts will now change the narrative. The elections in the state of Bihar in November will tell us if this strategy has worked for the party.

With this move, the government has thrown everything it has at boosting consumption growth in the country. GST 2.0, as the reforms are being called, is estimated to cost the exchequer Rs480bn ($5.6bn), but the government is counting on growth to minimise the damage. Although Sitharaman’s budget earlier this year carried several tax saving provisions for middle-class Indians, it did not sufficiently unleash animal spirits in the economy. Yesterday, stock markets opened with a bang but quickly subsided to a fairly muted session. We will have to wait until companies post the third-quarter results in January to see how successful this latest move is for the economy. The ugly truth is it is higher income, and not lower tax, that will boost growth. But who wants to hear that?

Do you think GST 2.0 will unleash animal spirits in the economy? Hit reply or email me at indiabrief@ft.com.

Recommended stories

The Trump administration is doubling down on antitrust cases against Big Tech, despite its setback with Google.

Have you heard of Vitol? It’s a secretive trading giant minting fortunes for its employees.

China’s solar sector racks up billions in losses.

At Singapore’s anti-fraud convention, even the experts got scammed.

The last interview with Giorgio Armani.

Check out these five great ultra-slim gadgets.

Jane Street appeals

India’s stock market regulator is tightening its framework for derivatives trading in order to control volatility and stamp out rampant speculation. Starting next month, traders’ intraday net positions, after offsetting longs and shorts, will be capped at Rs50bn ($570mn). Gross positions, in which long and short positions are counted separately, can be a maximum of Rs100bn. These limits are for individual trading entities and will be monitored by the stock exchanges at four random points during the trading day.

With this, Sebi hopes to bring greater control to India’s derivative markets, which have grown substantially in the past few years. These initiatives are particularly significant after its July order against Jane Street, in which it accused the American group of manipulating the markets. Jane Street faced a temporary ban on trading in the Indian markets, which was lifted after the firm deposited $560mn in an escrow account. In fact, on Wednesday, the company filed an appeal against that order, and claimed India’s market regulator had not granted it access to crucial documents related to the case. I have written to Sebi, but they did not respond.

The derivatives issue in the Indian market is a case of “be careful what you wish for”. Exchanges wanted a thriving futures and options market to increase the depth of the market, and the entry of large foreign players such as Jane Street — which had revenues of more than $10bn last quarter — was seen as a sign of success. However, insulating individual traders from the swings in the market caused by large traders has proven to be difficult.

Sebi’s challenge is in ensuring all market participants have an even playing ground. That is, quite frankly, impossible in a segment where momentum generated by large trades has a high impact. The new rules published earlier this week will cap the risks but this will come at the cost of a deeper market. I will be watching how this unfolds, and whether Sebi will be able to wrestle the market from the Darwinian principles on which it thrives.

Go figure

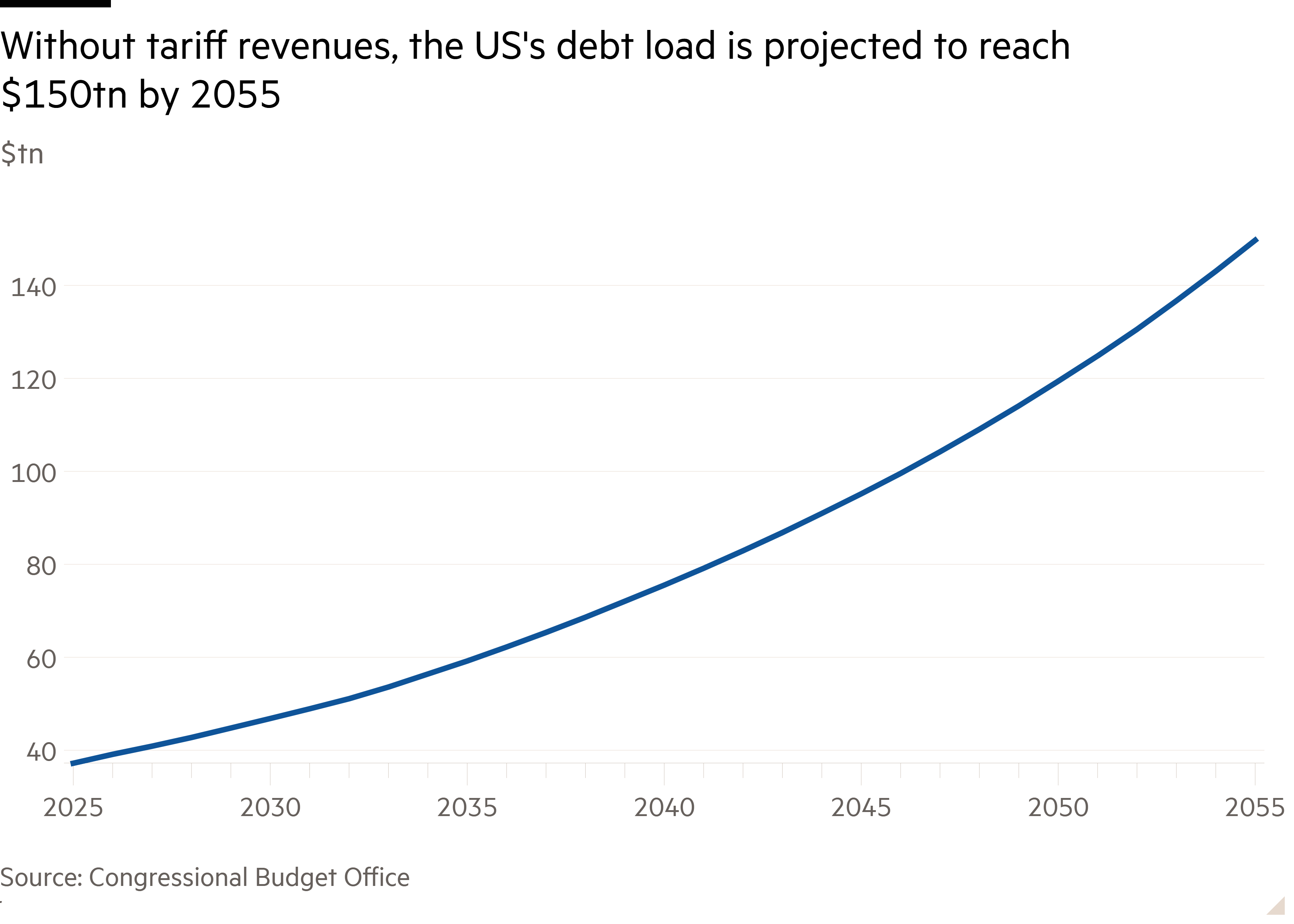

Bond traders are banking on revenue from Donald Trump’s tariffs to bolster the US’s public finances, in a sharp switch from earlier this year when his trade war triggered a brutal sell-off in the Treasury market. Tariffs are expected to boost US government revenues by $4tn over the coming decade.

Read, hear, watch

I’m looking forward to the Djokovic-Alcaraz semi-final match at the US Open. I’ll probably miss all the other matches because of my travel plans. Send me your predictions. (Team Alcaraz, here!)

Buzzer round

Which gibberish viral word, which could mean “cool”, “bad” or be used with no real meaning as a joke, entered the Cambridge dictionary this year?

Send your answer to indiabrief@ft.com and check Tuesday’s newsletter to see if you were the first one to get it right. Note: This question has been edited for clarity.

Quick answer

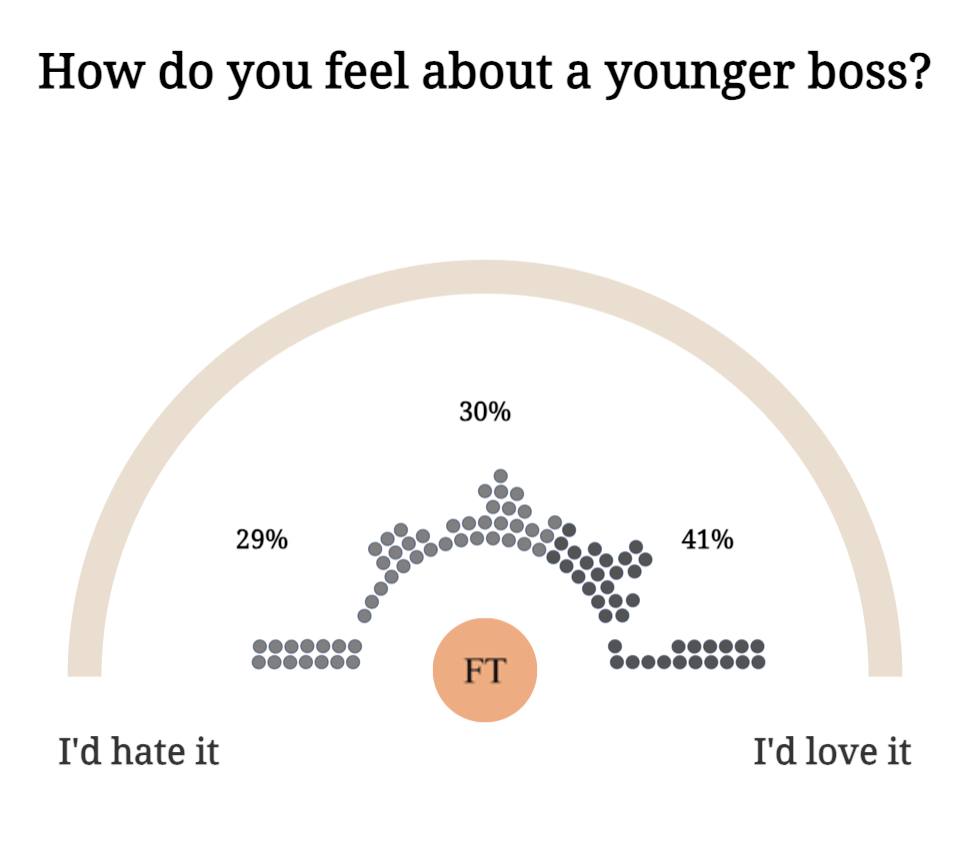

On Tuesday, we asked how you felt about having a younger boss. Here are the results. More than 40 per cent of you seem in favour. Colour me surprised.

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.