A four-month “ninja stealth rally” has driven Tokyo’s equity market to record highs, as global investment funds diversify away from China and the US and bet that a decade of structural change has transformed Japan’s corporate boardrooms.

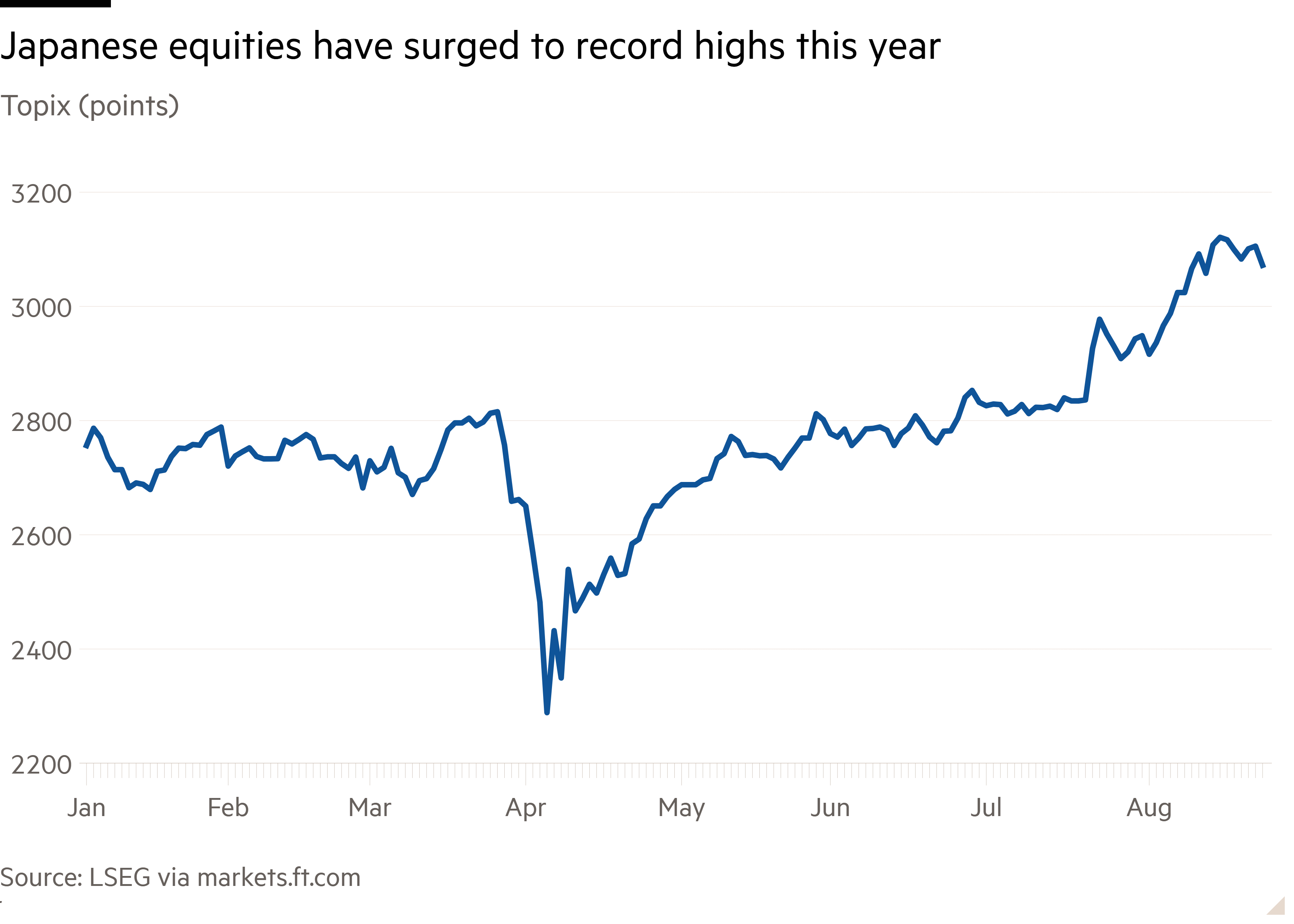

The rally, which began shortly after the panic set off by President Donald Trump’s “liberation day” tariff announcements in early April and which has been supported by a US-Japan trade deal, pushed the benchmark Topix above 3,000 for the first time in August.

Although the Topix has retreated about 1 per cent this week, it is still up more than 34 per cent since hitting a post-“liberation day” low on April 7, ahead of a 19.5 per cent gain for Europe’s Stoxx 600 index and a 33 per cent rebound in the S&P 500.

Analysts said the surge in Japanese stocks had drawn in foreign and domestic institutional investors.

The run was “materially different” from a rally in 2024 that pushed the exporter-oriented Nikkei 225 index to its highest level since the bursting of the 1989 stock market bubble, said Neil Newman, Japan strategist at Astris Advisory Japan.

“Foreign, domestic institutional and retail are now engaged,” said Newman.

A recent decision by Bridgewater, one of the world’s biggest hedge funds, to reduce its exposure to China by selling US-listed Chinese equities could encourage others to look at investment opportunities such as Japanese stocks, he added.

Japan’s outperformance has been helped by a trade deal with the US, agreed last month, to impose 15 per cent tariffs on Japanese goods imported into America. This was below the 25 per cent that had been threatened by Trump, although sharply different perceptions of what was agreed have since emerged.

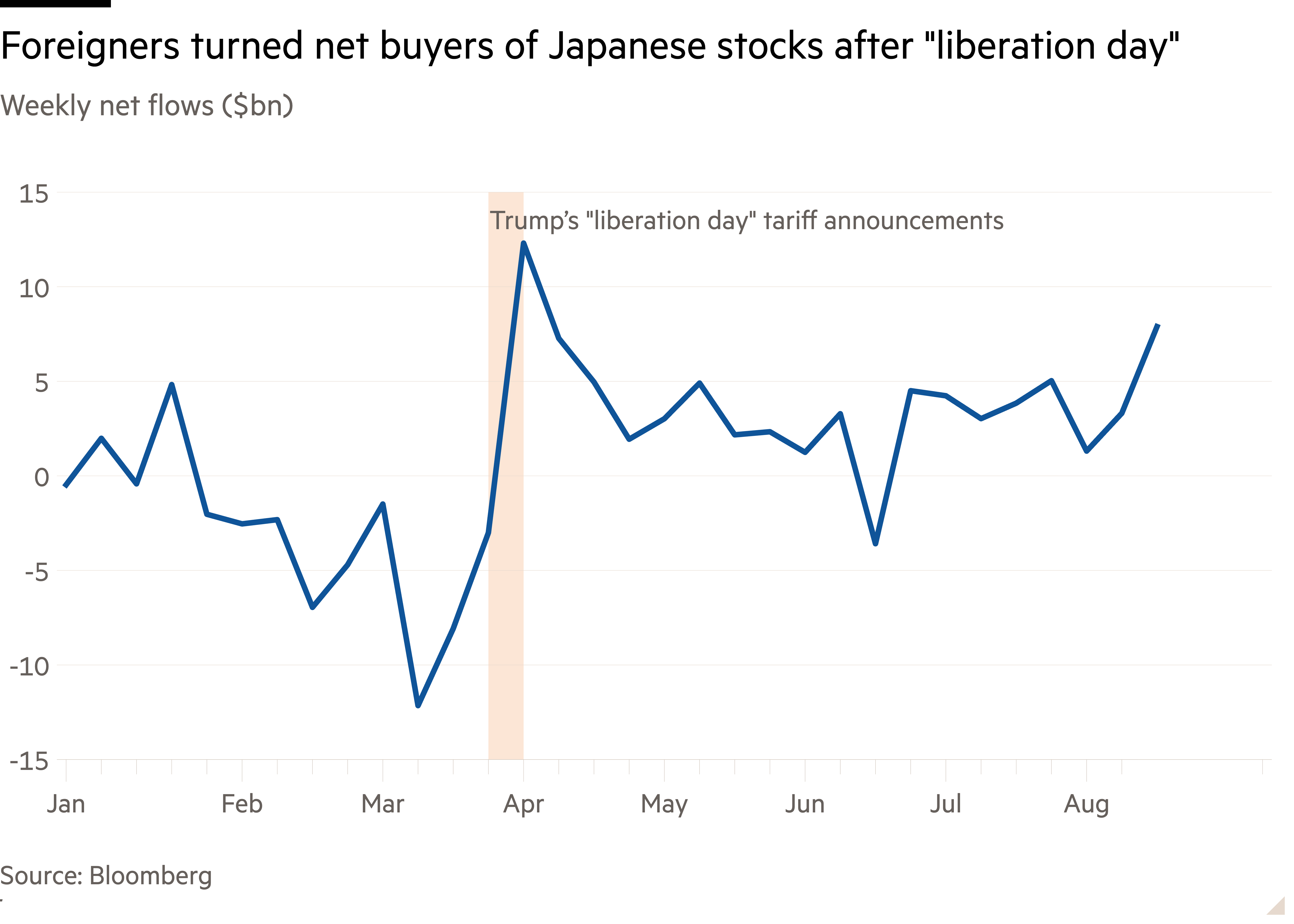

The performance of the Topix is an example of a Japan equity rally driven by non-Japanese investors, said Bruce Kirk, Japan strategist at Goldman Sachs. Foreign investors have ploughed $35.7bn into the stock market this year, mostly after “liberation day”.

Kirk pointed to near-continuous net foreign buying in recent months. “That’s really what was driving the ninja stealth rally we’ve seen since April,” he said.

Buying by Japanese households after the country expanded a tax-protected investment scheme last year has also helped support the rise in domestic stocks.

As of the end of last year, Japanese households held more than $14tn in financial assets, although half of this was in cash or deposits.

With the return of inflation and wages rising for the first time in three decades, domestic savers have a reason to change their allocations, said Joshua Crabb, head of Asia-Pacific equities at Robeco.

“If people think that deflation is over, the huge allocation we’ve seen to the bond market and cash is likely to find its way into the equity market,” Crabb said.

“Is Japan’s growth going to leap massively? No, that’s not going to happen,” he said. “Is there change that’s going to happen at the asset level because of inflation coming back after such a long time? Yes, absolutely.”

Shrikant Kale, Japan strategist at Jefferies, said the rally had taken the price-to-earnings multiple of the Japanese market to levels that previously represented the upper limit of investor appetite.

But that might have changed, he said, because of the pressure on Japanese companies to sell underperforming divisions and for management to be more shareholder-friendly.

Japan started to overhaul corporate governance in 2012. But the government’s attempts only gained traction after the Tokyo Stock Exchange began a “name and shame” campaign for companies that failed to meet requirements in 2023, said Charlie Linton, an Asia-Pacific portfolio manager at Ninety One.

“You’ve actually been able to realise some of the latent value in some of these Japanese stocks,” said Linton. “There’s still potential for that kind of re-rating, despite what’s going on in the rest of the world.”

“The corporate governance trend is here to stay for the long term,” said Oleg Kapinos, head of global distribution strategy at Asset Management One, a Japanese investment manager.

Investors said there are opportunities in the country’s industrial stocks, which have sprawling assets, if businesses focus on their most profitable holdings. Shares in Mitsubishi Heavy Industries, Japan’s largest defence contractor, have rallied almost 70 per cent this year on hopes that it will benefit from higher defence spending and more streamlined management.