Good morning. This promises (threatens?) to be a busy week. Tomorrow, US President Donald Trump’s additional tariffs on Indian exports kick in. Although over the weekend, ministers Piyush Goyal and S Jaishankar said that trade talks with the Americans were continuing, there are no signs of immediate relief for Indian exporters.

On Friday, first-quarter GDP numbers will be released, with implications for the central bank’s decision on interest rates next month. But the more pressing matter for the economy seems to be an unintended consequence of the government’s move last week to rationalise tax rates on goods and services. While corporates were looking for a strong uptick in consumer spending from the festival season — which starts this week with Ganesh Chaturthi and Onam — customers are waiting until October for the lower tax rates to take effect.

By the end of the week, Prime Minister Narendra Modi will be in Tianjin, China, (after a couple of days in Japan) and will meet both Chinese President Xi Jinping and Russian President Vladimir Putin. Will we wake up to a new world order in September? Who can tell? A week is a long time in 2025.

In other news, I’m thrilled to announce our new monthly series: the India Business Briefing Q&A. Through full-length interviews, I’ll be bringing you insights from the country’s top business and industry leaders — in their own words. More on this in Friday’s newsletter, featuring my debut conversation with Vivek Pandit, global co-lead of McKinsey’s private equity group. Don’t miss it!

Foreign investment in Indian banks

In a big move, India’s banks are opening up to global players. Two developments over the weekend have taken the sector a step closer.

First, the markets regulator has approved government-controlled Life Insurance Corporation’s request to be reclassified as a public shareholder in IDBI Bank. The move, reported in exchange filings, paves the way for a strategic sale of the bank. For a few months now, speculation has been rife that Emirates NBD is a frontrunner to buy a 60 per cent stake in the bank. In June, the central bank gave in-principle approval for the Dubai-based bank to set up a wholly owned unit in India, a move that would allow it to be treated as a local bank. Canada-based Fairfax Financial Holdings is also in the mix to buy IDBI Bank. We will know more about the specifics of this deal in the coming weeks once the due diligence process is over, but it certainly looks like the government and the Reserve Bank of India are clearing the way for a foreign entity to buy a substantial chunk of IDBI Bank.

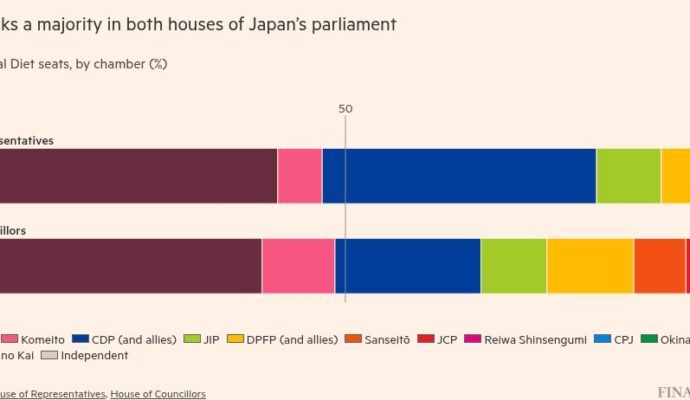

The other development on Saturday was Sumitomo Mitsui Banking Corporation winning approval from India’s central bank to acquire up to 24.99 per cent of Yes Bank. The Japanese lender will also get two seats on the board of Yes. Valued at $1.58bn (for 20 per cent), it marks the largest cross-border investment in India’s banking sector.

Taken together, these are definitive signs that the RBI is now in favour of easing some of the stringent norms around foreign investments in the sector. Although global investors, including portfolio investors, are allowed up to 75 per cent stake in Indian banks, strategic investments, which imply some involvement in the operations of the bank, cannot be higher than 15 per cent. (Market buzz is that this might go up to 26 per cent.) Regulations also cap voting rights for foreign entities at 26 per cent for any single entity, even if their shareholding is higher. The central bank will probably continue to deliberate and be cautious about introducing blanket reforms in ownership regulations, but it does seem to be more open now to foreign investment on a case-by-case basis.

The entry of big banks with high capital investment will transform both the lending and deals landscape in India. This is, understandably, a concern for domestic banks, which will face higher competition from players with deeper pockets. But India is now the fourth-largest economy in the world and a leading player in cutting-edge fintech solutions. It’s time for Indian banks to step up.

Do you think foreign strategic investments in Indian banks is a good idea? Hit reply or email me at indiabrief@ft.com

Recommended stories

How SoftBank’s Masayoshi Son became Donald Trump’s favoured foreign investor.

Private equity is struggling to raise money.

Publishers are racing to counter the ‘Google Zero’ threat as AI changes search engines.

Trump says he is firing Fed governor Lisa Cook ‘effective immediately.

Could you run a Premier League football club? Don’t miss this FT interactive game.

Check out this review of Srinath Raghavan’s latest book, Indira Gandhi and the Years that Transformed India.

Join 250+ policymakers, industry executives and investors at the Energy Transition Summit India in New Delhi on September 16 and 17. Register for a free digital pass here or enjoy 20 per cent off your in-person pass here.

Global AI comes for Indian users

Global artificial intelligence companies looking for a large market base are flocking to India and offering cheap access to their subscription services. Last week, OpenAI announced that it would set up an India office later this year and was also looking to hire employees locally, mostly for sales and customer engagement roles initially. Chief executive Sam Altman said that OpenAI’s Indian users had grown by four times in the past year, and that he would visit the country in September.

India is now the second-largest user base in the world for ChatGPT. But the competition is heating up. Earlier this month, OpenAI rolled out a special India subscription priced at Rs399 ($4.55) a month. This came close on the heels of a move by Perplexity, which has teamed up with telecom provider Bharti Airtel to give mobile users free access to its Pro offerings for 12 months. Meanwhile, Google is focusing on younger users, offering free plans for Indian students for a year.

While all of this is good news, it is pertinent to note that large technology companies are primarily looking at India as a user base, and not as a place where they want to set up their technology development facilities. OpenAI’s decision to place its first Indian office in Delhi and not Bengaluru, where the country’s software talent pool is concentrated, is telling. As a market, India offers global AI developers access to about 140mn English-speaking users for whom they don’t even need to incorporate language translations, allowing them easy access to data — both for teaching the models, as well as understanding user behaviour.

The government has welcomed OpenAI’s plans for India, with minister Ashwini Vaishnaw saying it will advance its IndiaAI mission to build an inclusive and trusted ecosystem for the technology. Perhaps he should have pushed the company harder to develop more in India, too. The government’s AI strategy seems to be largely an exercise in ticking the boxes. The IndiaAI mission routinely announces aspirational targets, such as free training for 1mn people and setting up centres of excellence. But there is very little impact that is seen on the ground.

Do you think global AI companies are using the Indian market without investing much? Hit reply or email me at indiabrief@ft.com

Go figure

With conflicts raging in various parts of the world, experts say an increasing number of people are dying of hunger, as public attention moves on and humanitarian agencies lose their ability to counter leaders willing to use food as a weapon.

The worst images now are coming from Gaza, where an entirely “man-made famine” has taken hold as Israel prevents aid agencies from delivering sufficient food to the enclave. A UN-backed food security monitoring panel has warned it could get worse. These are the panel’s projections for the number of people facing starvation in Gaza in August and September.

641,000

Catastrophe (Extreme lack of food; starvation; death)

1.14mn

Emergency (Large food consumption gaps)

198,000

Crisis (Food consumption gaps)

My mantra

“The operative word is balance. You should have the ability to take time off work. Physical exercise, meditation, yoga, are all helpful. And, of course, family. I have a 12-year-old daughter; I spend a lot of time with her, we have fun together. I believe that’s what helps me get back to work with renewed energy.”

— Aparna C Iyer, chief financial officer, Wipro

Each week, we invite a successful business leader to tell us their mantra for work and life. Want to know what your boss is thinking? Nominate them by replying to indiabrief@ft.com

Quick question

Do you think India should strategically realign with China and Russia? Tell us here.

Buzzer round

On Friday, we asked: the sales of which product, named after a famous actress, helped this company briefly overtake LVMH to become the world’s most valuable luxury corporation by market valuation earlier this year?

The answer is . . . the Birkin bag by Hermès, named after British-French actress Jane Birkin.

PV Kannan was the first with the right answer, followed by Yaman Singhania, Aniruddha Dutta and a person who wanted to be identified only as RJ. Calling out three more names today: Prasanna Venkatesh, Anjaneya Das and Rudrajit Dawn were also quick and correct. Congratulations!

(We’ll start a leaderboard soon.)

Thank you for reading. India Business Briefing is edited by Tee Zhuo. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.