Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

“You don’t have the cards,” Donald Trump famously remarked to Volodymyr Zelenskyy earlier this year.

The US and Ukrainian presidents are getting on better these days. But Trump’s brutally realist approach to international relations remains. It is all a trial of strength. Who has the best cards?

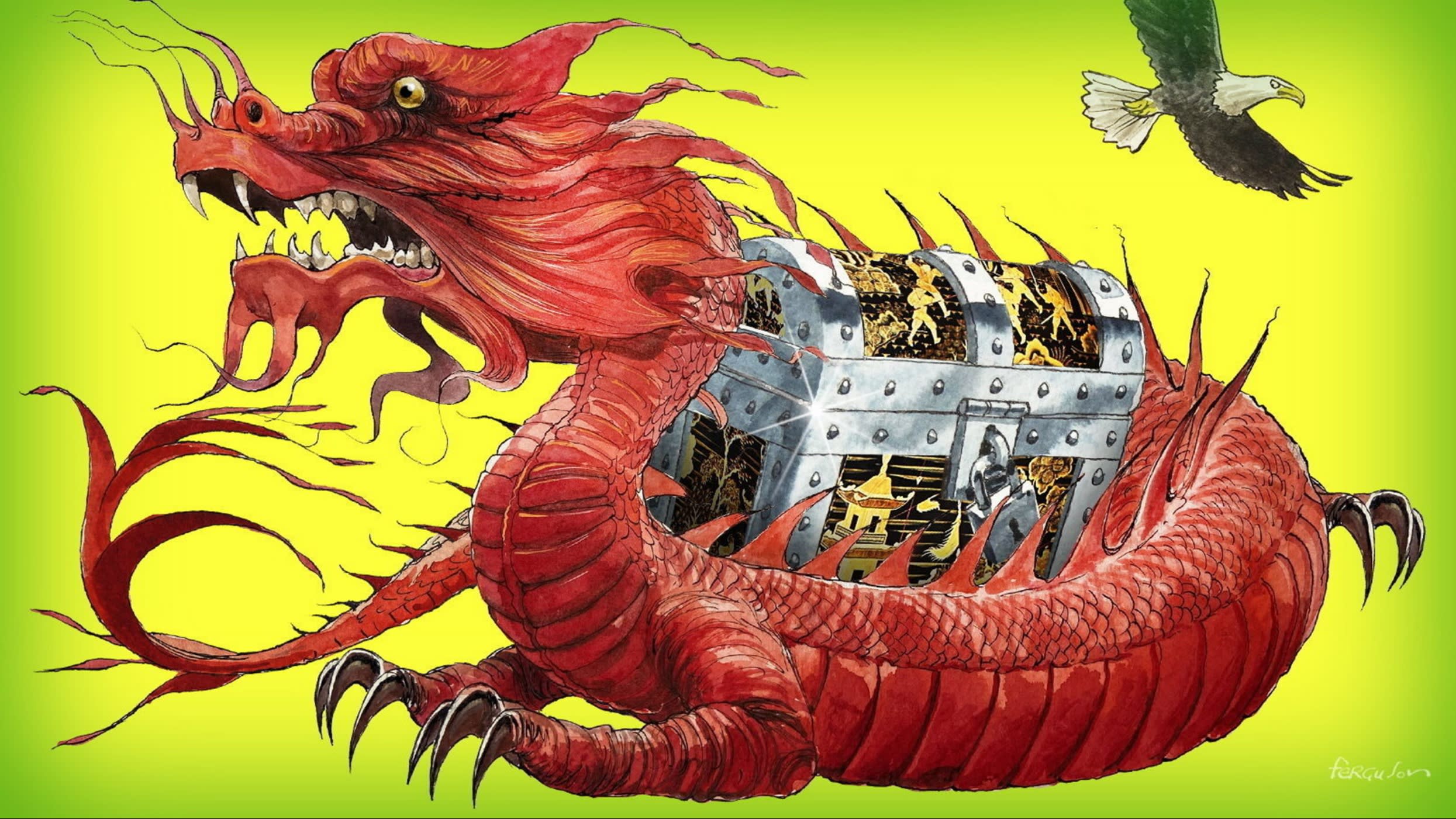

The Trump administration now seems to have realised that in the game of trade poker with China, it is Beijing that has the ace up its sleeve. This month, the US extended the 90-day truce in its trade war with China for another three months. As a result, China currently has more favourable tariff rates with the US than Switzerland or India. Beijing’s ace is its near monopoly on the production of rare earths and other critical minerals that provide vital inputs to western industry and the US military.

The names of the rare earths remain exotic and little known to the western ear. If Tom Lehrer were still alive, he could have promoted public understanding by setting them to music — as he once did with the chemical elements. But, in a full-on trade war, the western public might soon become familiar with names like neodymium and dysprosium.

China began to play its hand in earnest just after liberation day, April 2, when Trump announced punishing tariffs on most of the world, with China hit particularly hard. Two days later, Beijing’s Ministry of Commerce announced export controls on seven types of rare earths.

The effect on the world’s motor industry was dramatic and felt within weeks. Jim Farley, the CEO of Ford, admitted in early June that a shortage of rare earths used in magnets had forced his company to “shut down factories” temporarily. European manufacturers had similar problems.

Faced with this crisis, the Trump administration had to plead for the restrictions to be eased. A temporary agreement was reached in June. But if Trump raises tariffs to stratospheric levels again, Beijing will almost certainly reimpose strict export controls. Even now, it has not completely abandoned its restrictions on rare earth exports. Orders from overseas that look like efforts to stockpile rare earths are still being blocked.

Beijing’s grip on critical inputs for western industry gives China a uniquely powerful hand in any trade war with the US. A Chinese threat to block the export of rare earths is a much more powerful card than a European threat to block the export of Gucci handbags.

Even some of the weapons systems that the US would rely upon in the event of a war with China rely on Chinese rare earths. The F-35 fighter plane is dependent on several rare earths sourced from the country — including samarium, which is crucial for heat-resistant magnets, and yttrium, which is vital for targeting systems.

Europe’s green transition would also grind to a halt without a steady supply of Chinese critical minerals and rare earths, such as germanium which is used in batteries. One prominent European politician recently told me: “Our dependence on Russia for energy is very mild compared to our dependence on China for critical minerals. We’ve bet everything on the green economy and China could shut us down.”

China has built up this strategic strength over many decades. In 1987, Deng Xiaoping, then the country’s leader, remarked: “The Middle East has oil. China has rare earths.” In reality, rare earths are found all over the world. It is China’s willingness to commit to the often filthy business of mining and processing critical minerals — and the rare earths that are a vital subset of them — that has given Beijing its near monopoly. As a result, the country is thought to mine around 60-70 per cent of the world’s rare earths and control around 90 per cent of their processing and refining.

The west has long been aware of the theoretical dangers of its reliance on Chinese rare earths. As one Trump administration official told me: “We’ve sat around admiring this problem for decades.” His view is that the west was stymied by a mixture of environmental concerns and a reluctance to sanction state intervention in the market.

Will the trade war, allied to growing military rivalry with China, finally prod the west into fixing the rare earths problem? And can it move fast enough?

There are signs of increased urgency in Washington and Brussels. When Trump recently announced a framework for a peace deal between Rwanda and the Democratic Republic of Congo, he stated “We’re getting, for the United States . . . a lot of the mineral rights . . . as part of it.” He also put pressure on Ukraine to hand over mineral rights, in return for US support. The EU’s Critical Raw Materials Act, which came into force last year, has set targets for reducing dependence on China.

But, so far, the EU has no operational rare earth mines and only two major processing plants. Overcoming environmental objections to processing could be even harder than gaining access to the mineral. The Solvay facility in western France is set to expand. But following EU rules will raise production costs considerably.

One western security official says that “it’s taken more than 20 years to become this dependent on China. And it will take another 20 years to break the dependency.” But the west may not have the luxury of a generation to fix the problem.