Hedge funds are betting against Europe’s struggling car industry, as auto and parts makers battle a market slowdown worsened by US President Donald Trump’s trade war and fierce competition from Chinese rivals.

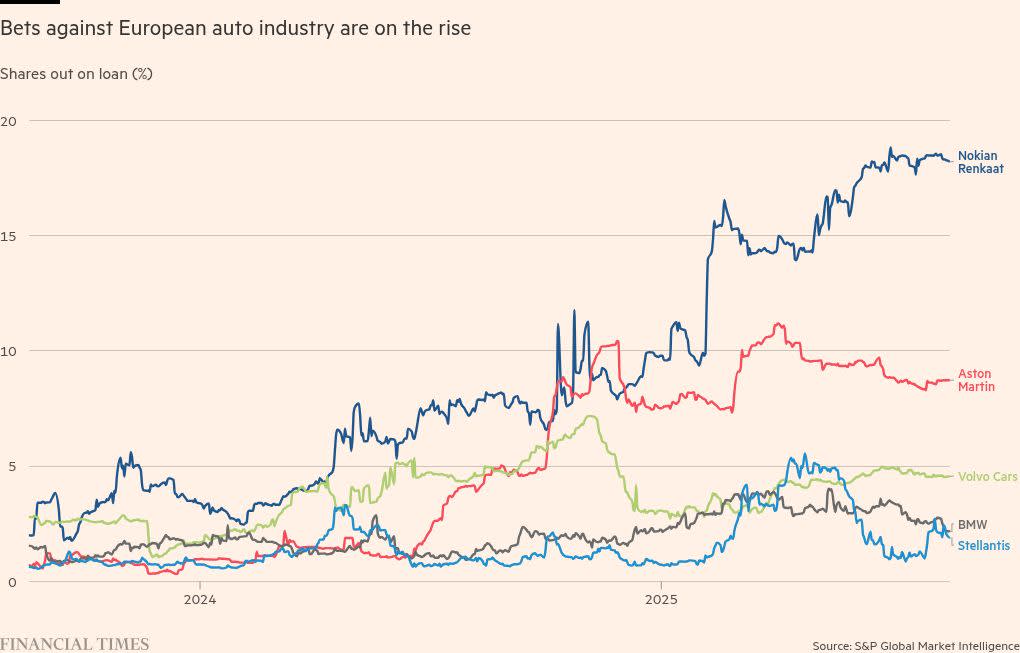

Short positions against some of Europe’s biggest parts manufacturers and carmakers have been on the rise this year following Trump’s return to the White House in January.

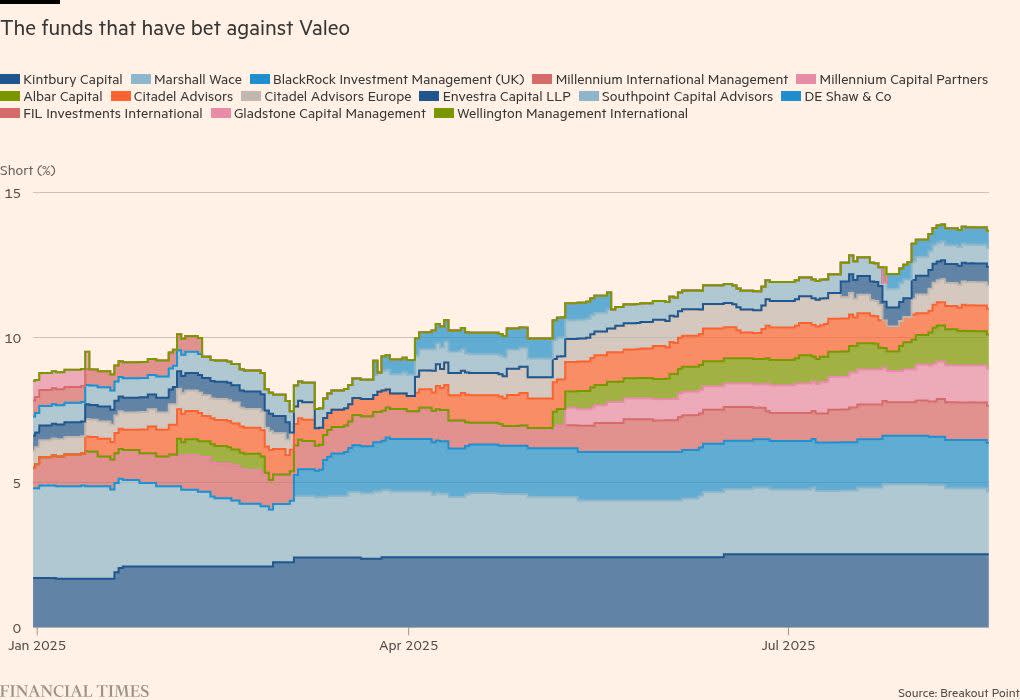

French components maker Valeo is Europe’s second-most shorted stock as a percentage of issued shares, based on disclosed short positions, according to data provider Breakout Point.

Shares out on loan — a proxy for short positioning — in the autos and components sector have risen 35 per cent since the start of this year, according to S&P Global, having hit a 2025 peak in April following the introduction of Trump’s ‘liberation day’ tariffs.

“Autos are in a bit of a mess,” said the head of one London-based equity hedge fund who is betting against several companies in the sector.

“German [carmakers] made a lot of money in China but that profit pool is disappearing . . . and it’s difficult for companies that export to the US because of tariffs.”

The US has imposed a 27.5 per cent levy on most European autos, which it agreed to reduce to 15 per cent last month. However, on Wednesday a US official said it will not ease these tariffs until the EU brings in legislation to lower its own duties on US goods.

Many European car and parts makers locate manufacturing facilities abroad to supply local markets. But those factories are typically reliant on imports of components into those markets, meaning they can still be affected by tariffs.

Even before Trump’s levies, many were struggling against the rise of formidable Chinese competitors such as BYD, both in their home markets and in China.

New York-based hedge fund Jericho has a short position amounting to 0.52 per cent of Stellantis’s shares, according to the latest regulatory filing, worth roughly €127mn, while BlackRock is running a short position worth €75mn against Volvo Cars.

“Things are very, very difficult,” said the London hedge fund manager. “We are particularly negative on Valeo, which had low margins to begin with and is not well placed.”

Valeo supplies parts such as lighting, heating and technology systems to big carmakers in Europe, the US and China, and has been hit by slowing demand, including for its electric vehicle components. The weakness of the dollar — affecting a large chunk of its sales — will cost it €750mn this year, the company warned last month.

The stock has attracted short bets from London-based hedge funds Kintbury and Marshall Wace, as well as US hedge funds Millennium, Citadel and DE Shaw, according to filings. The disclosed short positions in aggregate are worth around €355mn.

In the eyes of many investors, the trade war has only added to long-term problems that the European industry was already facing.

“Tariffs are part of our short thesis but the real problem with autos is they will never sell as many cars as they used to in China,” said another London-based hedge fund manager.

“They are behind on technology and electric vehicles,” the manager said. “This is a secular decline and will be for a while.”

Second-quarter earnings showed the impact of tariffs on some of Europe’s biggest carmakers. Stellantis said it incurred a €300mn hit from the new levies, as its sales in North America fell 25 per cent compared with a year earlier.

Volkswagen reported a €1.3bn hit from the trade war and joined Porsche and Mercedes-Benz in cutting future guidance. Germany’s top three carmakers are set to have more than €10bn wiped from their cash flows this year.

US carmakers have also been hit, with General Motors and Ford forecasting a $3.5bn and a $2bn fall in earnings due to tariffs respectively this year.

Some parts suppliers have been able to pass on a larger portion of tariff costs to their carmaker customers, their earnings have so far suggested. But the uncertainty created by Trump’s trade war still presents a challenge.

“It’s very difficult for any of these [auto part] companies to make any real progress on earnings,” said Vanessa Jeffriess, vice-president for industrials research at Jefferies. They are showing “limited or no volume growth at all” and no signs of improvement, she added.

However, bets against autos stocks have not universally paid off this year, as share prices have been buoyed since April by a broader market rally carrying equities to record highs.

Despite the growing short positions and the tariff hit, Valeo and Nokian Renkaat have seen their share prices rise more than 10 per cent this year.

Nevertheless, some believe that there could be worse to come for some firms.

Many companies frontloaded imports to the US early this year, as they waited for trade talks to conclude, so analysts say these effects are not yet entirely reflected on balance sheets.

“If you’re a manufacturer of autos, you’re facing the worst period you’ve seen for a long time,” said Craig Cameron, senior vice-president for European equities at Franklin Templeton.

“It’s the sector that worries me the most,” he said. “It’s getting crushed from both sides.”

Additional reporting by Ray Douglas