Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

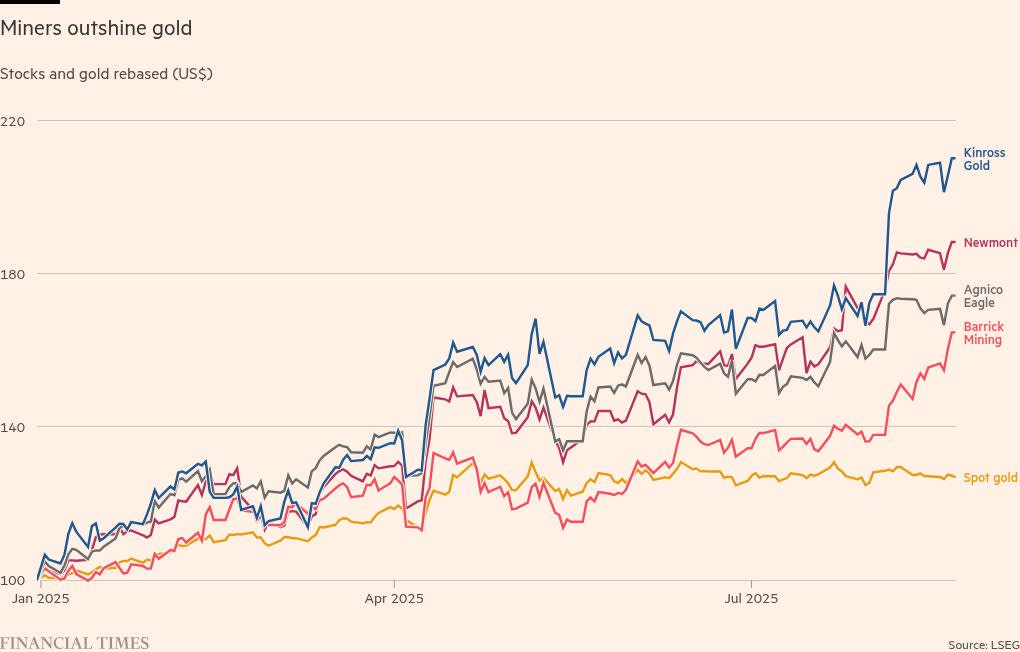

Picks and shovels never looked so good. Gold miners are trouncing the shiny metal: while gold has barely budged over the past three months, share prices of those that hack it out of the ground are up by as much as a third.

The relative fortunes make textbook sense. A chunk of fixed costs means miners’ profits should increase beyond the price of gold, thanks to the financial magic of operational leverage. But for years, those benefits were shredded by miners’ penchant for squandering cash on vainglorious acquisitions and forays into geopolitically risky corners of the globe.

That is changing. Many miners have amassed cash piles and are sitting on healthy balance sheets. Free cash flow yields were running as high as 8 per cent three months or so ago, before the latest rally took off.

Investors who pleaded for cash are now getting what they wanted in spades. In the last quarter US-listed Newmont, which typified the sector’s era of derring-do with its $19bn acquisition of Australia’s Newcrest in 2023, was among those returning capital via dividends and buybacks. Its cash pile is well ahead of targets and debt levels are comfortably below.

Also generating and returning cash: Canada’s Kinross Gold, nudged into action by activist investor Elliott Management, and Agnico Eagle. The latter had amassed $1bn in net cash at June 30, building its buffer while paying down debt. Barrick, having burnished its balance sheet, recently rewarded investors with a “performance dividend”.

Nor is it just miners’ liabilities that look more conservative. Formerly adventurous executives are becoming less gung-ho on geopolitically riskier terrains, although legacy issues — such as Barrick’s mine in Pakistan, or the challenges that face companies like London-listed Endeavour Mining in Mali — remain.

The perennial danger with gold rushes is turning up too late, and previous bouts of substantial outperformance by miners have typically been reversed. This time round there are a couple of props that could sustain the rally. Shaky politics support the gold price, for example. And miners’ costs are rising modestly: most pencil in single-digit inflation.

Since the second half of the year is typically stronger for gold miners, that should result in more cash generated and disbursed. That still leaves the question of what constitutes a sensible cash buffer when production pipelines are healthy. But that conundrum is one that plenty of miners, and their investors, are happy to have.