Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Phoenix Group has begun expanding in Australia after making its first investment in the country’s booming private credit sector with a £75mn debt deal.

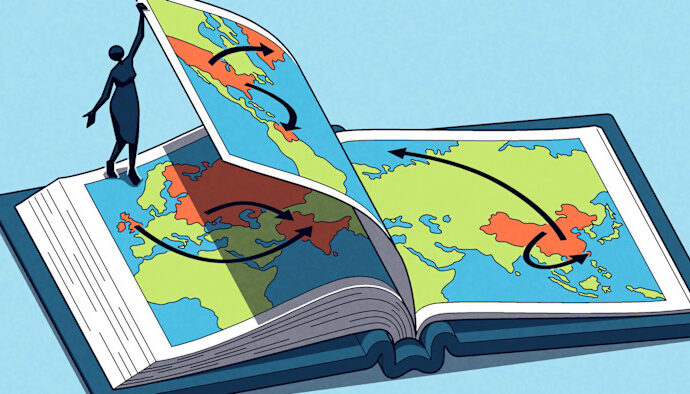

The UK’s largest savings and retirements business, with £290bn of assets under management, is one of a number of British pension funds looking to grow in Australia. The moves follow rising investment by Australian superannuation funds in UK, European and US assets in recent years.

The £75mn deal with engineering company Worley is Phoenix’s first private debt investment in the region, which it said signalled the first step in a “strategic expansion” across the Asia-Pacific.

Phoenix executives have made repeated trips to Australia in the past year to work more closely with its super funds and seek opportunities.

Mike Ambery, retirement and savings director at Phoenix, told the Financial Times that “Australia is viewed as a benchmark in the UK — the golden child of the industry” and that the two countries need to foster stronger two-way capital flows. “We will further strengthen those ties and look for assets to invest in,” he said.

David Camerlengo, a commissioner with the Australian Trade and Investment Commission, said that Australia and Britain’s “deep” historical trade relationship had been strengthened since a free trade agreement was signed in 2021 and ratified two years later.

“The commitment by Phoenix to the Australian market is a wonderful example of the bilateral investment flows between our nations,” Camerlengo said.

Worley is one of Australia’s largest engineering groups, worth A$6.7bn (£3.2bn), and provides services to companies in the mining, energy and chemicals sectors including BHP, Rio Tinto and Woodside Energy.

Phoenix’s move comes as Legal & General, the UK’s largest asset manager, also looks to expand in Australia.

Gareth Mee, chief investment officer for institutional retirement at L&G, said the group invests a small proportion of its balance sheet in Australian assets but was “interested to invest more in Australia, particularly given its mature infrastructure market.”

Australian funds, including AustralianSuper and Aware Super, have opened UK offices in recent years to build a stronger presence in Britain.

The UK is exploring hosting an Australian superannuation summit later this year to explore co-investment opportunities between the two countries’ biggest pension funds, according to multiple people familiar with the plans.