Good morning. At last some good news. Last week, the credit rating agency S&P Global upgraded India’s long-term unsolicited sovereign credit rating to BBB, on the back of the country’s sustained fiscal consolidation and economic resilience. This is India’s first upgrade since 2007!

In today’s newsletter, US President Donald Trump’s tariffs draw China and India closer to each other. But first, the goods and services tax gets a facelift.

Good and simpler tax?

Will India’s goods and services tax finally live up to its billing as a “good and simple tax”? After Prime Minister Narendra Modi announced an overhaul to the value added tax system in his Independence Day speech, a draft blueprint is being circulated to the states. This would remove two current rates, leaving one of 5 per cent on essential products and one of 18 per cent on everything else, except some luxury and “sin” goods and services. They will continue to be subject to a 40 per cent levy. So big cars are likely to be taxed at 40 per cent, small cars at 18. The proposal, GST 2.0 as it is being popularly referred to, also seeks to streamline the current system in order to better enable value addition and provide long-term clarity, stability and ease of accounting.

So what are the next steps? The states have to go over this proposal and come to an agreement. The group of state ministers responsible for this is expected to meet on Thursday. Its recommendations will go to the GST council, which will then deliberate on the reforms in September or October. In his speech, Modi indicated the new taxes would come into force before the festival of Diwali, which this year falls on October 20. While there is already some political bickering and one-upmanship at play, the chances are the reforms will go through even as the ruling party and opposition wrestle about who gets to take credit. (Politicking with taxes is an old sport in India, and the main reason why the annual budget announcements are such a spectacle).

More importantly, the government is acknowledging the stress in the economy. Modi pitched the reform as a “double Diwali bonus”, hoping the lower taxes would drive consumption growth. The cuts will deal a hefty blow to the government’s revenues, but it is counting on resulting demand growth to help offset an expected hit to GDP from lower exports caused by Trump’s tariffs.

This is the first of a series of steps the government is expected to take in order to counter criticism of its failure to secure a deal with the Trump administration. Modi’s government portrays the trade hit as an opportunity for India to focus on its domestic industry and market, and to look inward for growth. In the past couple of weeks, a number of corporate leaders have also suggested that the government should reform various regulations to make it easier for businesses to operate in India. Measures may be announced soon.

While India needn’t have waited for a failed trade deal in order to reform its domestic economy, if these do indeed come about it would be a good outcome from a bad situation.

Do you think GST 2.0 will succeed in actually being simple? Hit reply or email me at indiabrief@ft.com

Recommended stories

US to ‘co-ordinate’ Ukraine’s security with Europe; Kyiv offers $100bn weapons deal to Trump.

Investors lose billions on meme stocks as ‘pump and dump’ scams multiply.

China cracks down on foreign companies stockpiling rare earths.

The crypto group backed by Trump’s sons hunts for bitcoin companies in Asia.

Is AI hitting a wall? OpenAI’s underwhelming new GPT-5 model suggests progress is slowing.

Can a bad marriage be passed down the generations?

Join 250+ policymakers, industry executives and investors at the Energy Transition Summit India on September 16 and 17 in New Delhi. Register for a free digital pass here or enjoy 20 per cent off your in-person pass here.

India-China thaw

China’s foreign minister Wang Yi arrived in Delhi yesterday and met the external affairs minister, S Jaishankar. Today, he will sit down with national security adviser Ajit Doval to discuss boundary issues between the two countries before meeting Modi later in the evening. These meetings set the stage for Modi’s first visit to China in seven years. The prime minister is scheduled to attend a summit of the Shanghai Cooperation Organisation security grouping that opens on August 31 in Tianjin. While there, Modi is likely to hold bilateral discussions with Chinese President Xi Jinping, as well as Russia’s Vladimir Putin.

Wang’s visit signals the continued thaw in relations between Beijing and New Delhi, which began last October at the sidelines of a Brics summit, when Modi and Xi Jinping met for the first time since border hostilities escalated in 2020. But Trump’s trade policies have hastened the mending of ties between the two neighbours. Both countries have been threatened with some of the highest tariffs, and are at risk of additional US duties for buying Russian oil.

The buzz in New Delhi corridors seems to suggest that after a four-year freeze, direct flights between India and China might resume and that a higher number of visas may be granted on both sides. The expectation is that business relations will go back to what they were before the 2020 skirmishes in Galwan Valley. However, in my view, an immediate full reset is unlikely. While Trump’s upending of global trade has forced the two countries to play nice, there is still a trust deficit on both sides.

That being said, the current thaw will help resolve some immediate problems. Top on the agenda will be getting quick clearances for Indian businesses to access rare earths, minerals and other core supplies that are critical for operations. The electronics manufacturing sector, which is facing several uncertainties at the moment on account of tariffs, is also hoping for easier movement of technology and people from China. However, any big announcements are unlikely this week: the chances are we will hear those on September 1 from Tianjin.

Do you think India should draw closer to China considering the difficulties in the Indo-US relationship currently? Hit reply or email me at indiabrief@ft.com

Go figure

Even as tariff negotiations were under way, India’s trade with its top trading partner, the US, surged in the four months from April to July. Here’s a look at some key numbers.

$16bn

India’s trade surplus with the US

22%

Growth in exports to the US

12%

Growth in imports from the US

My mantra

“There is absolutely no substitute to using every AI tool that you can get your hands on today to manage your life, because it not only helps you remain abreast of so many things that are happening, but also helps you improve your productivity by leaps and bounds. I have learned many new AI tools from my children, and it has helped me improve the quality of my life manifold.”

— Sonia Dasgupta, chief executive of investment banking, JM Financial

Each week, we invite a successful business leader to tell us their mantra for work and life. Want to know what your boss is thinking? Nominate them by replying to indiabrief@ft.com

Quick question

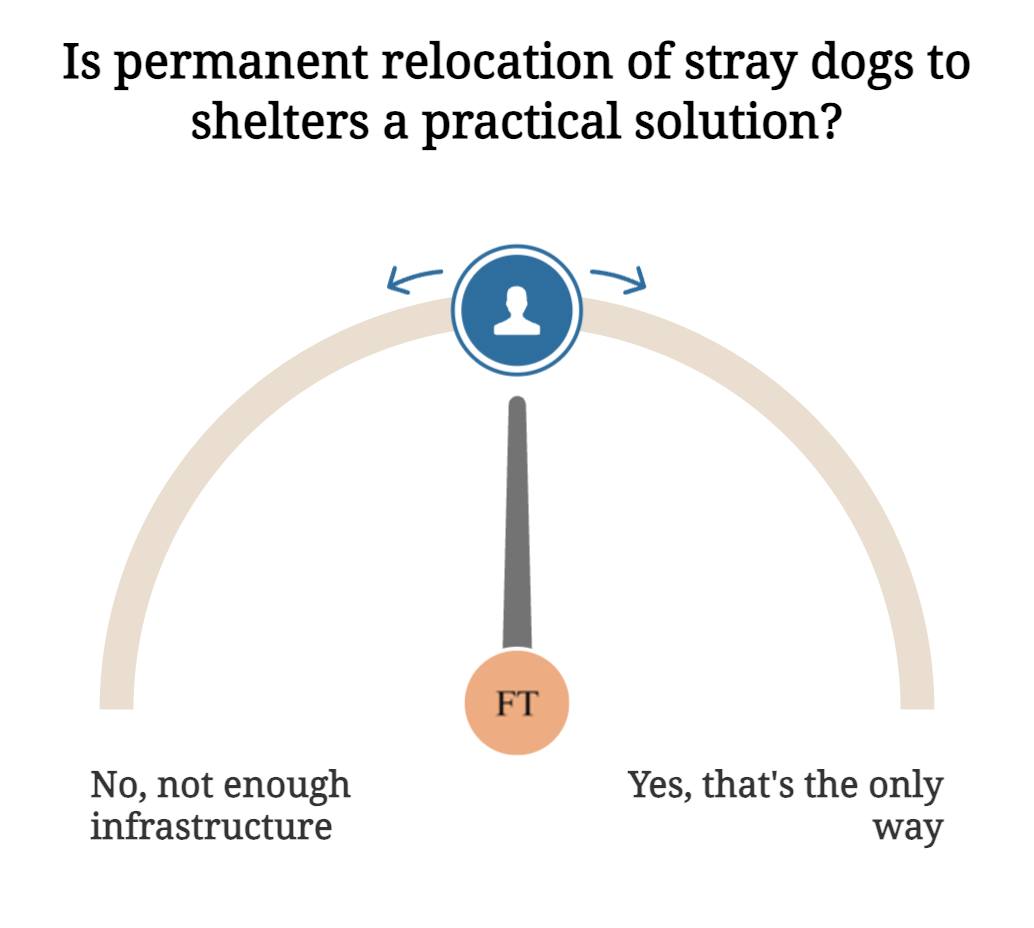

The Supreme Court’s order to permanently detain Delhi’s stray dogs in shelters has given rise to spirited arguments on both sides. Forget the ethics for a moment — do you think this is a practical solution? Tell us here.

Thank you for reading. Today’s India Business Briefing was edited by Mure Dickie. Please send feedback, suggestions (and gossip) to indiabrief@ft.com.