Hi everyone! This is Cheng Ting-Fang, your #techasia host this week, waving hello from Taipei!

I just returned from a brief trip to Tokyo, where I enjoyed fresh sashimi and sizzling barbecue. The summer heat was scorching and as intense as Taiwan’s tropical humidity. It’s been years since I have seen Tokyo through a tourist’s eyes and this time a few things stood out. On ordinary weekdays, children are a rare sight in the city and on trains. And outside of izakayas and tourist-frequented restaurants, Japan’s dining spots are remarkably quiet.

But this has been an eventful summer, with the US announcing new tariff rates for most countries. Upcoming tariffs of 100 per cent on foreign-made semiconductors are creating further uncertainties for the second half of 2025. Several tech industry executives told me they have modest expectations for the remainder of the year — traditionally a peak season for many sectors. In fact, many would consider it a best-case scenario if they can simply match the revenue and profit levels of 2024.

This week, Taiwan’s chip sector also came under the spotlight after Nikkei Asia exclusively reported that TSMC had taken legal action against several former employees for attempting to illicitly obtain sensitive information on 2-nanometre chip technology. The story was quickly picked up by major international and local outlets, including Bloomberg, the Financial Times, Reuters and CNBC. This marks the first-ever case involving national core sensitive technologies to be investigated under Taiwan’s National Security Act, which was enacted in 2022 to protect its flagship chip industry from foreign threats.

The incident has sparked discussions about how trade secrets are protected. TSMC is well known for having strong systems to guard its proprietary information. One chip industry contact shared a story on this that I always remember: “If you accidentally drive the wrong way in a parking lot for just three to five seconds, you and your managers will get an email alert right away telling you you’re going in the wrong direction.”

However, most tech industry executives agree that replicating advanced chip manufacturing, especially processes like TSMC’s cutting-edge 2nm tech, is far from simple. The production lines require thousands of intricate steps, precise fine-tuning of tools and chemicals and, crucially, the accumulated expertise of thousands of skilled engineers. Stealing documents or testing data is nowhere near enough to recreate such complexity. It’s similar to the challenge for any newcomer to build extreme ultraviolet (EUV) lithography machines produced by ASML, the maker of the world’s most advanced chipmaking tools, as Nikkei Asia earlier reported.

I am reminded of an interesting conversation I once had with Jos Benschop, executive vice-president at ASML, during a visit to the company’s headquarters in Veldhoven in the Netherlands. When asked how easy it would be to copy such machines, Benschop described the know-how behind these tools as an iceberg. “What you see is the tip of the iceberg. You might think, ‘OK, I can make the same iceberg,’ but 90 per cent of it is under the water, and you can’t see it.”

Trade secrets and national security

Taiwan Semiconductor Manufacturing Co has fired several employees after detecting unauthorised activities aimed at illicitly obtaining critical information about its 2nm technology and transferring it to external parties, according to exclusive reporting by Nikkei Asia’s Cheng Ting-Fang. TSMC confirmed to Nikkei Asia that it discovered the potential trade secret leaks and proactively initiated legal action against those involved.

Taiwanese prosecutors have questioned and searched the residences of several personnel suspected of involvement in the case, detaining three individuals. But the investigation is still ongoing to determine the extent and flow of the trade secret leaks. Major TSMC supplier Tokyo Electron later confirmed it had also fired an employee over suspected involvement in the case.

The incident has drawn global and local attention, as TSMC’s 2nm tech is currently the world’s most advanced chip production node, essential for next-generation processors in computers, smartphones and AI. It is set to enter mass production later this year. The suspected trade secret leaks also come amid a growing global chip race, with major economies pushing to onshore critical semiconductor manufacturing.

A hard sell

Beijing’s effort to consolidate the country’s fragmented semiconductor sector into a few national champions is facing major obstacles, write the Financial Times’ Eleanor Olcott and Haohsiang Ko.

At the start of the year, Beijing sought to create a state-backed chip manufacturing equipment giant by merging several companies, in a bid to create a domestic rival to leading US and European groups. But the talks have stalled due to disagreements over ownership and valuation, according to people familiar with the matter.

Although 26 semiconductor deals have been announced in 2025 — including a merger between CPU designer Hygon and supercomputer maker Sugon — progress is limited.

Experts argue that consolidation is key for building a self-sufficient domestic chip supply chain amid tough US export controls, but many companies lack strong technology and integration risks are high.

Many of the announced deals fail to proceed as buyers and sellers cannot settle on a price.

There has also been limited progress in consolidating the highly fragmented fabrication industry, where overlapping projects have led to waste and oversupply.

In the fast lane

Chinese carmakers are ramping up efforts to replace products made by Nvidia and other foreign chip leaders in their increasingly competitive domestic auto market, Nikkei Asia’s Cissy Zhou, Cheng Ting-Fang and Lauly Li report.

Not only have companies like Xpeng and Nio begun using self-developed chips to replace Nvidia’s solutions, but many local chipmakers, such as Horizon Robotics, have also seen more Chinese automakers adopt their products. According to Nikkei Asia’s analysis of government documents and industry interviews, at least 10 emerging and established Chinese chipmakers have identified the automotive market as their primary focus.

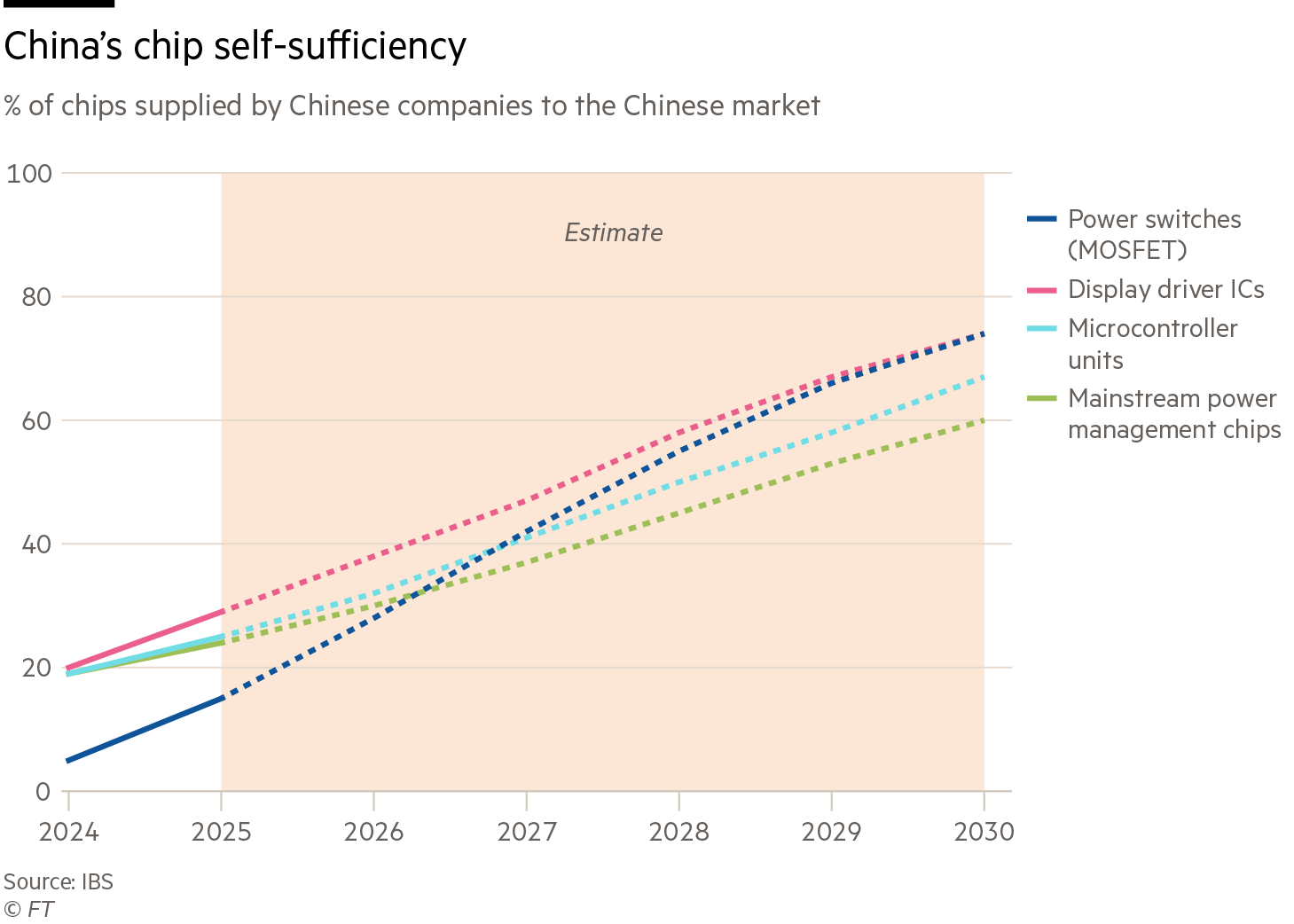

China has made significant strides towards self-sufficiency in some types of automotive-related chips. For example, local supplies of power discretes and sensors have steadily increased, followed by growing capabilities in microcontroller chips. However, progress in more advanced areas such as driver-assistance and autonomous driving chips has been relatively slower. China’s advancements could eventually impact the business of the market leaders in China.

100 per cent on chips

The latest shot in US President Donald Trump’s tariff war is aimed at chips. Trump announced at a White House event on Wednesday that he will impose an “approximately 100 per cent” tariff on chips and other semiconductor products, writes Nikkei Asia’s Yifan Yu. Trump suggested, however, that companies making major investments in the US could be exempt from that charge.

The announcement came as Apple pledged to invest a further $100bn in the US, in addition to the $500bn it promised in February. The iPhone maker is also ramping up its domestic procurement, saying it intends to source 19bn chips from a dozen states, including “tens of millions” of advanced chips made by Taiwan Semiconductor Manufacturing Co in Arizona.

Suggested reads

Apple suppliers bet on tariff carve-out for India-made iPhones: sources (Nikkei Asia)

Trump official urges Asia to reject Europe’s ‘over-regulation’ of AI (FT)

Taiwan’s Foxconn sells Ohio EV facility to focus more on AI data centers (Nikkei Asia)

Nintendo profits rise on 6mn sales of new Switch 2 console (FT)

Ex-CEO of Indonesian aquaculture unicorn detained in fraud probe (Nikkei Asia)

Japan looks to virtual reality, AI to pass on A-bomb survivors’ legacy (Nikkei Asia)

China summons Nvidia over ‘serious security issues’ with chips (FT)

Samsung’s $16.5bn Tesla deal will test chipmaker’s hopes for revival (FT)

Japan chipmaker Kioxia to weed out suppliers lax on cybersecurity (Nikkei Asia)

China’s JD.com launches €2.2bn offer for German electronics retailer Ceconomy (FT)