Stay informed with free updates

Simply sign up to the Chinese business & finance myFT Digest — delivered directly to your inbox.

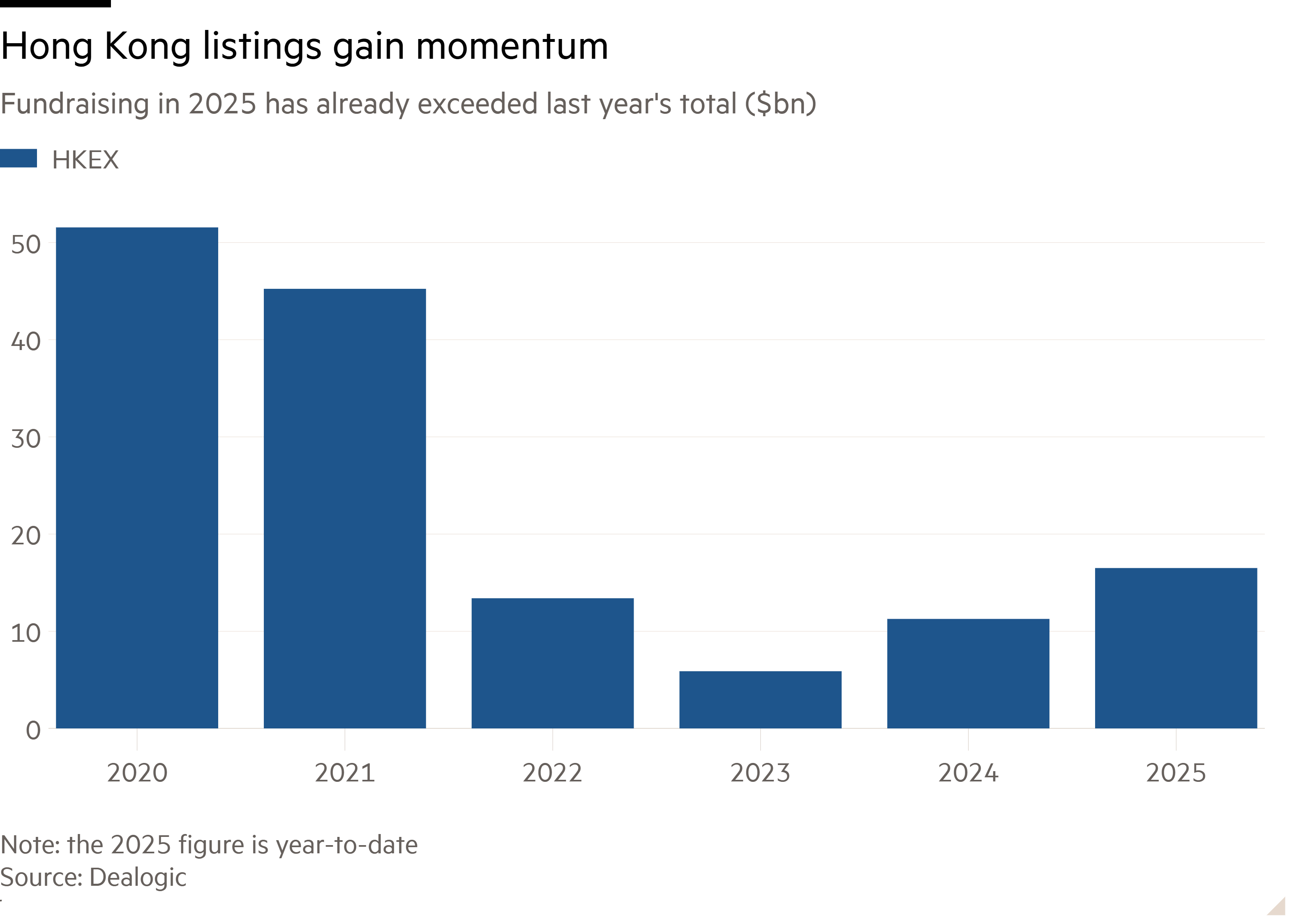

A rush of Chinese tech companies has applied for initial public offerings in Hong Kong after the city changed confidential filing rules as part of reforms that have helped fuel a listing boom in the territory.

Regulators in May announced a confidential filing option for lossmaking technology and biotechnology companies. Such filings allow companies to have their financial and operational information reviewed by the exchange and regulators before they publicly reveal their intention to float.

Biren Technology, one of China’s leading chipmakers, made a confidential filing in recent weeks, according to two people with knowledge of the matter. Rival Enflame Technology and artificial intelligence start-up Zhipu, which was valued at more than $5bn in a private funding round earlier this year, also plan to submit soon, the people said.

Both chipmakers are lossmaking but they expect revenues to surge this year as a result of export controls on US semiconductor giant Nvidia, according to the people. Biren was valued at about $2.5bn in a recent fundraising round, while Tencent-backed Enflame has a similar valuation.

MiniMax, another artificial intelligence company, filed paperwork around mid-July, two other people said. It was valued at about $4bn in its latest fundraising round this year, said the people. Biren, Enflame and Zhipu did not respond to requests for comment. MiniMax declined to comment.

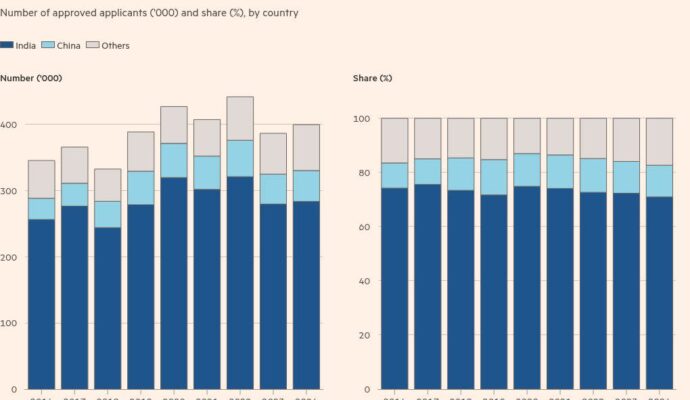

The number of companies applying for a Hong Kong listing hit an all-time high in the first six months of this year, with companies attracted by a soaring equity market and less stringent requirements compared with the mainland exchanges.

If a company files for an IPO on the mainland, it is not allowed to raise any more money during the waiting period before the listing is approved.

But in Hong Kong, companies can continue to raise money before they go public. Technology companies, especially chipmakers and AI companies, typically need to raise multiple rounds of funds a year to sustain growth.

A private filing also keeps the companies out of the spotlight and shielded from competitors before they receive an approval from China’s security regulator, which can take about a year due to a significant backlog of applications, according to people familiar with the situation.

In the first seven months of this year, 12 Chinese tech companies applied to list in Hong Kong under 18C, a provision in the exchange’s rules that allows lossmaking technology companies to float, according to data compiled by the Financial Times. The tally, which marks the highest amount since the rules were introduced in 2023, does not include the confidential filings not yet made public.

Fang Liu, a partner at law firm Clifford Chance in Hong Kong, said that confidential filings are appealing for Chinese tech companies seeking to avoid disclosing sensitive information.

“Once you disclose you could draw a lot of unfriendly attention” from competitors or other stakeholders, including threats and complaint letters to regulators, said Fang.

Hong Kong is also attracting Chinese companies that are no longer able to list in the US or the UK as a result of geopolitical tensions and increased scrutiny.

The China Securities Regulatory Commission has been encouraging groups seeking overseas listings to prioritise Hong Kong, according to industry insiders. They added that, while chapter 18C is typically used for lossmaking early stage tech companies, exceptions are made to companies that are already profitable.

Johnson Chui, head of global issuer services at the Hong Kong Exchanges and Clearing, said “HKEX’s ongoing efforts to refine and innovate its listing regime reflect a strong commitment to staying ahead of industry and technological trends.”