This article is an on-site version of our FirstFT newsletter. Subscribers can sign up to our Asia, Europe/Africa or Americas edition to get the newsletter delivered every weekday morning. Explore all of our newsletters here

Good morning and welcome back to FirstFT Asia. In today’s newsletter:

India’s Russian oil predicament

China warms to stablecoins

The global sand shortage

The Berkshire Hathaway premium fades

We start with the deteriorating US-India relationship, as Donald Trump announced an additional 25 per cent tariff on imports from India due to New Delhi’s purchases of Russian oil.

The latest: The decision was published yesterday in an executive order from the White House shortly after Steve Witkoff, a senior US envoy, met Russian President Vladimir Putin in Moscow. The executive order said the 25 per cent levies connected to India’s oil trade with Russia would be added to existing duties imposed on Indian imports. India’s foreign ministry called the US tariffs “unfair, unjustified and unreasonable” and said that its oil imports were “based on market factors and done with the overall objective of ensuring the energy security of 1.4bn people of India”. Analysts told the FT how the falling-out with the US will impact India’s economy.

India’s Russian oil conundrum: After years of his country bingeing on cheap Russian crude, Indian Prime Minister Narendra Modi faces a geopolitical dilemma as well as a practical challenge should he seek to re-engineer the energy supply mix of the world’s third-biggest oil importer. India imports about 5mn barrels of oil a day, of which 2mn come from Russia. Sumit Ritolia, a lead Kpler analyst, said New Delhi could “pivot more towards non-Russian barrels. But I don’t think we’ll see a day when India stops buying Russian oil”. Read more about Modi’s bind.

War in Ukraine: Trump is “open” to meeting Putin as well as the Ukrainian leader Volodymyr Zelenskyy as he seeks to broker an end to the war in Ukraine, the White House has said.

India news: India’s central bank held its key interest rate as Trump’s planned increase in tariffs threatens to send its economy into turmoil.

Here’s what else we’re keeping tabs on today:

Economic data: China and Japan release July trade figures. The Philippines reports second-quarter GDP.

Trade war: Trump’s “reciprocal” levies are set to come into force today. See the FT’s tariff tracker for more details.

Results: SoftBank, Sony and Toyota report earnings.

Five more top stories

1. UK deputy prime minister Angela Rayner has demanded additional information from China over its plans for a new “mega” embassy in London after several of its drawings contained areas that were blacked out. The late objection raises the prospect that ministers may reject the plans, which have been criticised by the White House.

2. China plans to allow the launch of its first stablecoins in a bid to internationalise the renminbi and compete against the dollar. However, concerns about capital flight are slowing the technology’s growth in the country, while regulators have warned about the potential for stablecoins to be used in money laundering.

3. Apple is preparing to add a further $100bn to its US investment plans as chief executive Tim Cook strives to insulate the iPhone maker from Trump’s trade war. White House officials said the Silicon Valley giant’s pledge would include a new “American manufacturing programme” to produce more of its devices and components in the US.

4. Airbnb’s second-quarter results beat estimates as bookings recovered from the initial economic shock of Trump’s trade war. But the home rental platform warned that its earning margins would compress in the third quarter as the US president’s new tariffs go into effect and as it invests $200mn in new services and experiences.

5. US institutional investors including MetLife and Harvard University’s endowment have backed a $420mn fund by one of the Australian venture capital firms behind Canva and other “kangaroo-nicorns”, as a country once dismissed as a tech backwater becomes a hunting ground for foreign capital.

The Big Read

From the US eastern seaboard to Australia’s Gold Coast, climate change is accelerating the erosion of shorelines, threatening the future of seaside communities. Sand is essential to beach revitalisation, but its cost and availability are putting limits to government efforts to mitigate further degradation.

We’re also reading . . .

Indonesia: Businesses in south-east Asia’s largest economy are raising alarm over a slowdown in manufacturing and domestic consumption.

Captain of convenience: Authorities have repeatedly targeted a mysterious figure who set up shipping registries in far-flung countries, including ones that are landlocked.

Alzheimer’s research: A study adds to the idea that there may be more rogue proteins implicated in cognitive decline than first thought, writes Anjana Ahuja.

Chart of the day

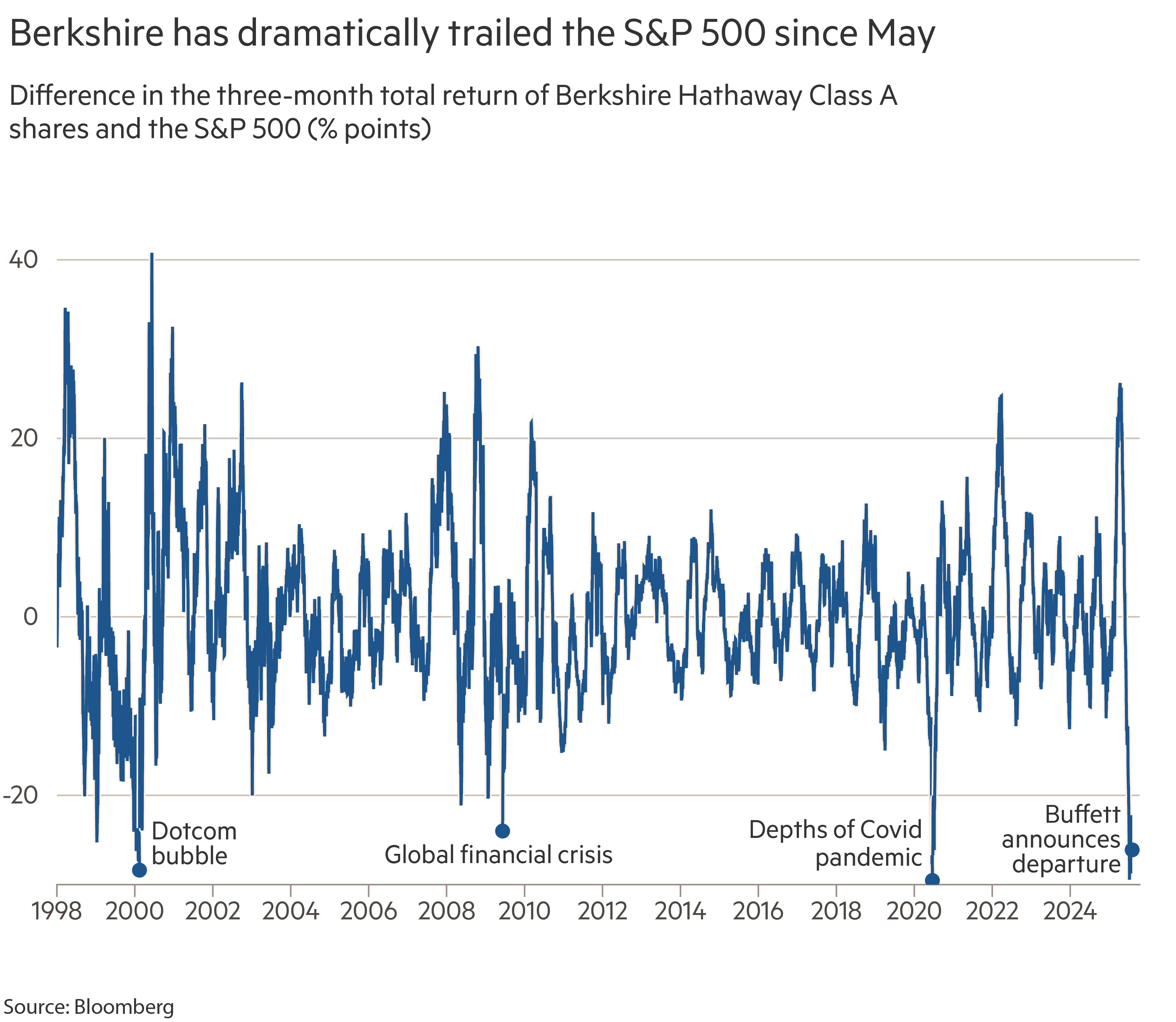

Shares of Warren Buffett’s Berkshire Hathaway have underperformed the wider market by one of the biggest margins in decades, as his retirement as chief executive nears and some investors head for the exits.

Take a break from the news . . .

. . . and pick up a comic novel. In a decade that has featured war, pestilence, famine and unstable global leaders, what readers need most are the brilliant, often undersung fiction writers who wring a smile out of us, writes Nilanjana Roy. While it’s so easy to rail at the state of the world, sometimes we just need a good laugh.